What a remarkable turnaround it has been! Just a year ago, the stock market was gripped by concerns of high inflation, rising interest rates, lower earnings, and an imminent recession. Today, however, a renewed sense of optimism pervades the market, indicating brighter days ahead. We have weathered a regional banking crisis, a debt- ceiling standoff, an earnings slump, and a sluggish economy. The market responded by rebounding from the October lows, ushering in a new bull market.

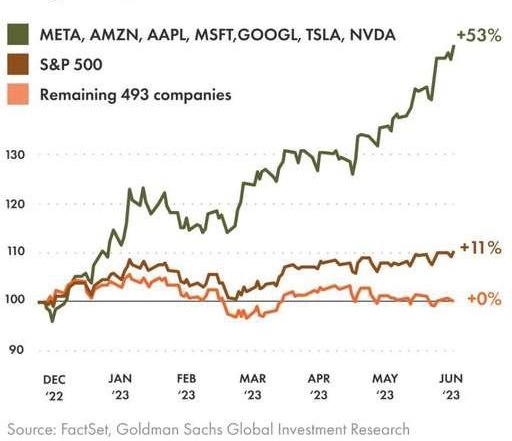

However, performance this year has been heavily reliant on a select few large technology stocks. Companies like Alphabet, Amazon, Microsoft, Meta, Apple, Nvidia, and Tesla have accounted for almost all the gains in the stock market thus far. However, we firmly believe that as earnings improve and market sentiment strengthens, we will witness broader participation across various sectors.

Big Tech’s Performance vs. the Rest of the S&P 500

All seven of these stocks were down in 2022 but experienced a “January Effect” as money rotated back into the most oversold names at the start of the new year. Apple, for instance, suffered a 26.4% decline on a total return basis in 2022, while Amazon and Tesla saw drops of 49.6% and 65.0% respectively. Microsoft experienced a 28.0% decline, and Meta was down 64.2%.

What If We Are in the Beginning of a New Bull Market?

We anticipate that investors will gradually shift their focus towards areas of the market that have not yet participated in this year’s rally. Last year our managed strategies outperformed with the markets significantly lower, and we expect greater upside from the stocks we own as money rotates into sectors that will benefit from technology driven increases in efficiency.

Looking ahead to the second half of the year, we anticipate weak economic headlines, but it is important to note that investors have already positioned themselves for a potential recession. In Europe, GDP growth has been sluggish, and technically the Eurozone is in recession. However, what if the market defies expectations and continues its ascent, indicating the beginning of a long-term bull market? We can expect bearish investors to start buying, propelling the market even higher.

