The Stock Market Can Continue to Rally

The strong start in January and the resilience of the stock market in 2023 bodes well for the remainder of the year. Throughout last year Strategy Asset Managers remained steadfast in our guidance to remain invested, anticipating a rebound driven by a robust economy, easing inflation, and a dovish Fed pivot. Overall sentiment has remained positive, even during temporary selloffs last March and October, fostering a sense of optimism that is helping to carry markets higher.

Outlook

Strategy Asset Managers’ outlook for the last 11 months of 2024 remains cautiously optimistic. While you should expect geopolitics and elections to drive volatility, ultimately the United States will come together to overcome the challenges it faces, just we have countless other times throughout our history. We anticipate a potential shift in consumer spending patterns driven by medical advancements and a trend towards onshoring. We also expect to see better earnings sentiment now that analysts have set their expectations low. This should favor companies with robust cash flows and high-quality businesses. Our strategies stand poised to benefit from this environment as well as broader upside participation across sectors and industries.

There is an old saying on Wall Street: “As goes January, so goes the year.” Historical data indicates a positive correlation between January’s S&P 500 performance and the market’s annual trajectory, further supporting our optimistic outlook.

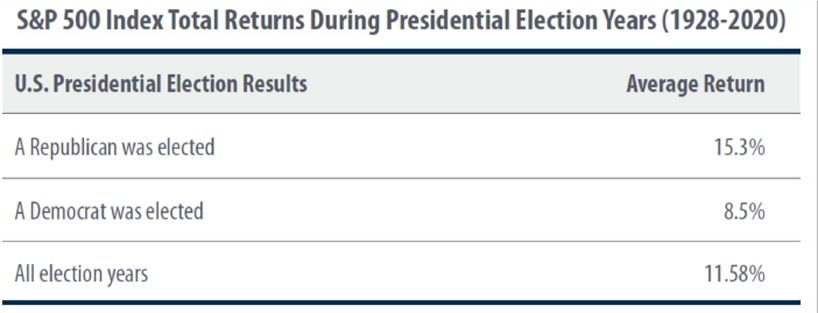

Investing in an Election Year

We have often said that policies, not politics, are what matter most. With a divided Congress and no supermajority, significant policy changes are unlikely. This will ensure a stable trajectory regardless of who wins the elections. Historically, election years signal favorable returns, with the S&P 500 exhibiting an average gain of 11.6% since 1928. We expect that the government will continue to provide policy support in the event of a weakening economy and a backstop should unemployment or defaults rise.

Stock Market Participation Will Broaden

Expect significant industry rotation as the economy transitions toward better-than-expected growth and persistent inflation. Previously subdued sectors may rally, aligning with historical trends following significant market advances. Since 1946, the S&P 500 has risen an average of 10% in years following a 20%+ gain.

Labor Market is Tight

People remain employed and initial jobless claims – a leading indicator – are at levels indicative of a tight labor market, not a hard landing. A robust labor market, coupled with wage gains and low unemployment, should underpin consumer spending and market stability. This tailwind remains a stiff one and will likely continue to be a strong foundation for the markets.

Artificial Intelligence

While Artificial Intelligence will certainly fuel layoffs in specific industries, it will not necessarily cause a large increase in the overall unemployment rate. Revolutionary new innovations have always been accompanied by fears of mass unemployment, yet typically these dire predictions have not materialized. While technological developments do make some jobs obsolete, they tend to create new opportunities in different industries. You could see this repeat as the next industrial revolution progresses.

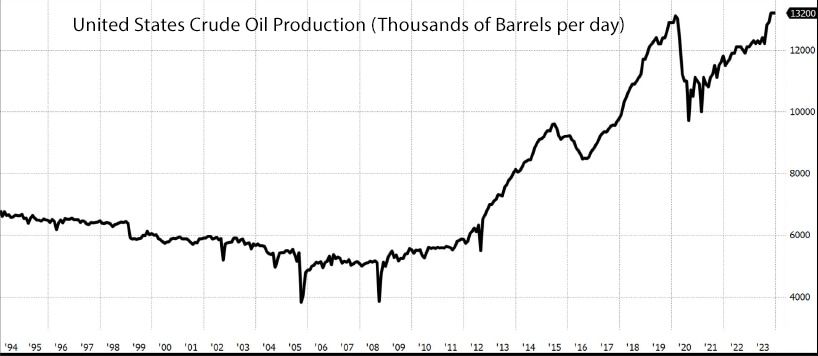

U.S. Economic Strength will Boost Global Growth

Heightened consumer prices, reflective of wage gains and a strong economy, are poised to persist, fostering a broad-based multiplier effect across the economy. This means you can expect higher prices to remain sticky. While a reorganizing of supply chains away from China will create uncertainty, it may benefit other regions, particularly Mexico and Canada. Furthermore, it could add fuel to a developing infrastructure super-cycle. Infrastructure investments focused on digitalization, decarbonization, and deglobalization are compelling opportunities. One of the big stories of the past decade has been the rapid growth of the U.S. oil industry. The United States is now the largest crude oil producer in the world, and as a nation we now export more oil than we import.

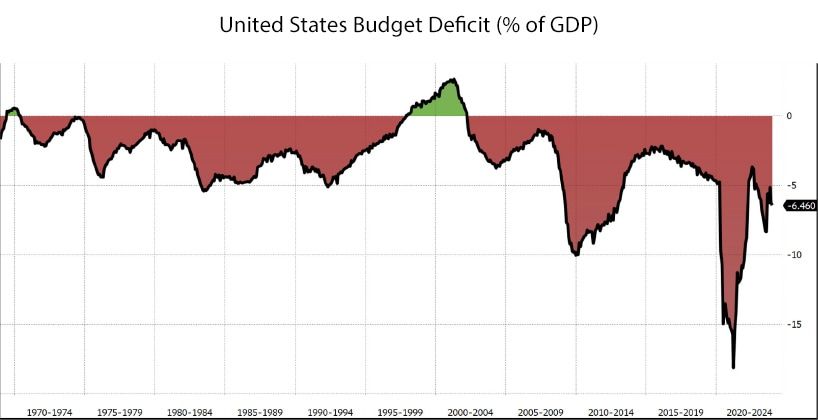

Rising Deficits

Government deficits have continued to rise at a staggering pace, and sovereigns across the world are flooding markets with new bonds to fund these deficits. While this is concerning, especially in the long run, markets have remained resilient for the time being. It is important to remember that the issue of excessive debt is even more severe outside of the United States, and that the Dollar’s position as the global reserve currency might allow the United States to endure excessive deficits for far longer than many expect.

Concluding Thoughts

You should expect volatility to reemerge as the stock market digests inflamed geopolitics and a contentious presidential election. However, the internals of the stock market and the U.S. economy look good to us. Household balance sheets remain in good shape, and this is positive for both the U.S. economy and broader equity markets. Strategy Asset Managers’ portfolios are well-positioned to capitalize on these favorable market trends.