As we transition into 2025, our outlook on the stock market is cautiously optimistic. Investor expectations are high after two years of excellent performance, but with many positive developments already priced in, you should prepare for a more volatile path ahead.

2024 was a very good year, with few market pullbacks and extremely low volatility. The market focused on resilient economic data and A.I. driven earnings growth. This economic and earnings resilience was key last year, with both corporations and the broader economy successfully enduring sticky inflation and high interest rates.

What to Expect in 2025

Most key themes from last year remain relevant in 2025. Inflation has slowed, the job market is healthy, and Artificial Intelligence is rapidly transforming our world. With an incoming pro-business administration focused on deregulation, we continue to be optimistic on the United States. Despite this, you should expect to see an increase in volatility as investors navigate one of the most complex market environments in history.

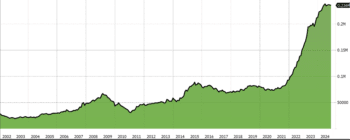

Market strategists generally share our optimism, and most are expecting mid-to-high single-digit returns, with Wall Street currently foreseeing 15% S&P 500 earnings growth in 2025 followed by another 13% in 2026. Strategy Asset Managers was far more optimistic than most strategists last year and the majority of factors that underpinned our positivity are still in place. The United States is the preeminent destination for investor capital, especially if an infrastructure investment super cycle materializes. Fueled by A.I., construction spending on manufacturing in our country has exploded, essentially tripling from its 2021 levels.

Looking Ahead: Opportunities and Challenges in 2025

Jobs and Consumer Spending

The economy continues to benefit from robust consumer spending. We are presently seeing many indications of consumer strength, especially in holiday shopping and vacation travel. Auto sales are accelerating, driven by a positive employment market. A strong stock market should also boost consumer spending.

The Impact of Fed Rate Cuts

The Fed’s rate cut cycle in 2024 was not in response to an economic recession. Rather, the Fed is cutting in response to large declines in the rate of inflation. The market has now concluded that this rate-cutting cycle is over, and the present expectation is for only another 0.25% of cuts in 2025.

Corporate Earnings

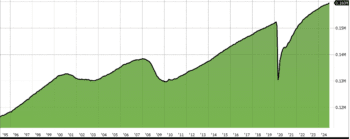

Earnings growth is predicted to be extraordinarily strong, with Wall Street currently foreseeing 15% S&P 500 earnings growth in 2025 and another 13% in 2026.

Policy

President-elect Trump’s agenda of tax cuts and deregulation is expected to propel economic growth. He has pledged to remove 10 regulations for every new one imposed during his second term. While history says it will be difficult to fulfill this promise, a deregulatory push is expected to be a critical focus of his presidency, particularly with Elon Mush and venture capitalist Vivek Ramaswamy leading the Department of Government Efficiency (DOGE). DOGE will aim to $2 trillion in wasteful government spending. For reference the government deficit in 2024 was $1.8 trillion, so achieving this goal could result in the first budget surplus in decades.

This could benefit the most regulated industries: financials, manufacturing, and energy. Lower taxes would naturally boost corporate earnings.

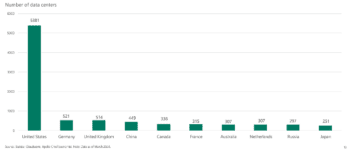

U.S. Data Center Growth

The US is experiencing a surge in corporate and research spending on the back of the Artificial Intelligence (AI) revolution—a dynamic not seen in other developed nations. This “AI boom” is structural, widespread, and pervasive, ranging from investments by tech giants in the development of AI itself to the infrastructure supporting it, from semiconductor design and manufacturing to the building of data centers, increased energy generation needs, and further automation of supply chains.

This is unique to the U.S., and there are now more data centers in the US than in all other major countries combined.

Mega Caps Still Outperforming

The equity market is presently more concentrated than it has ever been. Amazon, Apple, Alphabet, Meta, Microsoft, Nvidia and Tesla – also known as the “Magnificent Seven” – accounted for more than 50% of the S&P 500’s total gains in 2024. Our largest single stock exceeds the total size of every public market other than Japan.

Risks

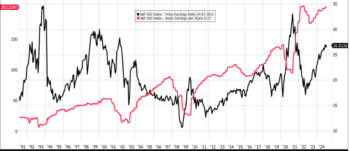

Major risks to our outlook include the potential negative impact of tariffs, sticky inflation, and high valuations. Additionally, geopolitical uncertainties, including trade tensions and political instability in Europe, could weigh on global markets. While inflation has fallen significantly from its peak, it remains above the 2% target and any significant resurgence could force the Fed to reverse its 2024 cuts. Federal government spending rose an astonishing 10% last year, resulting in our government borrowing around $2 trillion in only twelve months.

It’s also notable that following the presidential election, markets have shifted gears, and a speculative frenzy has taken hold in areas such as crypto and lower-quality/unprofitable growth stocks—a sign that investor sentiment is becoming increasingly positive.

With equity valuations near all-time highs, the stock market is beginning the year at a challenging starting point. While favorable earnings growth estimates and solid economic growth could enable risk.

What You Should Know

Fueled by technological optimism and strong earnings growth, the stock market continued to break records in recent years despite high interest rates. So long as consumers remain employed and continue to spend, we can continue to see good economic growth in the 4th quarter and into 2025.

Further evidence of a soft landing would be well received by the market, as would the restoration of the so-called “Fed Put”. The “Fed Put” is the idea that the government will respond to any stock market selloff with decisive policy support. Since 2008 policymakers have used all available tools, up to and including the actual purchase of bonds, to boost markets, and we can expect this policy support to remain for the foreseeable future.