Second Quarter Review

The performance of the stock market in the first half of the year has been very encouraging, with the S&P 500 index achieving multiple new all-time highs. Overseas economic data is starting to show improvement as well. While 1st quarter GDP growth was weak at 1.3% annualized, we think this may be understated due to the ongoing effects of supply chain bottlenecks.

The U.S. economy continues to be the strongest major economy in the world by far. While the strong consumer has driven higher imports, exports failed to keep pace as overseas growth faltered. However, we think that the technology being developed here in the United States will eventually lead to increased efficiency and stronger growth in the rest of the world. Perhaps things are not as bad as they might seem, and the worst of the global economic slowdown is behind us.

U.S. Consumer Strength

Consumer spending has fueled US economic resilience and outperformance vs other advanced economies. U.S. consumers have benefitted from low fixed-rate mortgages, pandemic-era savings, and strong income growth.

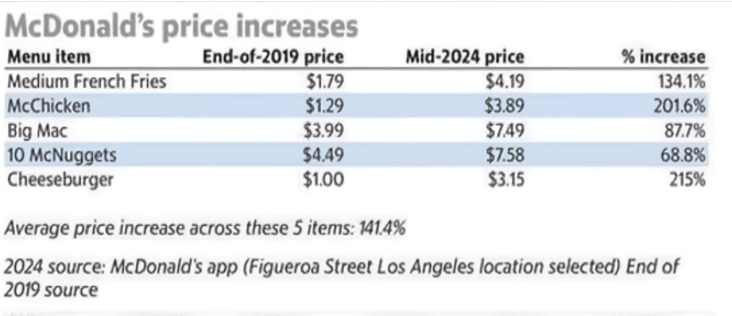

Shoppers have been shocked by how quickly prices have risen since 2021.

However, we are starting to see that trend reverse for certain items, with big-name retailers announcing price cuts. Walmart, Amazon Fresh, Walgreens, and Target all recently announced price cuts on essential goods like food. Low-income consumers are being forced to prioritize essentials over discretionary spending. Lower prices for goods are a sign of relief for consumers, though this may impact profit margins for retailers.

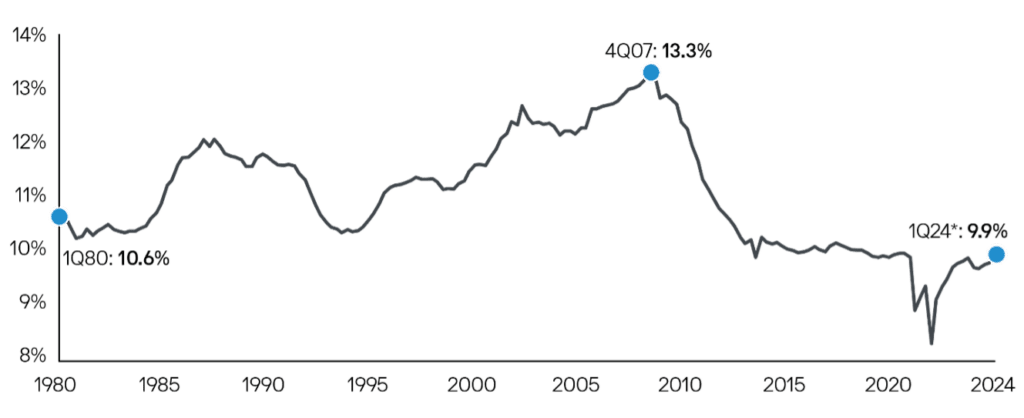

Households Are Not Leveraged

When interest rates plummeted during the Pandemic, many homeowners and corporate CFO’s took advantage and refinanced their debt. These individuals and corporations were mostly unaffected by the large increases in interest rates we have seen over the past couple of years.

In fact, U.S. homeowners are on average only paying 3.8% on their mortgages. This low sensitivity to interest rates has helped keep the U.S. out of recession and is great news for the stock market, which may not require imminent rate cuts to continue its rally.

