As you enter 2021, we extend our appreciation for the trust you have shown in us. We remain optimistic and want to share why you should also feel positive about the future of the equity markets. With so much negativity and misinformation out there, it is vitally important for you to know where we stand on the issues that affect you financially. This outlook, which is our official opinion, is based on facts, evidence, and decades of experience.

While the unprecedented events we experienced in 2020 will not soon be forgotten, hope is on the horizon and a return to normalcy is imminent. We acknowledge that public health restrictions are devastating to our livelihood: we stopped eating and drinking together, entertaining one another, and going on holiday together. This leads us to ask, what will you do when it is safe to resume these activities? We believe that the end of the pandemic will be followed by a release of pent-up consumer demand. We think vaccine-induced herd immunity will, quite literally, make it okay to party again. And, my goodness, will we have reason to party.

2020 Recap

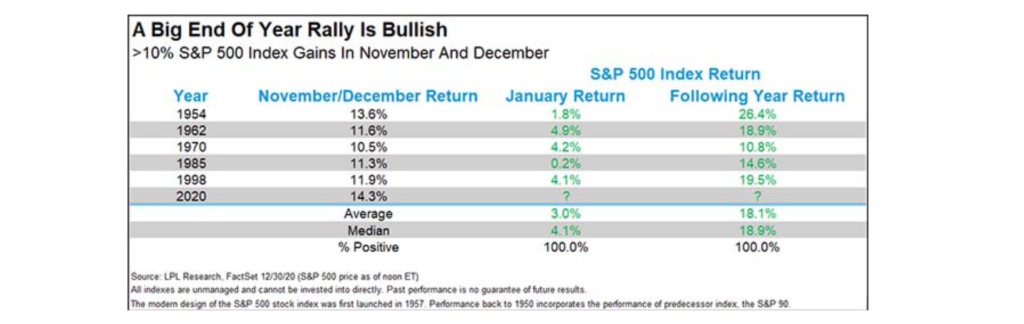

As we look back at 2020, the uncertainty caused by COVID created fear in almost every activity we did. We saw the market make an all-time high on February 19. Then stocks collapsed 35% by March 23, making it the quickest and sharpest bear market in modern history. While the media’s “Talking Heads” predicted more pain in the market, we trusted our research. This research showed that market returns are driven by fundamentals such as corporate earnings, interest rates, and the state of the economy. From there, thanks to extremely aggressive global monetary and several critical fiscal policy responses, stocks climbed nearly 70%. This resulted in yet another double-digit annual percentage gain for the S&P 500 Index.

Fed Provided Support and Bought Time

The Federal Reserve provided trillions of dollars in stimulus. This money was injected into the markets and for the first time, the Federal Reserve purchased corporate bonds and even high yield debt. According to Alexander Hagstrom, CFA, last year the Central Bank Stimulus was three times larger than the total stimulus in 2008! Whether rightly or wrongly, the Central Banks are now expressly working to make sure that stock prices rise.

Digital Revolution

Technology made it possible for incredible collaboration and achievements. The world has seen this collaborative forward momentum in everything from medicine to government. We saw multiple highly effective COVID vaccines developed in record time and learned that it is possible and effective for people to work remotely. The explosion in e-commerce has been phenomenal. The exciting acceleration of innovation and technological growth will continue to revolutionize how we live, think and work.

Unintended Consequences of the Government Shutdown

It is important to remember that the current financial crisis is government induced. The economy was doing very well before the pandemic, and the resulting economic drop was an unintended consequence of lockdowns meant to combat the spread of the virus. Shops and restaurants were closed, entertainment venues and holidays were canceled. This led to high unemployment and a drop in savings for those not working. However, this was not the case for people who continued to work. Those who continued to work saw an increase in savings, as they were unable to spend during the closures. This is a reason why we see such a wide discrepancy in household spending and an unplanned rise in household savings.

Policies, not Politics

In August we said that policies, not politics, are what matter most. As we noted in October, elections do not drive the market, policy does. We know that both sides agree on government stimulus. They also agree on deficit spending, which is likely to be the way forward regardless of the new administration. Therefore, we foresee a future of ultra-low rates and almost unlimited money printing. Moreover, our government came together to provide policy support that is likely to stay in place for some time, reminiscent of the Roaring Twenties.

2021 Outlook

We are looking forward to 2021 and anticipate that the COVID-19 vaccines will jumpstart economic growth and enable people to resume normal activities. We could see an incredible growth rebound, as pent-up demand from the last year gets carried forward in a significant way. When we look out further, the outlook is even brighter. We see many positives: improving economic growth, better corporate earnings, a potentially calmer U.S. political landscape, accommodative policy, and hopes that vaccine rollouts will finally end the devastating coronavirus pandemic.

