Before we look ahead to the future, it is important to look backwards at the last eighteen months. Last year was a very good year for the stock market. We thought this year would be decent as well, even if not as great as 2019. However, we did not expect this level of volatility. The year 2020 has been filled with unprecedented events that are still ongoing, with several key issues looming in the second half of the year. But we are looking over the horizon and feel optimistic for the future.

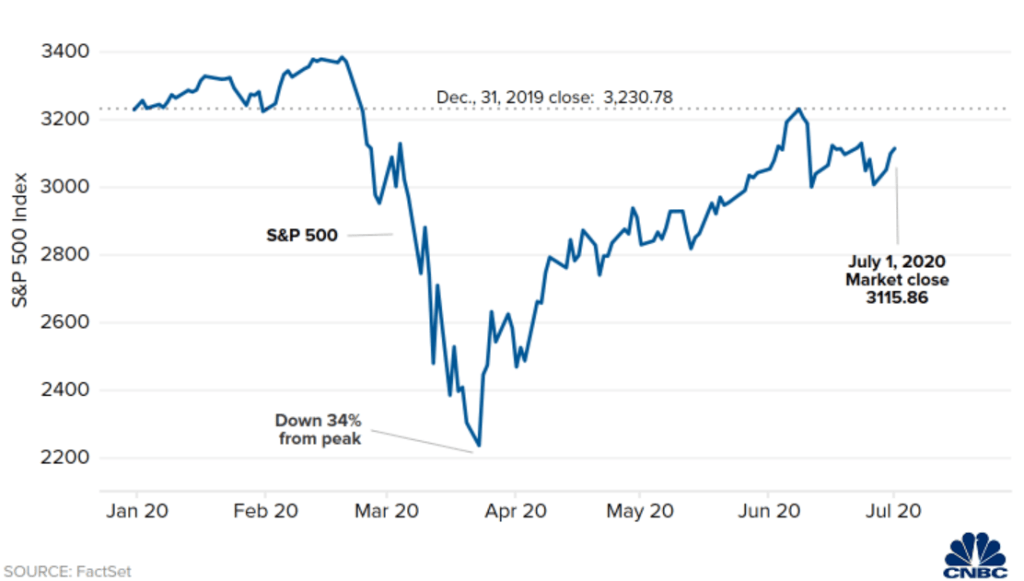

After a dramatic turn of events at the start of the year, as most of the world shut down economically to slow the spread of the coronavirus, the markets sold off 35% in one quarter. Governments around the world responded and attempted to ease the impact of the shutdown with liquidity injections and stimulus packages. By April, we thought there was a good chance the bottom for the markets had been reached, and by May we were optimistic that the markets’ recovery would continue. It became increasingly obvious that the Fiscal and Monetary stimulus bought time for an economic recovery set to accelerate later this year. The markets responded with one of their strongest quarters in history.

As we head into the second half of the year, we believe that uncertain times call for trust in verifiable facts. There are reliable reasons to be positive and optimistic. Earlier in the year there was an economic recession and an unprecedented global health crisis. Fast forward three months and the global economy is once again expanding, with financial asset prices coming off one of their strongest quarters in history. While health experts are quick to caution that the coronavirus remains a serious threat, high-frequency data and our own eyes and experience tell us that commerce is returning as virus fears abate and safety precautions are successful. Furthermore, technological breakthroughs in science and medicine will continue to transform the way we live. The Digital Revolution has made it possible for incredible collaboration and achievements. The world has seen this collaborative forward momentum in everything from medicine to government. We have seen that it is possible and effective for people to work remotely, and the explosion in ecommerce is phenomenal. The acceleration of innovation and technology will continue to revolutionize how we think.

VALUATION CONCERNS

EPS growth estimates in 2020 are being lowered but estimates for 2021 are being raised. So while corporate earnings could decline 20% in the first half of 2020, there are indications that they will reverse higher in the third and fourth quarters. The vulnerability in the markets is, in large part, because analysts do not yet have a good sense of the ultimate economic impact of the coronavirus. For those companies with high sales to China or a dependency on a global commodity, near-term forward revisions may be lowered. Several retailers’ decisions to close stores serve as a reminder that closures by businesses are a risk to economic activity regardless of official lockdowns. Even if the U.S. economy re-opens and economic numbers do not live up to expectations, policymakers are likely to respond with even more stimulus. This stimulus has been and hopefully will continue to be positive for the stock market.

FISCAL AND MONETARY SUPPORT CONTINUE

To combat the government induced shutdown, the Federal Reserve cut interest rates to zero on March 15, 2020 and offered essentially unlimited liquidity. The Fed’s view is that things will just keep getting better and better as the economy gets up and running again. This will be helped not only by normalizing activity but also by fiscal and monetary policy support. Central banks around the world have already come together and they remain committed to supporting the financial system. In the United States, the Federal Reserve has now established a “whatever it takes” approach to helping the economy through the coronavirus shock. Financial institutions are joined globally in a commitment to help navigate this unique time. The Fed is trying to stay ahead of concerns about the economy, fundamentals, and geopolitical/social turmoil caused by the spreading coronavirus.

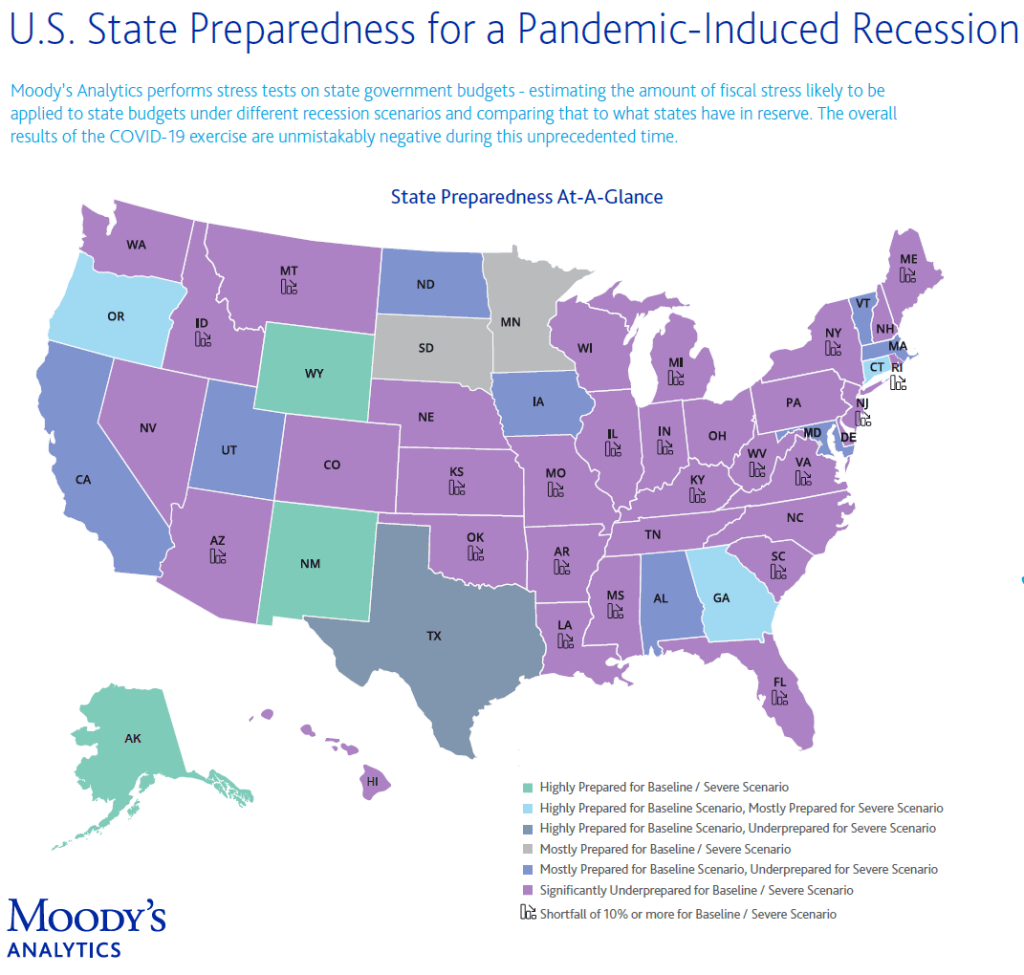

There is concern in financial markets regarding the massive deficits facing U.S. states and municipalities. Moody’s stress tested revenues and expenses under various COVID-19 scenarios. The report shows that state and local governments will need approximately $500 billion in additional aid over the next two fiscal years to avoid major damage to the economy. Timing is of the essence, as policymakers face several important budget deadlines in the weeks and months ahead. If action is not taken quickly enough, the spending cuts and tax increases that would need to be undertaken could cost several million additional jobs and further delay the recovery. There is every indication that the actions needed will be taken with due speed by our policymakers.

POST PANDEMIC WORLD

Coronavirus is a black swan event that is shaping our way of life and continues to impact financial markets. No one knows with certainty how much, or for how long, the Coronavirus will impact the US economy. A post Covid-19 world will feature volatility as the markets trade on news headlines and public fear. As we push toward a cure, the ongoing threat of a surge in cases could potentially delay the recovery. Despite this we are learning more about the virus daily and we will—together — get past this thing.

