This is a time to reflect on the difficult year that has passed and focus on the challenges and opportunities ahead. Strategy Asset Manager’s active management delivered last year, and we are well prepared for 2023. For our balanced accounts, we were able to take advantage of and lock in higher interest rates, while our stock strategies outperformed due to sector positioning. With manufacturing returning to the U.S., and the world moving past the pandemic, these strategies are set up to succeed in the new year.

With all the talk of a downturn and imminent recession, we know that the global economy is slowing. We know that big technology and media companies are cutting jobs. But we also know that unemployment is low, credit is plentiful, and inflation is cooling. People still want to travel, and this should have a calming, positive effect on the economy.

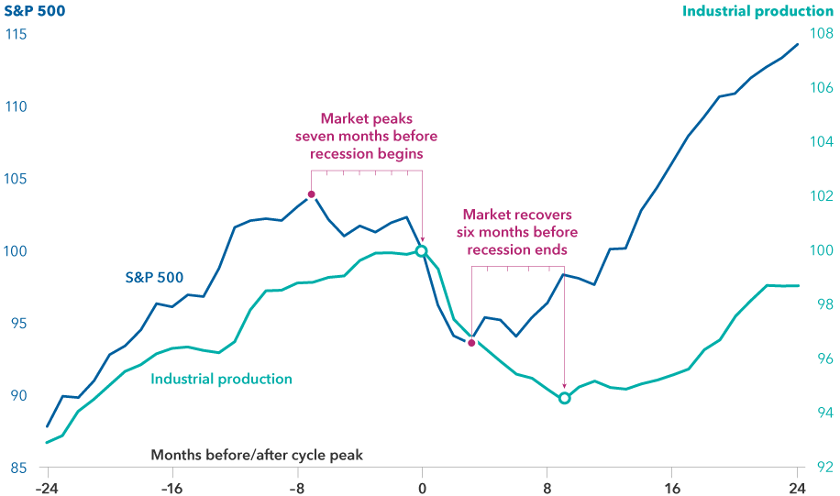

Stocks Turn Up Before the Economy

Our analysis of 11 U.S. cycles since 1950 shows that recessions have ranged from 2 to 18 months, lasting about 10 months on average. However, the stock market usually starts to recover before recessions end. Stocks led the economy on the way down during this cycle, with nearly all major equity indices entering bear market territory by mid-2022. If history is any guide, stocks should rebound about six months before the economy bottoms.

Opportunity Ahead

The U.S. economy should slow as the Fed continues to fight inflation, eventually affecting jobs and wages. At the same time, equity markets could rise as investors become more optimistic about inflation and the Fed stops raising interest rates. We believe it will be easier to navigate inflation’s negative impact on corporate earnings and consumer balance sheets in 2023. This contrasts with last year when inflation continually surprised central banks and investors to the upside. Our message is to ‘Keep it Simple’ in 2023. The massive increase in short-term interest rates has created attractive total return opportunities across many investments, without having to take on excessive risk.

When will the Markets Stabilize and Move Higher?

After a volatile 2022, you should remain optimistic thanks to strong employment and healthy credit markets. You should be on the lookout for economic or geopolitical signs that a sustained market recovery is on the way. We do believe that markets will begin to recover as the uncertainty surrounding interest rates, inflation, and fiscal/monetary policy dissipates. China’s reopening after years of intense lockdown will provide an additional boost. Yes, there are a lot of negative headlines, with the most prominent being the U.S. hitting its debt ceiling. However, regardless of what happens with the debt ceiling, the U.S. will not default on its existing obligations. In any outcome, the government will continue to service its existing debt. Most likely, however, the debt ceiling will be increased, as it has 78 times since 1960.

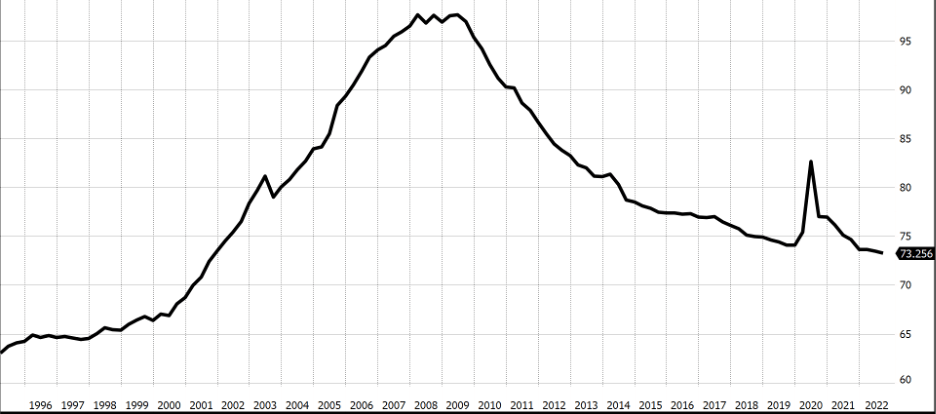

U.S. Consumers Less Sensitive to Rates

While some consumers will certainly suffer from the rapid rise in interest rates, it is important to note that, in aggregate, U.S. households are far less leveraged than they were prior to 2008.

Consequently, they may be less sensitive to rising rates than most imagine.

Made in America

One silver lining from the pandemic is the return of manufacturing to the United States. Years of globalization have led to underinvestment in machinery, plants, and other capital projects. With global supply chains damaged by Covid, companies can now clearly see the benefit of keeping supply chains in America. Significantly lower energy costs in the U.S. could also give American manufacturers a competitive edge. You might see ‘Made in the USA’ become a byword for growth yet again.

