After a year defined by policy and macroeconomic volatility, we see a calmer, more supportive environment for risk assets developing in 2026. Productivity gains tied to artificial intelligence have the potential to drive meaningful disinflation, while economic growth is projected to remain steady. In the United States, both earnings and cash flow are positioned to benefit from a market-friendly policy mix and declining global interest rates.

In case you missed it: Tom Hulick recently appeared on FOX Business’ Making Money with Charles Payne and the Schwab Network’s Morning Trade Live with Sam Vadas.

Key Themes Shaping 2026

AI and Infrastructure: Entering the Next Phase

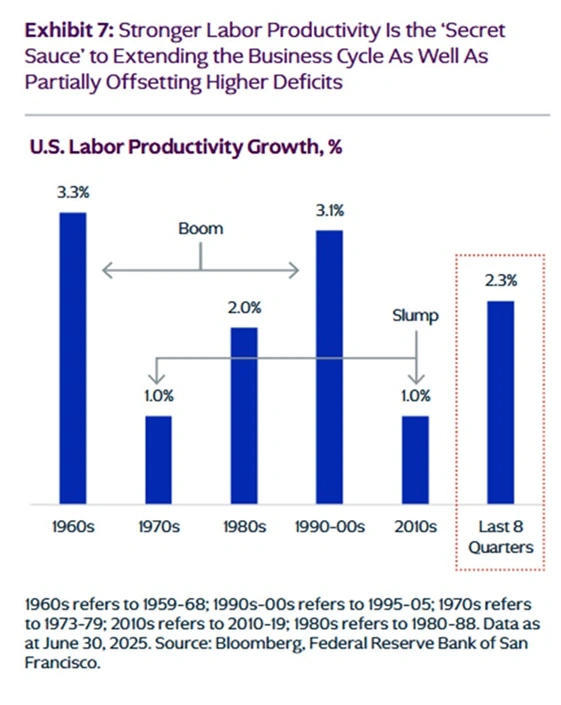

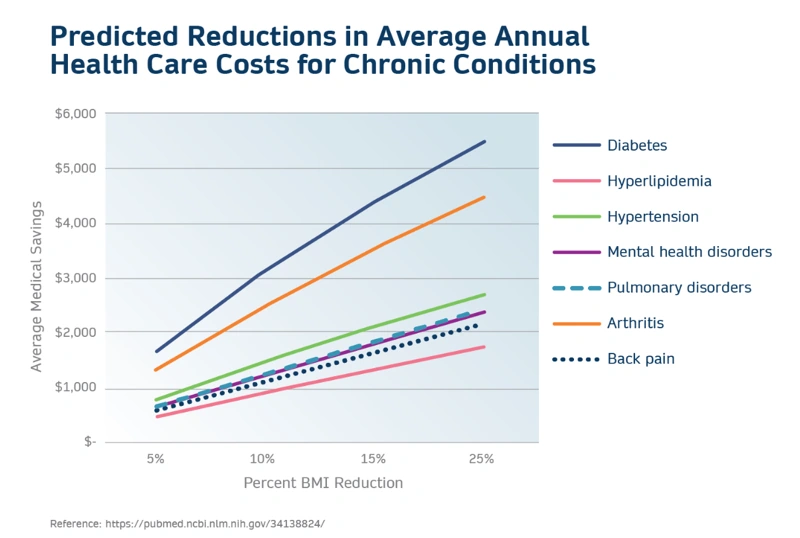

Artificial intelligence is moving beyond infrastructure build-out into application-driven innovation. We are entering a phase where AI adoption is expected to generate measurable productivity gains across multiple industries. Advancements in autonomous vehicles, robotic surgery, and other applied technologies have the potential to significantly improve quality of life while reducing long-term healthcare costs.

This technological shift is driving unprecedented demand for reliable, low-cost power. This need for affordable energy is fueling large-scale infrastructure investment, particularly in power generation and grid expansion. If the United States is to maintain leadership in technology and manufacturing, energy availability will be critical. America holds a structural advantage as the world’s largest producer of natural gas, positioning it favorably as AI-driven electricity demand accelerates.

An Uneven Economy and Investor Sentiment

The current environment has been favorable for asset owners but challenging for borrowers. The so-called “K-shaped” recovery continues to highlight disparities across income groups, industries, and regions. Higher-income households have benefited from asset appreciation, while lower-income consumers remain pressured by elevated costs.

This divergence is evident in consumer behavior and corporate trends. For example, premium travel and leisure spending remains resilient, while more price-sensitive segments face ongoing inflationary strains. Labor market data reflects a similar bifurcation: smaller firms have been reducing headcount, while larger companies continue to hire.

