First Quarter Review

In times of uncertainty, we look to eliminate emotion and rely on our research. While market exhales can be difficult to stomach, 10%-20% declines are normal and should not be cause for panic. While we would love to see stocks go up every single day, this is simply not realistic. In recent months risky assets like technology stocks and cryptocurrencies have fallen from their all-time highs while low volatility and foreign stocks have benefited. Uncertainty over tariffs has led the market to price in negative outcomes, leaving room for positive surprises in the months ahead.

Active Management and Avoiding Emotion

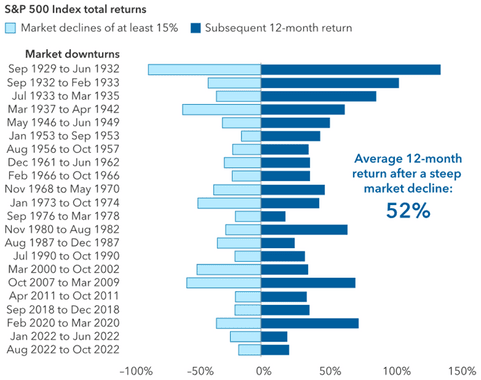

Over the past decade twenty percent market declines have occurred roughly every two years, with 2025 as no exception. Rather than fixating on the decline behind us, we are focusing on what comes next. Historically, steep selloffs have often been followed by strong rallies. We are not overreacting to headline news and are instead analyzing the tangible policy changes to fiscal spending, immigration, and regulation.

Opportunity

What if, instead of more uncertainty, markets start to see positive news flow? When investors are feeling negative, positive developments often catalyze fierce rallies.

It is notable that, although investors were unprepared for tariffs, importers largely are. Many have been stocking up on products and have stockpiled several months’ worth of goods. Those businesses that have prepared will not need to overreact in the short term, especially if they believe that these tariffs will not be permanent.

Game of Geopolitical Chicken?

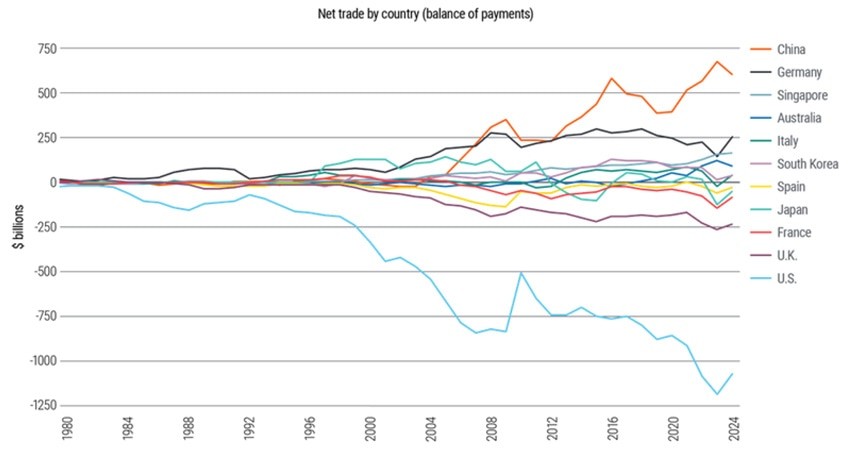

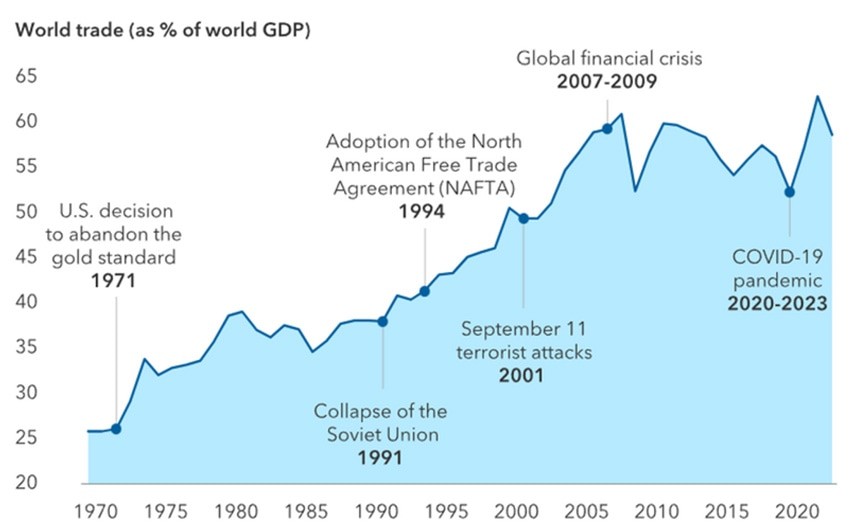

Although trade wars hurt all countries involved, there is a great deal of asymmetry in that countries like Canada need U.S. trade far more than the U.S. needs to trade with them. It seems as if the administration is banking on this leverage in its attempts to secure favorable deals. While trade is certainly critical for the United States, among major economies our economy is among the least exposed.

Figure 1: U.S. looks to rebalance global trade

With that said, trade deals might move very slowly due to anti-American political sentiment. Canada is a perfect example – while their economy would be devastated by a trade war with the United States, most Canadians feel bullied and do not want to give in. However, that is an emotional rather than a practical response, and as the Canadian economy begins to suffer, we can expect this to change. Foreign politicians are playing politics for their voter base when they speak of replacing the United States – America is nearly ⅓ of global consumer spending and replacing that amount of spending is simply impossible over any short time horizon.

Why the Stock Market Can Recover

Selloffs like the one we just experienced are nothing extraordinary, occurring approximately once every two years. Our strategy, which has been the correct strategy over decades, is to not panic and to stay invested. Remember, there was an over 30% drawdown in less than one month during Covid – back then there was widespread fear and uncertainty just like today. We stayed the course, and both the markets and economy made it through. Keep in mind that tariffs are completely reversible at any time – even in a worst-case scenario they could be quickly removed.

Where do we go from here?

The tangible effects of the tariffs and their associated policy uncertainty will start to become visible over the coming months. While survey data is extremely negative, “hard” economic indicators remain positive. With that said, we are watching the market environment closely as it evolves and actively managing portfolios to weather this storm. We own profitable, stable, cash flowing companies that have endured many crises in the past and are well positioned to continue to thriving however the situation develops.

Power of America Inc

Policy aside, technology continues to move forward, and America remains home to the innovations that are transforming the world. We know that there is a great deal of uncertainty, but in the midst of this we are reminded of a quote from Winston Churchill: “Americans can always be trusted to do the right thing, once all other possibilities have been exhausted.”