We hope that you are enjoying the Summer with your family and friends. It is hot and dry out here in Southern California, and life is getting back on track. Both the financial markets and the U.S. economy remain strong. This commentary will detail why we at Strategy Asset Managers remain positive and explain some of the ways that we are working to safeguard your financial future.

I am pleased to share some exciting news with you. My longtime friend, Richard P. Kinkade, Jr., has joined our investment and wealth management team. Rick is an experienced portfolio manager who is fluent in Spanish, and he will help to build our international investment management business.

After being locked down due to the pandemic for over a year, I felt it was important to have all the members of the firm meet in Southern California for a team building rally. Everyone enjoyed getting together in person. I am sure you felt the same excitement when you first gathered with your family members and friends after being physically distanced for so long.

I also want you to know that we continue to take extra steps to adapt to the complexities of the evolving technology and internet security environment. Did you know that SAM is one of the only wealth management firms that offers clients an in-house expert to help solve technological issues? We offer an exclusive, high-level concierge IT service to our clients. If you are frustrated, stuck, or unsure about any technology, password, computer, phone, internet security, or email issue, then reach out and we will help.

Another timely reminder…with interest rates at historic lows, if you would like to discuss borrowing/lending needs, whether refinancing your home mortgage or setting up a pledged asset revolving securities-based line of credit, please give us a call.

Why are these updates important? SAM is always taking steps to help you navigate an ever changing and increasingly complex environment. We aim to be proactive, concentrate on the future, and adapt when market and economic conditions change. We truly appreciate the personal relationships we have with you and look forward to seeing you in person soon!

Have a great rest of the Summer!

Sincerely,

Tom Hulick, CIMA

CEO and Managing Partner

Before looking ahead to the second half of 2021, let’s look back to see where we were and what has changed. One year ago, in our June 2020 letter, we said the following:

“if we look out twelve or eighteen months from now, there is a high probability that the business outlook will be much better.”

Since that time, financial markets have come roaring back as the global economy reopened and restrictions were lifted across the world. Our outlook in 2021 has been positive and remains opportunistic.

2021 Second Quarter Review

The equity markets rose to breach all-time highs. The stock market’s stellar 2nd quarter performance was driven by a spike in earnings, which rose more than 60% on a year-over-year basis. 2021 full year earnings are expected to beat last year by a remarkable 30%. This is some of the strongest earnings growth ever seen in modern history.

Many commodities (Lumber, Agriculture, Copper) started to decline after sustained moves higher in the aftermath of the virus lockdown and reopening.

Interest rates peaked and began falling during the 2nd Quarter, consistent with our expectations. This fueled a recovery in growth stocks relative to value, a resumption of the trend which has defined markets post-2008.

The reopening of the economy drove inflation higher, most prominently for Hotels, Airfare, Used Cars, and Restaurants.

We believe that we are in a strong bull market which began in March 2020, during the depths of the COVID meltdown. Most U.S stock market indicators appear very healthy, and breadth has surged during the second quarter.

Earnings Strength

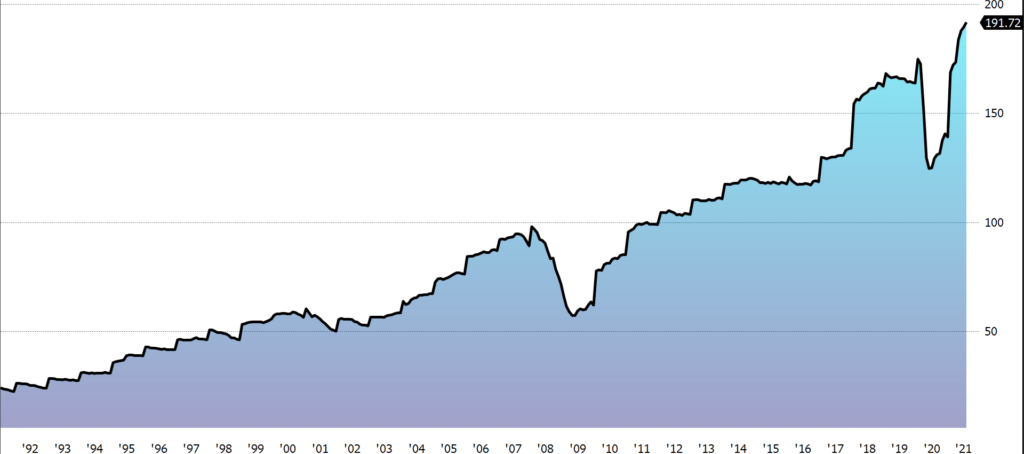

Earnings are the most critical driver of stock market returns over the long term, and they are rising at an almost unprecedented rate. Earnings growth for the second quarter of 2021 is on track to be the best since the fourth quarter of 2009. Q4 2009 was the beginning of a decade long bull market.

While the 12-month forward P/E of the S&P 500 remains a bit elevated, earnings expectations have yet to catch up to an economy coiled to spring higher. Many of the stocks in the market are deserving of high multiples as they boast strong cash flows, rosy future growth, and the ability to borrow and invest at interest rates near zero.

Why Inflation Will Not Derail the Market

Both growth and inflation have picked up markedly in recent months, but we think that only the spike in economic growth will be persistent and that inflation will dissipate next year. In our May commentary we noted that:

“soaring prices for various key materials, like lumber, are likely to ease once additional capacity comes online.”

Lumber has since collapsed in price, falling more than 60% in the last two months alone. This was predictable because the initial spike in prices was mostly the result of disruptions in the supply chain, and as these issues started to resolve price began to rapidly normalize.

A similar sequence of events should start to play out in other commodities as higher prices drive new supply and the disruptive effects of the virus fade.

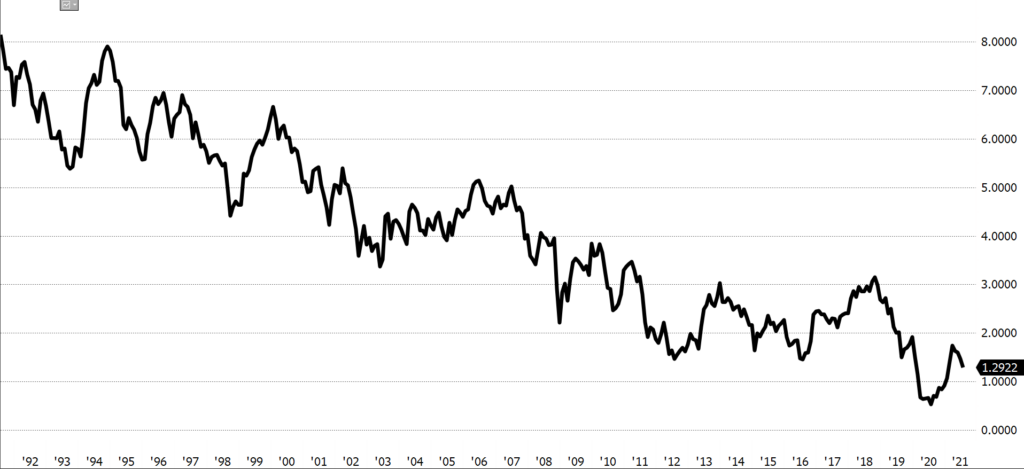

Why Interest Rates Will Remain Low

A key ingredient for our bullish outlook in 2021 is the persistence of low interest rates. Global interest rates remain well below rates in the U.S. – Japanese and European 10-year yields are at or below 0% while US yields are near 1.3%. Government policy in Europe and Japan prevents rates from rising in any material fashion. This is part of the reason that we still believe long-term interest rates will have a hard time moving higher in a sustainable way.

If long term rates were to spike due to excessive inflation, the stock market could be destined for temporary turbulence. However, this would inevitably force the Fed to come to the rescue, as it has done many times previously, and push rates back downwards toward zero while pumping trillions of dollars of liquidity into the financial system.