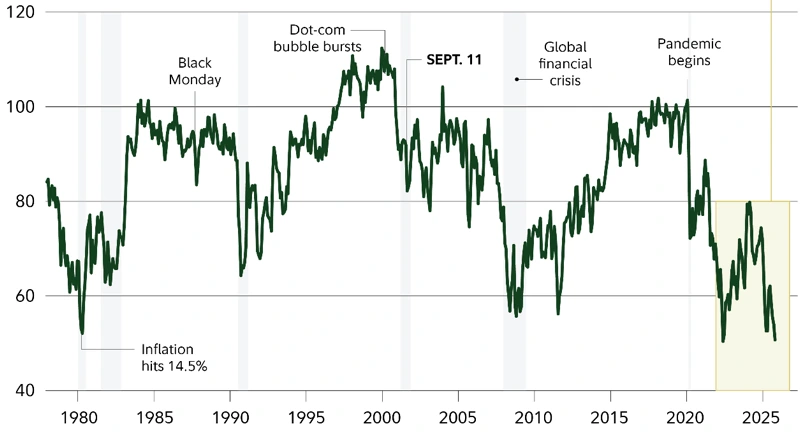

Consumer sentiment and job confidence remain near historically low levels, even as market fundamentals improve. This creates the potential for upside surprises should confidence begin to recover.

University of Michigan Consumer Sentiment Index

Growth, Earnings, and Policy Tailwinds

While near-term economic growth may moderate due to a softening consumer, market volatility, and episodic political disruptions, the broader global growth picture remains constructive. Foreign nations should also benefit from technological adoption, fiscal support, and improving trade conditions.

Several structural tailwinds support the medium-term market outlook:

- Earnings growth remains solid. S&P 500 earnings are forecast to rise approximately 10.8% in 2025, followed by an estimated 12.7% increase in 2026, with further gains expected in 2027.

- Pro-business policies, targeted government spending, and global infrastructure investment are supporting manufacturing activity in regions such as the United States, Germany, and Japan.

- Pricing power is gradually re-emerging across select industries, aided by productivity improvements and AI-driven efficiencies.

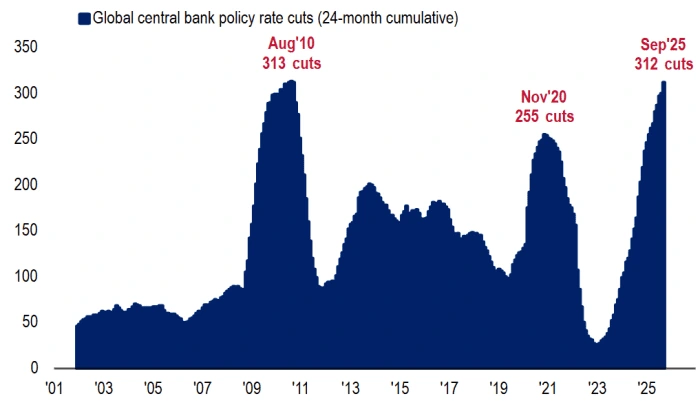

Interest Rates: Supportive

Global central banks remain broadly accommodative. In the U.S., recent rate cuts signal continued support for economic expansion, while other major economies have continued to reduce interest rates.

Central bank behavior suggests that their inflation target has now risen from 2% to 3%, resulting in rate cuts despite inflation remaining above historical norms. Given elevated government debt levels and limited appetite for fiscal restraint, sustained high interest rates appear increasingly untenable. While short-term rate volatility is likely, the longer-term trend points toward lower rates globally, barring a renewed inflation shock.

Secondary Effects: Healthcare Innovation

Breakthroughs in weight-loss and metabolic treatments may have profound economic implications. Next-generation therapies—such as the emerging “triple agonist” drugs—are showing promise in reducing fat mass while preserving muscle, potentially improving long-term health outcomes. These innovations could meaningfully boost productivity and lower healthcare costs over time, rivaling the economic impact of AI.

Geopolitics, Policy, and Market Volatility

A calmer global backdrop may emerge if tariff relief and geopolitical de-escalation continue. Investor sentiment remains historically low, leaving ample room for positive surprises. While political uncertainty can drive short-term volatility, these episodes rarely alter long-term economic fundamentals.

Importantly, recent market pullbacks remain well within historical norms. Corrections and periods of consolidation are a healthy part of longer-term bull markets. Credit markets and liquidity indicators do not currently signal systemic stress, and recent volatility in digital assets has not triggered broader financial instability.

Looking Ahead

As 2025 draws to a close, powerful tailwinds are emerging. After a year shaped by uncertainty, geopolitical tension, tariffs, and subdued sentiment, conditions appear to be improving. Rising productivity, moderating inflation, and a more constructive global growth outlook present compelling opportunities to invest in a better future.