2020 has been quite a year: COVID-19, government-imposed lockdowns, elections, dramatically lower interest rates, record highs for equities, and we still have a month to go. With all of this uncertainty, you may feel a tremendous amount of anxiety, but remember: the most important thing that you can do is to take care of yourself and stay healthy.

The financial market continues to move higher. This is fueled by positive announcements related to the efficacy of vaccines and the success at COVID-19 tamp-downs in other countries. We now have some certainty with the election after some bumps in President-elect Biden’s transition period. The financial markets are happy with some early announcements, especially the nomination of Janet Yellen to take over for Steve Mnuchin at the Treasury. We have seen a tremendous rally following the election and a belief that good outcomes will prevail, whether we are talking about leadership transitions, the coronavirus, the economy, earnings, interest rates, inflation, or the performance of the stock market itself.

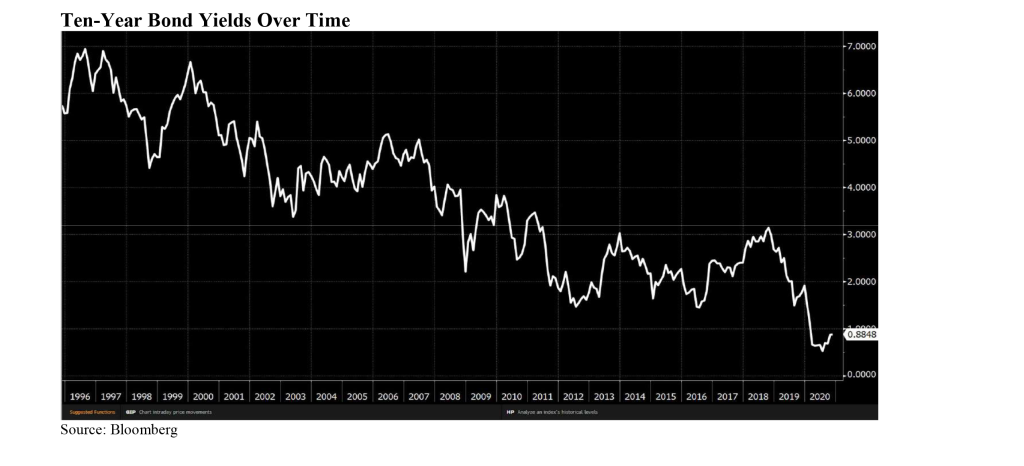

Post-election, the market outlook has shifted quickly from one of massive government spending to one of more limited government spending. Political gridlock is a positive outcome for the stock market, and we do not expect any major new programs that will require dramatic changes in funding or taxation. Interest rates will stay lower for longer, which will help the economy recover. Tax rates will stay low, which will also help. The capital markets should enjoy the effects of both—helping to maintain good prices and valuations that can aid fundraising and confidence in our recovery. This is a good backdrop for equities and the Fed still has our back.

Reasons for Optimism

Now that we are hearing positive news on COVID-19 vaccines and treatments, the market is looking forward to better times. This has resulted in beaten down sectors advancing. Again, as long as money rotates with the equity market, that is a good thing. Below are reasons why we are thankful:

The Holidays will be celebrated!

Thanksgiving is typically the start of the strongest period for the markets.

Normally, it takes years to develop a vaccine; to achieve what looks like a 90% efficacy rate in less than a year is truly remarkable.

U.S. economic data continues to improve, led by strong retail sales.

Advanced technological breakthroughs continue to improve our quality of life.

A potential compromise with Congress regarding an additional government stimulus package.

U.S. History has demonstrated that Americans can adapt to major life changes, including the COVID-19 pandemic.

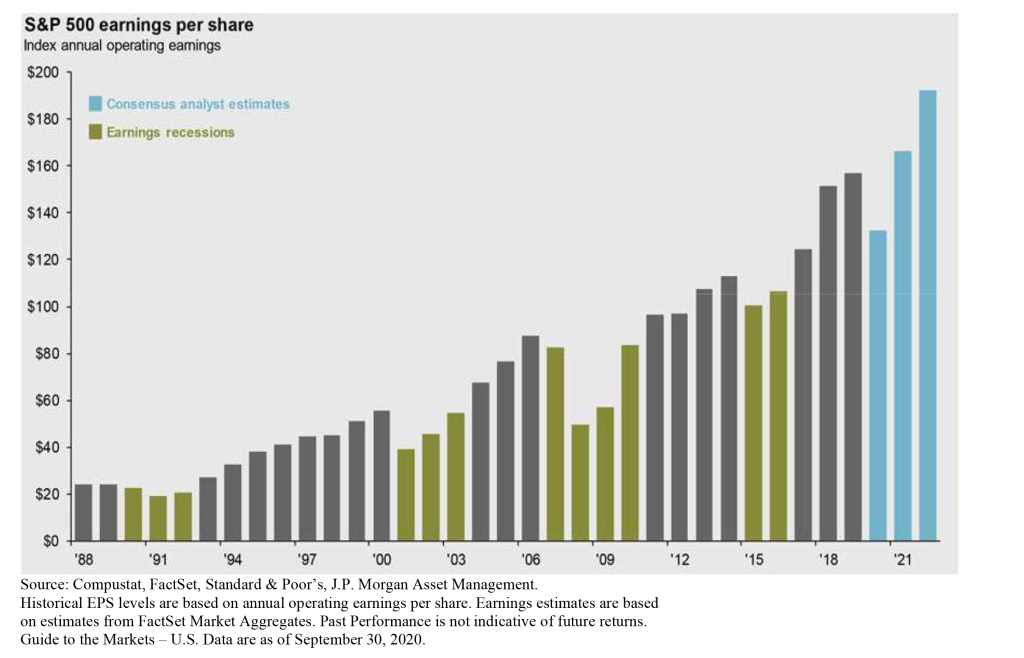

U.S. Corporate earnings are on track for the second biggest beat in history, following last quarter’s record (Source: BofA/Merrill Lynch).

Technically

A market pushing to new highs is not always suggestive of a market top or of a significant pullback. Eighty-four percent of stocks in the S&P 500 traded above their positive trend lines last week. In the past, this has suggested strong performance for the index in the months to come, with 90% of observations positive one- and two years out.

What It All Means

Over the coming months, we think the sharp acceleration in coronavirus cases and the associated consequences are likely to translate into a period of rockier economic growth. Damage has been done to both the economy and public health. We also think that the lack of progress on a new fiscal stimulus package will likely hurt growth over the coming months. However, if we look out further, the outlook is brighter. The good news surrounding vaccine effectiveness and the prospects for widespread distribution in the first half of 2021 should improve economic mobility. This should also allow for the U.S. and most of the rest of the world to enter into a self-sustaining economic expansion.

Happy Holidays and be safe,

Joseph Traba, Managing Director and Senior Portfolio Manager