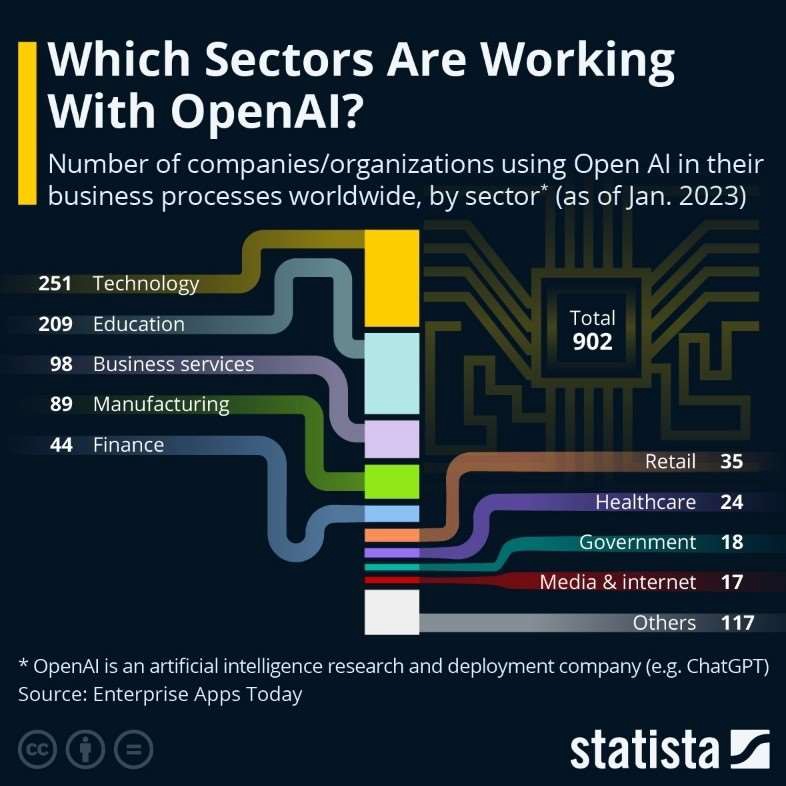

One of the driving factors behind the recent enthusiasm for U.S. stocks is the booming interest in artificial intelligence (AI). Investors are optimistic about the U.S. market due to resilient consumer spending, a robust labor market, and the apparent easing of the banking-sector crisis, at least for the time-being. Additionally, many investors are hopeful that the Federal Reserve is approaching the end of its interest rate hike campaign. An end to rate hikes could create more room for markets to thrive.

Recent months have seen an unprecedented surge of manufacturing investment into the U.S. as corporations look to move their supply chains onshore and position themselves to profit from the technological advances set to revolutionize manufacturing for decades to come.

Construction Spending on Manufacturing Rising in the U.S.

How is SAM Participating in the AI Boom?

We firmly believe that technology only moves in one direction: forward. We are still in the early stages of a technological revolution, and our managed strategies are positioned to benefit from the positive impact of AI adoption and the increased efficiencies that it will enable. Across our portfolios, SAM is invested in leading technology companies like Microsoft and Google in addition to cutting-edge semiconductor manufacturers. We anticipate that industrials firms like ABB will reap significant benefits from the Robotics/AI revolution. The healthcare sector is also poised to benefit as its firms utilize AI to expedite drug development and improve treatment.

What are the Risks?

While we expect the Federal Reserve to pause its rate hikes at some point this year, persistently high inflation and a stronger-than-expected consumer could keep interest rates elevated. Mortgage rates have risen, dampening housing demand and leading to higher office real estate vacancies. Commercial real estate prices have also taken a hit, potentially leading to contagion effects impacting banks and other financial institutions. In China, the government’s continuous bank bailouts have created a zombified economy, preventing a strong recovery. In the U.S., we anticipate more corporate bankruptcies, as we witnessed earlier this year with the collapse of regional banks. However, this is a necessary process for a free market, allowing unprofitable companies to exit to make room for innovative companies to flourish.

Technically: The Contrarian Breakout Continues

Technically speaking, the breakout in international markets such as Japan, Mexico, and Europe, represents a potentially bullish signal. The percentage of stocks above their 200-day moving average, an indicator of market breadth, is higher in these markets compared to the U.S., where the rally has been largely dominated by a handful of stocks. Furthermore, historical data reveals that, since 1957, the S&P 500 index has produced a median return of 20% in the year following a decline. For this trend to continue, we will need earnings to recover over the next few quarters and/or the Federal Reserve to pivot or halt its tightening cycle.

Where Do We Go from Here?

We acknowledge the risks present in the market. However, it’s important to remember that the market often bottoms while the economy is still in recession. SAM has adopted a defensive approach because of the Federal Reserve’s emphasis on increasing the unemployment rate. Thus far, the stock market has focused on robust employment and the positive aspects of AI technology, looking past the challenges posed by lower earnings, slowing economic indicators, and the uncertainty surrounding interest rates and inflation. Nevertheless, what if earnings only decline to the extent predicted by consensus estimates, and the Federal Reserve concludes its tightening cycle? It is entirely possible that we are entering, or have already entered, the next bull market, with the light at the end of the tunnel becoming increasingly visible.