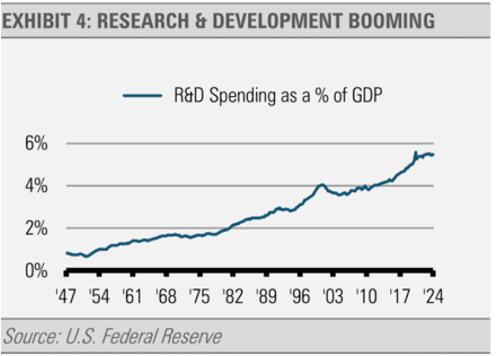

U.S. Leadership in R&D

The United States continues to lead the world in investment in research and development (R&D). R&D investment has climbed to an all-time high of more than $1.5 Trillion annualized and now represents 5.5% of GDP. For reference, this is more than triple the R&D spending we saw during the 1990’s.

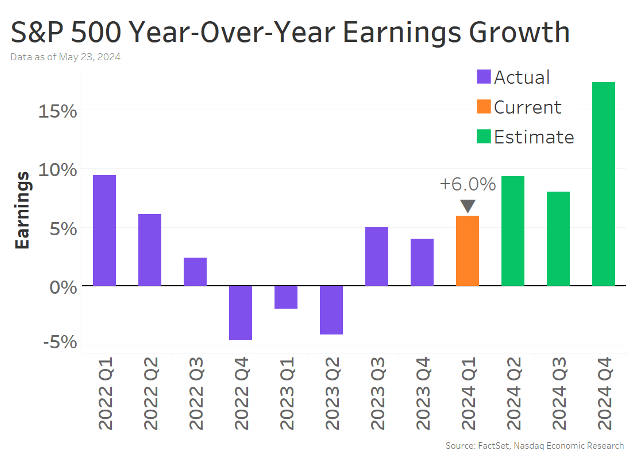

S&P 500 Year-Over-Year Earnings Growth

S&P 500 earnings have been extremely strong as well, increasing 6% year-over-year in Q1 with expectations for nearly 10% growth in Q2.

Technology has been the driving force in financial markets, catalyzing innovation throughout the economy. Product development, customer engagement, and a whole host of other critical business activities stand to benefit from the revolutionary technologies currently being deployed. Companies are searching for ways to most effectively leverage AI and other transformational technologies. The AI-related “Fab Five” (Amazon, Google, Meta, Microsoft, and Nvidia) were responsible for the market’s earnings growth in Q1. Earnings for these companies grew 85% year-over-year, while falling 2% for the rest of the S&P 500.

Utilities Benefitting from A.I.

A.I. requires incredible amounts of electricity to function, and utility companies stand to benefit as a result. A ChatGPT query consumes ten times the energy of a Google search, and the large data centers necessary to support A.I. will consume unprecedented amounts of electricity. Electricity demand in the U.S. has been flat for decades, but the rise of A.I. is likely to reverse this decline. Utilities valuations are also 10% to 40% lower than other AI-related sectors, and these companies can provide exposure at a better price.

What we are Keeping an Eye on

While leadership has favored growth this year, factors including extreme sentiment, seasonal headwinds, and elevated valuations could threaten this leadership in the 2nd half of the year.

Inflation continues to stay sticky around 3%-3.5%. We are watching closely for any reacceleration driven by the U.S. governments unprecedented budget deficit and the trillions of dollars of liquidity the Fed has pumped into the financial system. If inflation accelerates or fails to decline, interest rates might be maintained at this elevated level. This cycle has proven remarkably unpredictable, and active management will be essential to navigate the uncertain future.

What To Expect Going Forward

The S&P 500 has had the second-best start to an election year on record, trailing only 1928. A strong first half has typically boded well for performance the rest of the year. While weakening breadth needs to be monitored, strong momentum is a positive signal for the rest of 2024. Summer is typically a slow time for the equity markets, and you should expect to see a pause as the markets digest the gains from the 1st half. With that said, you should expect increased volatility accompanied by solid economic growth in the last six months of 2024.

Presented By: