First Quarter Review

After a strong technology-led 2023, the stock market rally continued in the first three months of 2024. The gains have broadened out, and the performance gap between the big tech stocks and everything else is no longer expanding as more stocks participate in the upside. This improved market breadth has been accompanied by all-time highs in international markets including Japan, Germany, and France. S&P 500 earnings have continued to rise alongside the economy. A broad pick-up in global manufacturing data is indicating improved business sentiment, which bodes well for future returns. Despite these positives, the persistent geopolitical tensions, looming U.S. Presidential Election, and divergent trajectories of global central banks highlight the crucial role of active management in navigating a fundamentally uncertain world.

Technical Update

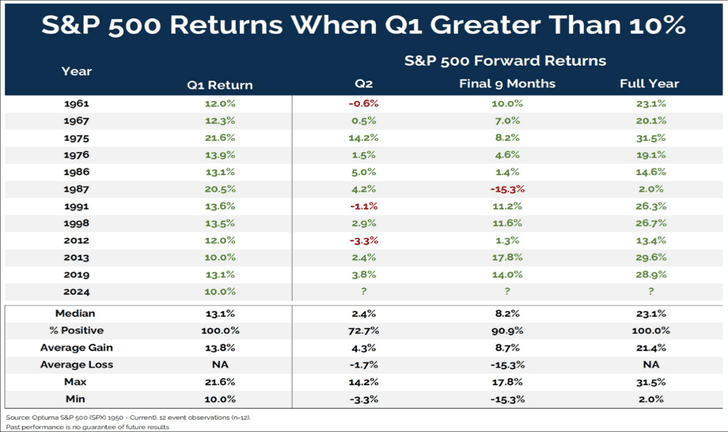

Led by momentum in Semiconductor and other Artificial Intelligence stocks, the S&P 500 had an extraordinarily strong Q1. Strong first quarter performance typically bodes well for the rest of the year.

Inflation Remaining Sticky

Buoyed by resilient housing markets and rapidly rising insurance costs, inflation has remained stuck around 3.5% for ten months. Market participants now assume it will be months before the Federal Reserve can begin cutting interest rates.

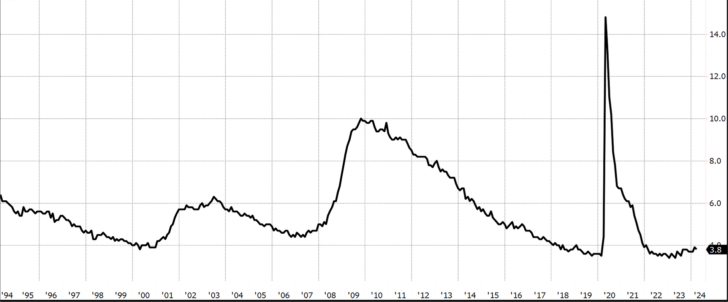

Labor Market Resilience

The labor market has been resilient in the face of higher interest rates, with unemployment continuing to hover near secular lows. The strength of the labor market has fueled consumption and economic growth, allowing the United States to avoid recession.

Manufacturing Green Shoots

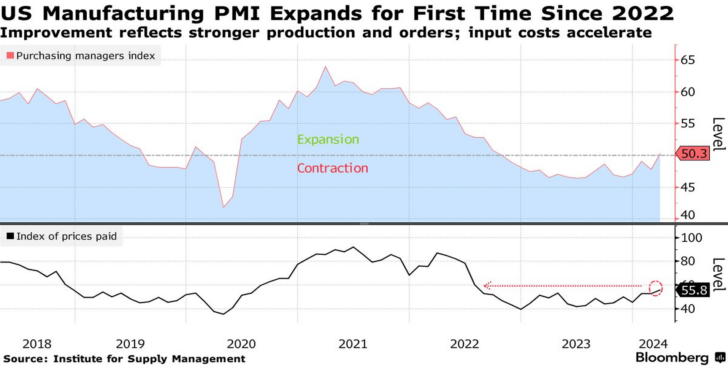

Companies are growing more comfortable with artificial intelligence and are integrating the latest tools into their supply chains to cut costs, speed distribution, and get ahead of potential disruptions.

US factory activity expanded in March for the first time since September 2022 on a sharp rebound in production and stronger demand. The Institute for Supply Management’s manufacturing gauge was the strongest since June 2022.

Major Risks

High interest rates and high inflation remain the preeminent risks to the economy. While consumers and businesses are faring well in aggregate, underneath the surface many Americans are struggling, forced to put essential expenses on high-interest credit cards.

The wars in Gaza and Ukraine primarily impact the economy by driving higher commodity prices. Iran is a major oil exporter, and as a result any attack on Iran or aggressive sanctions enforcement could potentially cause a spike in oil prices, feeding higher inflation. However, the US is relatively insulated thanks to its position as the largest oil producer in the world.

Regardless of who wins in November, conflicts over trade with China have the potential to escalate. The U.S. has incentivized firms to bring manufacturing back onshore and foreign businesses have drastically cut their investments into China. This is the first stage of a broader long-term economic decoupling.

The ever-present media headlines predicting the end of the U.S. Dollar have once again proven to be completely wrong, and the Dollar has appreciated against other major currencies in the year-to-date. With a strong Dollar and the sustained outperformance of a handful of technology stocks, the United States stock market now represents an astonishing 60% of all global equities.

What It All Means

Stock markets are due for an exhale after the impressive performance in Q1, and you should be prepared for a consolidation of recent gains. The market has come a long way in a short time, and it is unreasonable to think it will keep running at this pace.

Last year we predicted that interest rates would remain higher for longer, and this has proven to be the case. If rates rise or growth disappoints, we could see a pullback in the popular A.I. names and the $9 trillion currently invested in money market funds might be deployed into other areas of the market.

Strategy Asset Managers continues to see opportunities to stay invested and actively select stocks with lower risk profiles, less leverage, and positive long-term outlooks.

Presented By