Market Overview

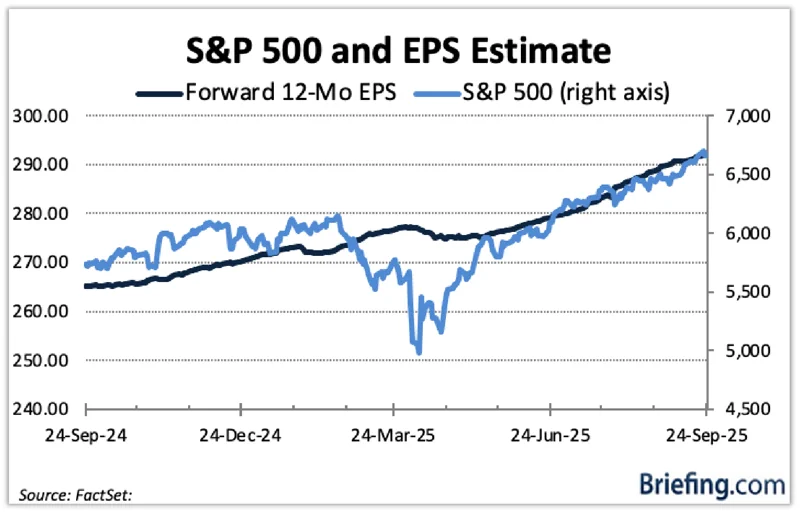

After flirting with a bear market earlier this year on fears that tariffs could tip the U.S. economy into recession, the stock market quickly recovered and staged an impressive rebound. The rally was broad based with U.S., international, and commodities making new all-time highs. Investors looked past a steady drumbeat of negative headlines, soft cyclical data, and rising inflation expectations, focusing on resilient corporate earnings instead.

Driven by Artificial Intelligence (AI) innovation, information technology led the charge once again. We also saw a surge in infrastructure stocks as the demand for increased power is going global. The only sector to lose ground in the third quarter was consumer staples, which continues to struggle with changing eating habits and increased costs.

Earnings results suggest that the broader economy remains sturdy, though cracks are emerging in consumer behavior. Households are becoming more selective, price sensitivity is rising, and the wellness movement— fueled in part by the popularity of weight-loss drugs—is shifting demand toward higher-protein, clean- ingredient foods and away from ultra-processed staples.

Technological Disruptions

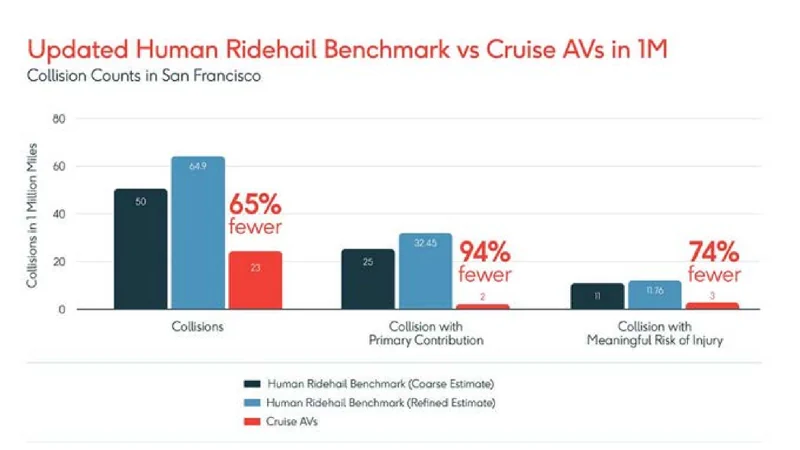

While Artificial Intelligence is stealing the headlines (rightfully so), we continue to see rapid technological advance across a wide variety of areas. One of the most important and transformative technologies of our time will be autonomous vehicles – driverless cars are already operational in many cities, and the potential is truly extraordinary. Early research has shown an astounding 74% reduction in serious crashes thanks to this technology. There is no doubt that autonomous vehicles, once fully implemented, will save tens of thousands of lives each year in the United States alone.

Infrastructure Build-Out

A.I. is generating incredible demand for computing power and fueling an unprecedented infrastructure build-out. Demand for processors, storage, and electricity is surging, driving massive investment into data centers and power generation capacity. Over the next decade, trillions of dollars in global infrastructure spending are expected to support this transformation. The scale of this investment cycle, spanning semiconductors, utilities, and construction, represents a powerful tailwind with bipartisan political support.

U.S. CONSTRUCTION SPENDING ON DATA CENTERS ($ MILLIONS)

U.S. CONSTRUCTION SPENDING ON DATA CENTERS ($ MILLIONS)

Inflation Pressures

The increased data center demand has unfortunately started to have a significant impact on electricity prices, which have steadily increased after years of relative stability. With scores of new data centers for construction, the United States must invest in new electricity generation capacity.

