Strategy Asset Managers Worldwide Equity portfolio seeks to achieve long term capital appreciation by investing primarily in the common stocks of globally diversified, financially strong, and well managed companies. The portfolio will typically hold 25 to 35 stocks with 70 to 90 percent invested in domestic equities and 10 to 30 percent invested in international equities in the form of ADRs. Risk is primarily managed by broadly diversifying the portfolio across geographies and economic sectors/industries. We look for companies with established market positions and favor companies with increasing dividend payouts. In general, the portfolio is looking for stocks that have P/Es at a discount to the market, free cash flow to finance their growth, and a strong competitive market position. Inception Date: 07/01/2001.

The portfolio management team examines price to sales, price to book, balance sheet leverage, earnings and price momentum, and insider buying. Additionally, Strategy Asset Managers seeks companies that have good corporate governance and have incentive plans that align management with the interests of the shareholders. A stock can be sold if it hits its price target, its fundamentals change, or if it can be replaced by a stronger candidate with more upside potential. If we determine that the thesis is no longer valid, the stock is sold.

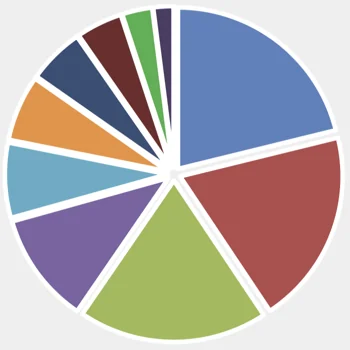

Sector Percentages as of 09/30/2025

Period Ending 09/30/2025

| QTD | 2024 | 3 Year | 5 Year | 10 Year | |

|---|---|---|---|---|---|

| Worldwide Equity Gross | 5.6% | 18.2% | 20.2% | 14.0% | 11.0% |

| Worldwide Equity Net | 5.4% | 17.6% | 19.2% | 13.1% | 10.2% |

| Global Equity Index | 7.0% | 18.0% | 24.1% | 14.9% | 13.1% |