While production in America does carry higher costs, manufacturers will be able to capitalize on revolutionary technological advancements in the field of robotics/automation. While we are excited by new developments in healthcare and software, there might also be a wave of innovation from capital equipment companies. You could see a capital investment super-cycle and an industrial rebirth as the reshoring of supply chains, grid modernization, and investments in renewable energy drive demand for capital equipment spending. The result could be a boom for manufacturing, especially if input costs decline.

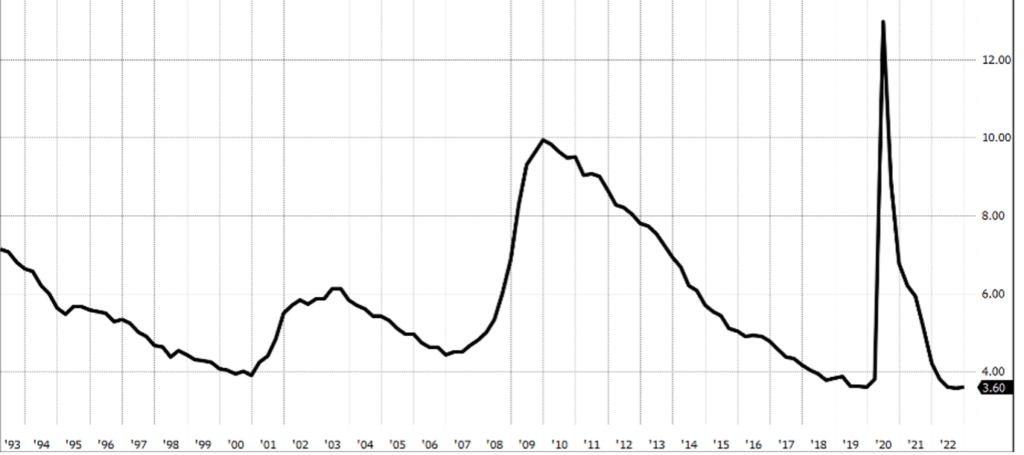

Jobs Market Still Strong

Defying widespread calls for a recession, the U.S. labor market remains extremely strong. While layoffs from large technology companies have been well publicized, these workers are finding new jobs quickly, and employment in other industries has remained robust.

Inflation Declining

Since peaking last June, U.S. inflation rates have declined for six consecutive months. If prices of oil and housing remain where they are today, we can expect the rate of inflation to continue its decline in 2023. If this scenario comes to fruition, then it is possible that the Fed will move to a more neutral position, helping stabilize mortgage rates and backstop the decline in the housing market. Falling inflation, a more neutral Fed, and stable interest rates could result in a stable or weakening U.S. dollar. This would prove beneficial for S&P 500 companies, which earn a large proportion of their revenues in foreign countries.

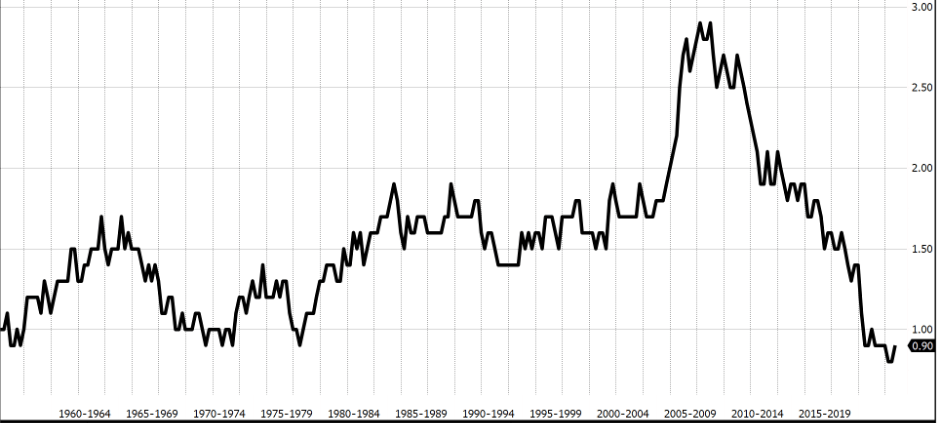

While many pundits are calling for a 2008-style crash in the housing market, we are in a very different situation today. Firstly, U.S. homeowners no longer have floating rate mortgages. This means that the rapid spike in interest rates is not affecting their monthly payments. In addition, homeowner vacancy rates are near their all-time lows. This is the opposite of 2008, when vacancy rates were at all-time highs.

Risks

There are, however, risks that could derail our forecast. For example, the Fed could remain too aggressive in the face of declining inflation and rising unemployment. Increasing energy costs, driven by ongoing or escalating geopolitical factors, could cause inflation to remain higher than expected while also creating general uncertainty around the global economy and financial markets.

Technical Picture Improving

There was a significant sector rotation last year as performance leadership shifted to energy, utilities, and consumer staples. These top-performing sectors are amongst the smallest in the S&P 500, totaling only around 14% of the benchmark. Information technology alone is almost double that size, representing 27% of the index. This size disparity was even more pronounced at the beginning of 2022. With more stocks participating to the upside, market breadth has improved. The sector rotation is a very encouraging development and a big reason why Strategy Asset Managers outperformed last year.

Putting It All Together

You should be optimistic that conditions will improve as we get more certainty regarding earnings, inflation, interest rates, and geopolitics. As of now, the market is in a holding pattern, and it will continue to be volatile so long as uncertainty persists. However, global growth and consumer spending could get a boost from higher wages, abundant job openings, and declining inflation. You should look beyond the stock market’s lackluster performance in 2022 to the future with renewed optimism. High quality, well-managed companies will be able to compete and flourish, however the economic environment develops, and patient, selective investors will be rewarded over the long term.

P.S. If you think this type of information would be beneficial to anyone you know, please share this communication with them.