There have been numerous inflation scares over the last forty years, with three in the past decade alone. Each time these fears have proven to be unfounded. U.S. 30-year bond yields have risen more than 1% year-over-year eight times since the 1990’s. In every instance, interest rates went on to fall in the following year.

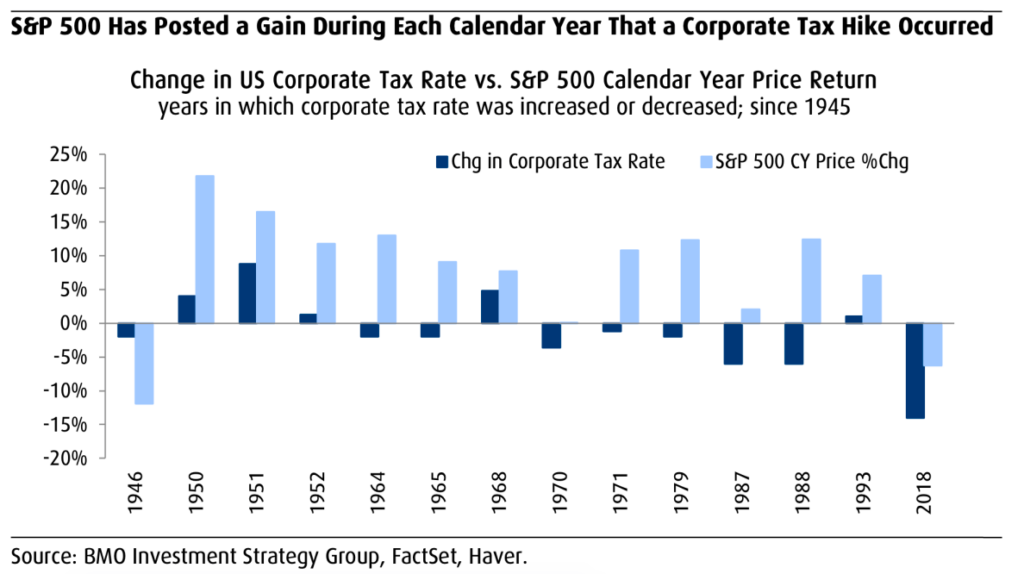

Tax Hikes & the Market

While we do expect taxes to rise in the future, they are very low relative to historical norms. Even if corporate effective tax rates were to double, they would still be similar to tax rates during the 1980’s and 1990’s, which were tremendous boom years for both the economy and markets. In American history there has never been any relationship between tax rates, either corporate or personal, and the performance of the stock market. The market has tended to rise in both low tax and high tax environments, and since 1945 the S&P 500 has risen during every year in which corporate tax hikes were enacted.

Markets Head Higher After a Strong First Half

With the equity markets trading at all-time highs, we understand that there are concerns that the markets will drop. Markets being up, however, does not mean that they must go back down. In fact, history shows that the opposite usually happens. Since 1928, there have been 27 full years during which the S&P has gained 10% or more in the first six months. In those years, the S&P has returned an average of 6.9% during the second half of the year. There have been only seven occasions when the S&P experienced a loss in the second half of the year after posting a double-digit gain to start the year[1].

What It All Means

We remain bullish on the equity market due to the growth in earnings and the ongoing economic rebound. Falling interest rates are positive for equity valuations and the lack of reasonable yield opportunities in the bond market makes dividend growth stocks much more attractive. This all points to more and more equity buying. Fiscal stimulus, high household savings rates, and the reopening of the economy are fueling strong economic growth and positive expectations for the future. Technological advancements have driven gains in productivity across the economy, and the pace of scientific advancement is only going to quicken in the years to come.

Have a wonderful Summer,

Joseph Traba, Managing Director and Senior Portfolio Manager

Thomas W. Hulick, CIMA, CEO and Managing Partner

Alex Hagstrom, CFA, Portfolio Manager

[1] Source: Nasdaq Dorsey Wright