Funding a comfortable retirement has the potential to be a challenging process for anyone. But women, in particular, are especially likely to confront a number of financial risks during their 60s, 70s and beyond. The main reason: Women have a well-established history of living longer than men while often having fewer opportunities to accumulate wealth over their lifetimes. That one-two punch can make retirement feel like a bit of a minefield for many women—even those with significant wealth.

The good news: There are steps women can take that can potentially put them in a better position for retirement.

Women face some unique hurdles that make their march toward retirement that much steeper. For example:

1. Women live longer.

Women live almost six years longer than men, on average, to age 79 versus 73½ years old, respectively, according to the Centers for Disease Control and Prevention. The CDC has also forecast life expectancy at birth for women in 2019 at 81.4 years, versus 76.3 years for men. But at age 65, women are likely to live nearly another 21 years compared to men’s additional expected 18 years.

What’s more, affluent women tend to live even longer. One study found that women in the top 1% were expected to live to 88.9—10.1 years longer than those in the bottom 1%. Those extra years can boost the odds of women both running out money and spending some of their retirement years without a partner for support.

Living longer may lead to spending more money on health care. More than 70% of assisted living residents are women, and over half of nursing home residents are female, according to statistics compiled by Zippia.

2. Women build less wealth.

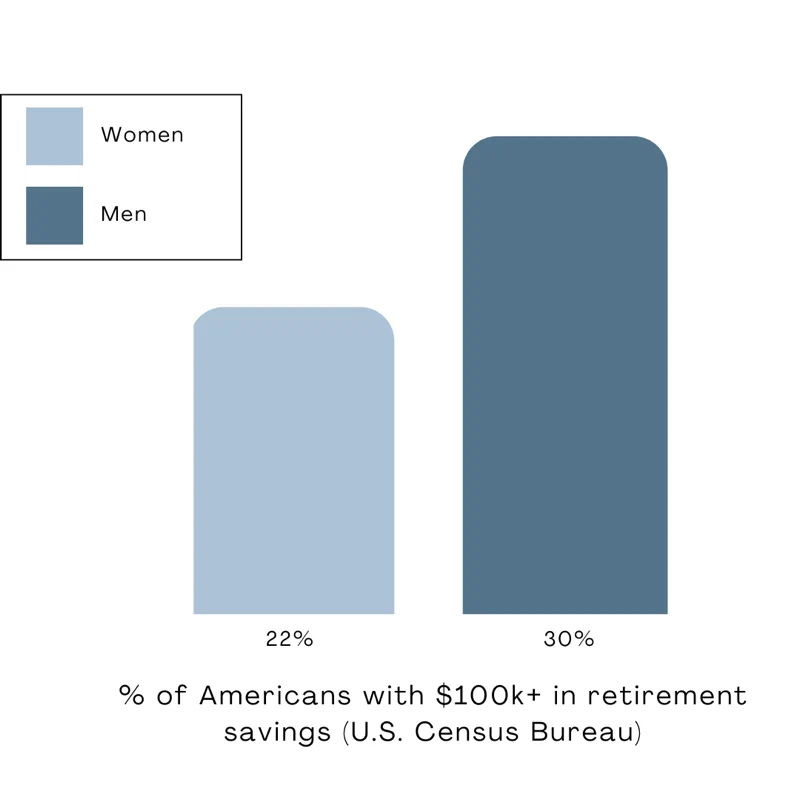

Women’s financial health is also generally less sound than men’s. U.S. Census Bureau data shows that just 22% of women have $100,000 or more saved for retirement, while 30% of men do. What’s more, U.S. women are projected to reach retirement with just 75% of the wealth accumulated by men, according to Willis Towers Watson.

This disparity can lead to some alarming outcomes. For example, women 65 and older are 80% more likely than men of the same age to be living in poverty, according to The National Institute on Retirement Security. If you have significant assets, you may not be likely to become impoverished, of course. But the research highlights the risks that women, in particular, face when it comes to having adequate funds to live a comfortable lifestyle in retirement.

STRATEGIES TO CONSIDER

Some of the biggest systemic challenges for women—including pay inequities and time away from the workforce—remain real factors that can take time to address. The good news is that a successful retirement is possible for women who harness these various strategies:

1. Plan for a multistage retirement

The facts point to women in general living longer than men. Therefore, women with partners should consider what retirement will look like both as a shared journey and, potentially, later as a solo stage. Each stage may have different financial requirements and costs as well as other issues to navigate. The solo stage, if it occurs, is likely to be more expensive and complicated as you age and potentially face increased health care costs and responsibilities you’ll need to address on your own instead of with a partner. Planning for a multistage retirement should involve honest discussions about investing and spending—as well as wishes

and needs—with advisors, family members and others who might one day be involved in helping with caregiving.

2. Get involved—and stay involved—with family finances.

If you’re not already, look to be an active partner in investment decisions and other financial matters. That might mean learning more about aspects of financial planning and retirement spending (from your advisor, books, adult ed classes and other resources), as being financially informed can be crucial in making wise, confident decisions about wealth—and in feeling comfortable with decisions that may affect your future.

3. Work smarter.

If you work, look for ways to increase your take-home pay. One idea is to job hop. Pew Research found that 60% of workers who changed jobs saw an increase in their real earnings, versus only 47% of those who remained with the same employer. Staying in the workforce for a longer period of time is another way to potentially arrive at retirement with more money saved up. It could also help you build up additional Social Security credits that result in more retirement income.

4. Allocate more money to retirement savings.

An obvious move—one that could be easier said than done, of course—is to set aside more money in retirement-focused accounts. That might mean putting more into a 401(k) or Roth IRA, or a health savings account designed to help fund health care expenses. There are also spousal IRAs, which let a working partner open an IRA for a nonworking spouse to save for retirement. Consult with a professional about the rules, benefits and risks of any retirement savings option you’re considering.

Conclusion

Retirement can present some unique and tough challenges for women. But there are plenty of ways you can increase the likelihood of living the lifestyle you desire and remaining in healthy financial shape throughout your golden years.