With prices of beef, milk, coffee, and health-insurance also rising rapidly, inflation is taking a severe toll on the middle and lower classes in the United States, and any further acceleration in price increases for necessities has the potential to fuel societal unrest.

U.S. AVERAGE RESIDENTIAL ELECTRICITY PRICE ($/KwH)

Consumer Caution and Credit Tightening

Years of accumulated inflation and a slowing job market has manifested in the auto sector, where there have been two high profile bankruptcies within the last few weeks. These failures have prompted questions about the health of the $1.7tn auto finance sector, a niche but fast-growing part of Wall Street’s securitization market. Credit card debt has exploded to $1.2 trillion, with average interest rates exceeding 22%. Student loan problems are back too, with more than 10% of all student loans currently delinquent.

While unfortunate, bankruptcies are a natural process within capitalist economies, and a bankruptcy/repossession cycle within the auto industry should help to unwind some of the post-Covid price spike.

AUTO LOANS SERIOUS DELINQUENCY TRANSITION %

Overall, the consumer is in poorer shape than many think. This, alongside the softening in the labor market, does potentially justify further interest rate cuts.

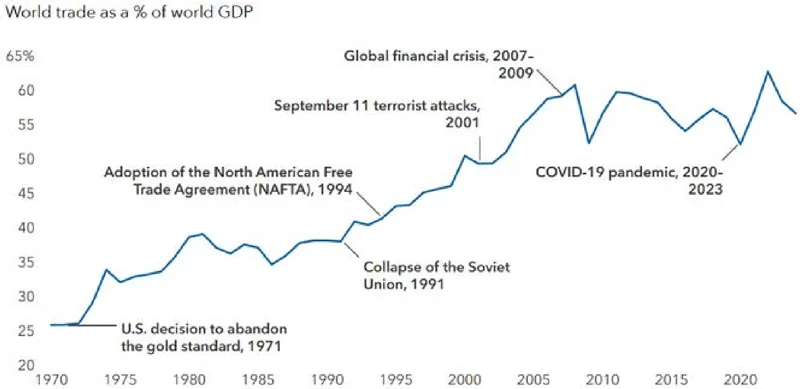

Reshaping Globalization

Globalization as we knew it — the post-World War II Washington consensus — is clearly fading. In the years ahead, physical goods may not flow as freely as they once did. There may be more of a regional approach to free trade, including smaller trading blocs. With that said, fears of a collapse in global trade because of tariffs have not materialized, and global trade activity remains robust. Globalization is not ending, it is transforming. Supply lines are being redrawn, rules are being rewritten, and the costs of doing business are rising. It will likely take years for the new consensus to take shape.

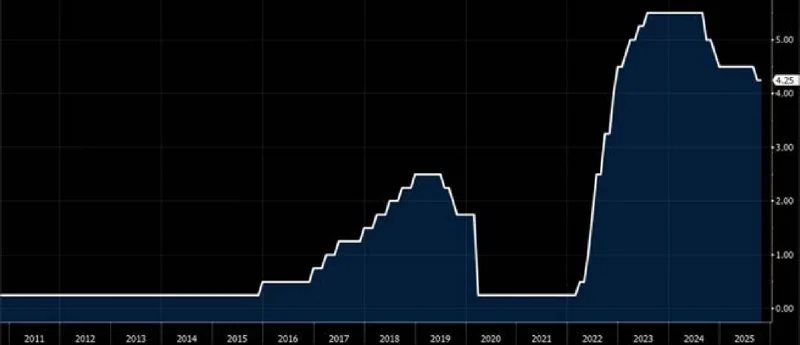

Interest Rates Lower

After a nine-month pause, the Federal Reserve lowered interest rates in September. This rate cut was unusual as it came with US equity indices trading near all-time highs. The Fed typically eases monetary policy in response to economic weakness, so rate cuts often coincide with weak stock markets.

Since 1990, there have only been a handful of times when the Fed has cut rates with the S&P 500 within 1% of its all-time high. On each of those occasions, the index was higher a year later, although stocks sometimes had a rocky ride in the short term.

FED FUNDS RATE

Outlook: Powering the Future

The stock market is at record highs, credit spreads are historically tight, the economy is reasonably strong, and inflation is creeping up. The overall picture is a market that might be getting ahead of itself and due for a breather. We have taken profits and raised cash to diversify into foreign markets and cheaper stocks, although we still maintain a pro-growth bias overall.

While America certainly has its issues, no other country can match us technologically or economically.

Try to avoid the noise and focus on the underlying fundamentals, which remain strong. You can expect a little bit of a pullback after the recent rally, and we are monitoring employment data closely as a key indicator of economic health.