The Strategy Asset Managers Growth portfolio invests in companies that exhibit superior growth, are leaders in their respective industries, and have a proven management team. We target innovative growth leaders across all market capitalizations and seek out firms with the capability to disrupt established industries. Certain sectors that will benefit from major demographic or economic trends will be emphasized in the portfolio construction process. Other key selection criteria include: a strong or unique business franchise/competency and a history of delivering superior financial performance regardless of the business cycle. Inception Date: 06/30/2018.

Other factors we consider are competitive position and market share, addressable markets, growth, profitability, and returns on invested capital. We also focus on companies with defensible and durable growth profiles. The portfolio generally takes a long-term view of investing and incurs relatively low turnover. Holdings may be sold or replaced due to deteriorating fundamentals, a loss of management focus, or the emergence of better opportunities elsewhere.

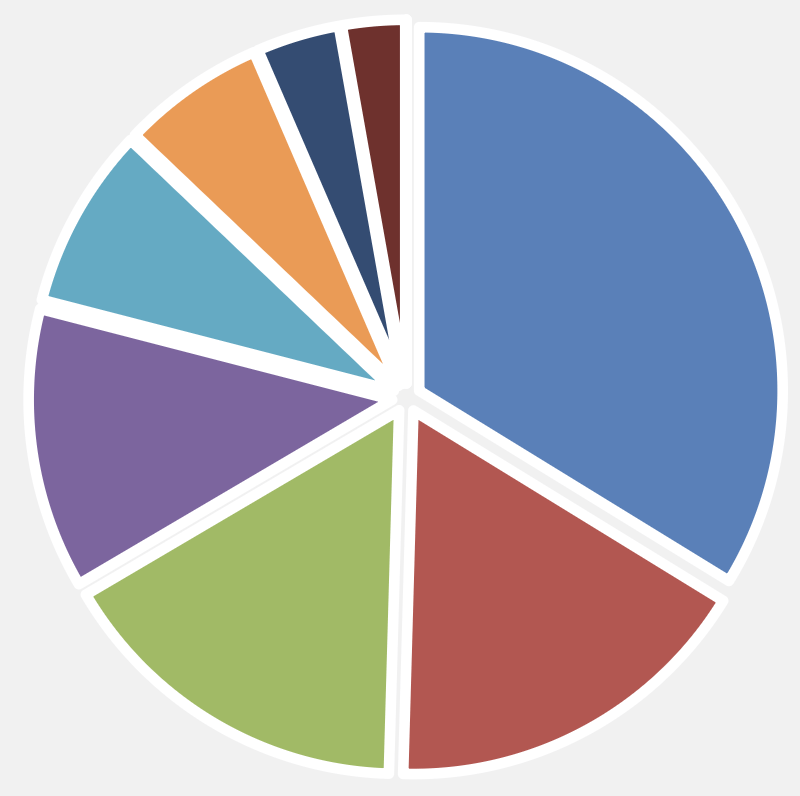

Sector Percentages as of 12/31/2025

Period Ending 12/31/2025

| QTD | 2025 | 3 Year | 5 Years | Inception | |

|---|---|---|---|---|---|

| Concentrated Growth Gross | 5.4% | 16.0% | 27.8% | 14.4% | 16.5% |

| Concentrated Growth Net | 5.2% | 15.0% | 26.8% | 13.5% | 15.7% |

| Russell 1000 Growth ETF | 1.1% | 18.3% | 30.9% | 15.2% | 18.1% |