Third Quarter Review

The third quarter is officially in the books, and, despite a bumpy ride, U.S. stocks finished solidly in the green. The S&P 500 Index fell nearly 10% in early August, but stocks quickly recovered and reached a new all-time high by early September. The market was up in the month of September for the first time since 2019. This strong momentum bodes positively for the rest of the year.

In another encouraging sign, recent positive performance was broad, with a wide variety of stocks as well as interest-rate and economically sensitive sectors outperforming.

U.S. Strength Fueling Opportunities

Resilient U.S. growth is starting to fuel an acceleration overseas, with certain international markets outperforming as a result. Several key themes are fueling this growth; these include technological advancement, increased energy demand, and government deficit spending. Large banks and other financials have benefitted from growth in both consumer and government expenditures.

Infrastructure development sits at the intersection of several powerful structural trends that are reshaping the world. Artificial intelligence, automation, and onshoring will drive significant investment in infrastructure, potentially worth trillions of dollars. These initiatives have bipartisan support, and we expect that infrastructure investment will move forward regardless of the results of the 2024 elections.

Positive Signs

Inflation has rolled over, and the Fed is lowering rates from a position of economic strength to preempt any significant weakening within the jobs market. Credit is plentiful and cheap for corporations, while economic growth continues to track within a 2%-3% range.

In September, the U.S. Federal Reserve lowered interest rates by 0.50%, decreasing borrowing costs for the first time in four years. This much-anticipated move should affect mortgage, credit card, and savings account rates for millions of Americans. What does this mean for you?

Lower interest rates can be positive for stock prices. Firstly, they enable companies to borrow money more cheaply for investments in future growth and profitability. Secondly, lower rates make savings accounts and money market funds less attractive, potentially inducing investors to move money into the stock market. Currently, there is a record $6.47 trillion sitting in money market funds, so this effect could prove to be significant.

There have been few indications of imminent recession, and lower rates in the United States will enable foreign central banks to reduce interest rates in their own countries.

Earnings Growth

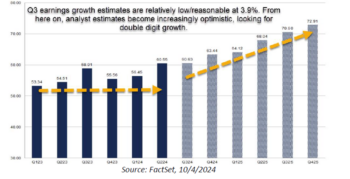

Third quarter earnings results will soon be released and estimated future profits for the S&P 500 continue to be extremely strong. At present it is expected that S&P 500 earnings for the full year 2025 will increase by an impressive 14%.

Election Update

While you should prepare for heightened volatility as the November elections approach, over the long term it will be policies that matter, not politics.

We think you are likely to see a split government again in 2025, with neither party gaining full control of the White House, the Senate, and the House of Representatives. Remember that promises made on the campaign trail often look nothing like policies enacted after Election Day. Wild policy swings are less likely than the media would have you believe, and ultimately the market’s focus will return to fundamentals: the economy, the consumer, and corporate earnings.

Global Stimulus

We have entered an unprecedented era of government fiscal policy. In the past, large deficits were reserved for times of crisis such as recessions and wars, but today the government is stimulating the economy even though economic growth is strong and the unemployment rate is low. This never-before-seen combination of government stimulus and a strong economy has proven to be extremely positive for corporate earnings.

We expect major governments across the world to follow America’s lead, running large deficits in tandem with interest rate cuts. These stimulative policies could prove positive for U.S. companies that earn revenues abroad. China has already begun working to boost its flagging economy, and most market participants expect that these efforts will only increase in size and scope over time.

Debt Problem

The Federal Reserve typically lowers interest rates in response to a slowing economy and rising unemployment. However, our government’s debt is now large enough to compel policymakers to cut rates regardless of the economic environment. At present, the government owes almost $36 trillion, not even counting future obligations to fund Social Security and Medicare/Medicaid.

Additionally, the economic plans put forward by both presidential candidates are projected to add another $3.5-$7.5 trillion more in new debt over the next decade. Ultimately, this level of government debt will force the Federal Reserve to keep interest rates as low as possible, potentially causing another spike in inflation.

What You Should Know

Fueled by technological optimism and strong earnings growth, the stock market continued to break records in recent years despite high interest rates. So long as consumers remain employed and continue to spend, we can continue to see good economic growth in the 4th quarter and into 2025.

Further evidence of a soft landing would be well received by the market, as would the restoration of the so-called “Fed Put”. The “Fed Put” is the idea that the government will respond to any stock market selloff with decisive policy support. Since 2008 policymakers have used all available tools, up to and including the actual purchase of bonds, to boost markets, and we can expect this policy support to remain for the foreseeable future.