History tells us that pandemics act as an accelerator of change. On the plus side, this pandemic drove businesses across the world to rise to the occasion by facilitating remote work for millions of employees. Now what was once relatively unusual is standard practice, with a huge swathe of the population using video conferencing apps like Facetime, Zoom, Google Hangouts, and Cisco WebEx. History also assures us that while change is never easy, it can be ultimately beneficial. We can look back to the 1918-1919 Spanish flu pandemic and see that the U.S. emerged victorious, going on to enjoy the “Roaring Twenties,” one of the most prosperous decades of the 20th century. The lessons learned in the hardest of times help us to be better and stronger in the future.

POLITICAL HURDLES AHEAD

The next big event up ahead is the U.S. elections and the uncertainty they create. In this case it is also wise to keep a historical perspective and be mindful that policies, not politics, are what matter most. Political uncertainty itself is unlikely to disrupt financial markets unless there is some evidence that it is impacting the behavior of companies and consumers. For now, however, governments and consumers continue to spend. This liquidity should prove an effective balm for the occasional case of geopolitical jitters.

We, at Strategy Asset Managers are prepared for any political outcome and while we understand the fears and concerns regarding the upcoming November elections, we are confident that America and our financial markets will remain strong no matter what. Our investors can trust that we, at SAM, have flexible, excellent plans for all outcomes. Our nation has always been built on the strength of her citizens and history assures us that the United States has come together time and time again as one nation, “indivisible, with freedom and justice for all”.

TECHNICALLY

With earnings season winding down for a while, the market typically will, usually between May through September, trade sideways in a wide and loose range, so be prepared for some wild swings to happen in response to random “headline rhetoric”. Volatility is to be expected. Currently, markets have reversed lower from overbought levels and are consolidating – or exhaling after a big workout. However, the bigger picture trend remains up. The shorter-term/minor trends, which are more susceptible to the day-to-day “noise” and opinions, is currently under pressure. While each of the major domestic equity indexes saw recent declines, long-term indicators remain positive. We believe the markets are consolidating as we enter the “Summer Doldrums.” But if we look out further, the market has a strong probability of being higher.

KEEP YOUR PERSPECTIVE

We, at SAM, want to encourage you to be hopeful. During difficult times stress can wreak havoc on your brain and cloud your thinking. It is important to stay calm and not make financial decisions that can jeopardize your long-term investing plan. Try to take a step back, remove the emotion, remember your game plan, and not panic. With respect to immediate concerns, we know that economic and earnings reports are going to be concerning. However, the market is looking past the storm and indicating better, brighter days ahead. There are also glimmers of hope in the fight against COVID-19. Social distancing, wearing a mask, and washing our hands will help curtail the spread of the virus and return us to what we once considered normal. The bottom line is that, over time, our nation has been through multiple market corrections, recessions, economic downturns, geopolitical crises, unusual volatility, virus outbreaks, political uncertainty, and more. Each time the market has recovered and achieved new highs. As one of our Founding Fathers, Benjamin Franklin said, “he who can have patience, can have what he will”. We at SAM encourage you to have patience, and all will be right again for our markets and our hard-earned investments.

WHERE DO WE GO FROM HERE?

The fear surrounding the pandemic is indeed logical, as both health and wealth are at risk. We do not want to imply that we should not continue to take the coronavirus as seriously as it requires to be taken. However, we do not want to allow fear to make us irrational or hasty in our decisions about our investments. If we look out twelve to eighteen months, there is a high probability that the business outlook will be much better. The global pandemic has had a significant impact on world economies, and this may continue for a time. Despite this impact, the market, as measured by the S&P 500 Index, has come a long way in a very short period. We expect the short-term path of the markets to be bumpy but encourage you to hang on tight and keep driving cautiously while looking optimistically forward. Despite all the valid worries and concerns, our outlook at Strategy Asset Managers continues to be positive and hopeful. We are looking forward and are bullish and expectant for further gains and a bright future as the U.S. economy re-opens and consumers begin to spend freely once again.

We wish you a wonderful time as this auspicious month in American history begins. Let us feel pride and joy as we once more celebrate our Nation’s Independence Day, and as we continue to gaze with promising optimism towards our united ability to create change and prosper.

We look forward to hearing from you and continuing to serve your needs,

Thomas W. Hulick, CIMA

CEO and Managing Partner

Strategy Asset Managers

Joseph Traba

Managing Director and Senior Portfolio Manager

Strategy Asset Managers

Alex Hagstrom, CFA

Portfolio Manager

Strategy Asset Managers