Strategy Asset Managers Worldwide Dividend Plus strategy focuses on high quality companies with above market dividend yields. Emphasis is placed on identifying reasonably priced companies that have sustainable dividends, consistently increase dividend payouts, and are projecting dividend growth. The portfolio can invest across all geographies and economic sectors/industries and is composed of 10 to 30 percent non-US common stocks and 70 to 90 percent US common stocks. Stock selection starts with identifying candidates that are selling at a discount to fair value and have the balance sheets to sustain or enhance dividend growth. Inception Date: 01/01/2004.

The portfolio holds securities with above average dividend yields, strong dividend payment histories, sustainable free cash flow, and a track record of dividend increases. We also look to include companies with lower volatility than the market and a positive business outlook that could translate into price appreciation and dividend growth. The portfolio will typically hold 25 to 35 stocks. A stock can be sold or replaced if it hits its price target, its fundamentals change, or we identify a stronger candidate with more upside potential or the prospect of faster dividend growth.

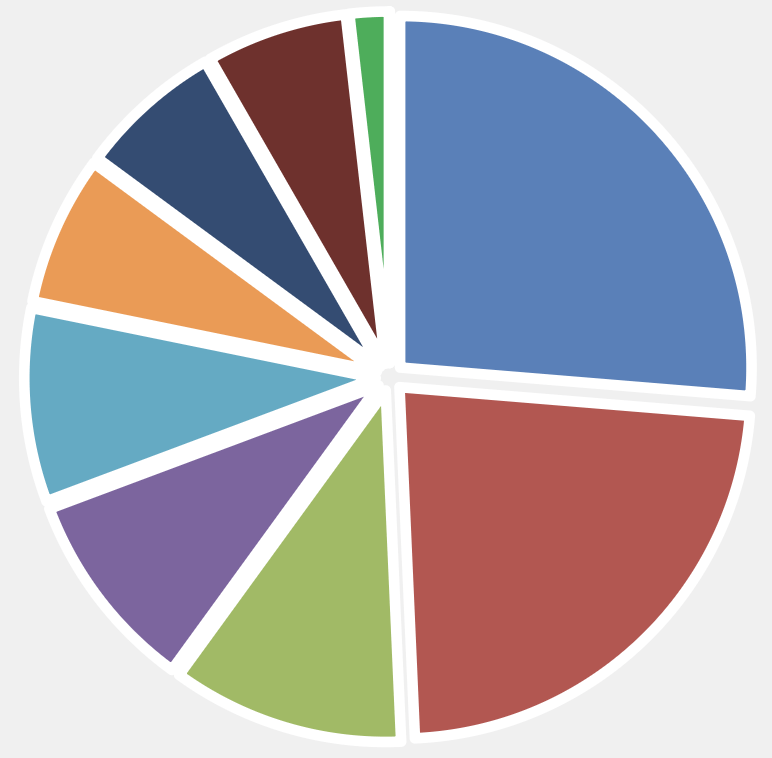

Sector Percentages as of 12/31/2025

Period Ending 12/31/2025

| QTD | 2025 | 3 Year | 5 Year | 10 Year | |

|---|---|---|---|---|---|

| Worldwide Dividend+ Gross | 0.0% | 14.4% | 14.6% | 11.4% | 10.8% |

| Worldwide Dividend+ Net | (0.2)% | 13.5% | 13.7% | 10.5% | 10.0% |

| Global Dividend Index | 1.3% | 15.5% | 11.1% | 11.5% | 10.1% |