Pent Up Demand

You do not have to be an economist to understand the desire to let loose, get together, and take risks after a year of cautiously locking down at home and distancing ourselves from one another. We think the belief in good times can spur consumers to make bigger purchases, businesses to invest in a greater capacity, workers to train for better jobs, and, as one of our fertility experts notes, families to have more children. All of these would contribute to a durable pick-up in growth.

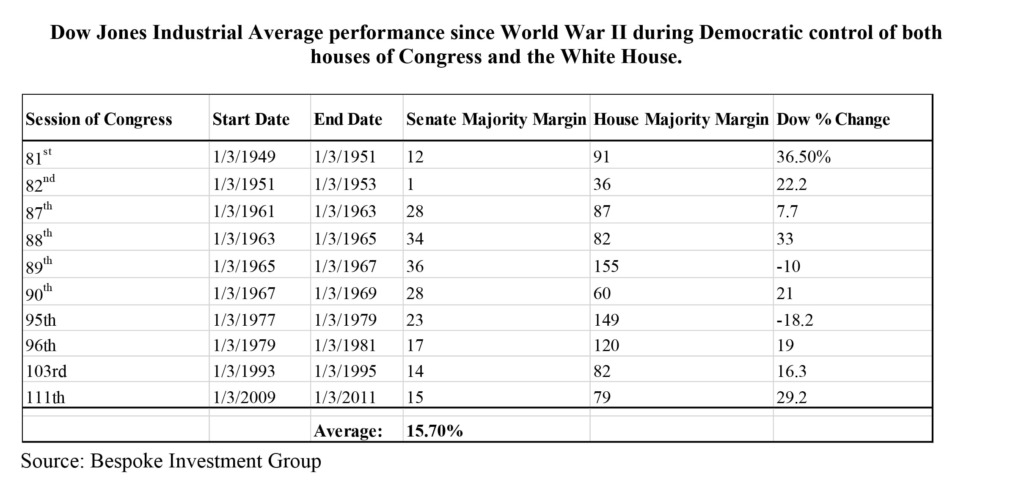

Market Returns Under Democratic Control

Last year, we said history suggests that equities will do fine with Democrats in Washington. In fact, the S&P 500 index has returned an average of 14% per year and the Dow 16% per year when Democrats have controlled Congress and the White House since 1948, according to DataTrek Research. It is also important to remember that Democrats have neither the political capital nor the votes in Congress for sweeping change. The party holds a slimmer majority in the House than it did before the November 2020 election.

What Is Concerning

We think there is good reason to be optimistic, but we are mindful that a lot of market performance has been pulled forward into 2021 Our concerns are if we see any of the following events: the pandemic continues, increased government regulation, major policy reform, and substantial increases in inflation or interest rates. This could slow the rebound in the stock market and would limit the expected strong earnings growth.

Technically

Like we said in May, the market is forward-looking and sees better times ahead. Interestingly, the market’s gains last year were primarily driven by a handful of superstar stocks. Three of the biggest tech giants — Apple, Amazon, and Microsoft — accounted for more than half of the S&P 500′s return last year according to Howard Silverblatt, a senior index analyst at S&P Dow Jones Indices. Absent the top 24 companies, dominated by tech and digital services, the S&P 500 return would have been negative in 2020. We expect to see sectors other than technology perform well. This is called improving market breadth, which is typically healthy for the overall market and often occurs after economic difficulty.

A Bright Future for Commodities

One of the most important lasting consequences of the virus has been the widespread adoption of Modern Monetary Theory. The theory posits that as long as inflation is not high, the government should be printing and spending money in large amounts. While once considered fringe, this philosophy has been fully embraced by Politicians, Central Bankers, and Academics around the world. Policy developed around this theory should be extremely positive in the long term for commodities and the companies which produce them. Although short- term effects are difficult to predict, in the long run more money being printed and spent should eventually drive large increases in commodity prices. We are watching and analyzing the situation closely to position your portfolio to benefit should this trend emerge.

Backdrop Still Positive for Equity Markets

We believe that a chaotic political season is winding down and that the economy is gearing up for a post-pandemic reopening. As the vaccine’s rollout continues, we can see that some countries may be well on their way toward national immunity. We also think that economic and earnings growth will be strong over the next year or two. This is a favorable backdrop to own stocks as they should get a boost from an economic recovery alongside continued hyper-accommodative monetary policy. The equity market also benefits from fiscal support for households/businesses and negative real returns on government bonds.

The Final Point

In times of uncertainty, do not lose faith in the United States. Our nation has always been built on the strength of its citizens, and history assures us that our country has come together time and time again as one nation, “indivisible, with freedom and justice for all.”

Wishing you a healthy and successful New Year,

Joseph Traba, Managing Director and Senior Portfolio Manager Thomas W. Hulick, CIMA, CEO and Managing Partner

Alex Hagstrom, CFA, Portfolio Manager