The Strategy Asset Managers Market Oriented 50 portfolio is a momentum-based strategy that seeks to provide a high total return through investment in S&P 500 securities. Our proprietary algorithm ranks all 500 stocks in the S&P 500 based on a quantitative assessment of medium-term price momentum. The portfolio consists of 50 highly ranked stocks and is rebalanced twice each year. During the rebalance stocks which have fallen in the rankings are fully liquidated and replaced with more highly ranked positions. The Market Oriented strategy is designed for investors with a long-term investment horizon who want broad equity exposure and the chance to outperform the S&P 500 index. Inception Date: 4/2001.

Winning positions are only trimmed in extreme circumstances, and as a result the portfolio tends to be fairly tax efficient despite its turnover. This is because the winners “are allowed to run” and the proceeds of the sales are invested on an equally weighted basis into the new candidates. On occasion stocks are replaced outside of the typical rebalance process, and we do attempt to avoid extreme sector concentrations.

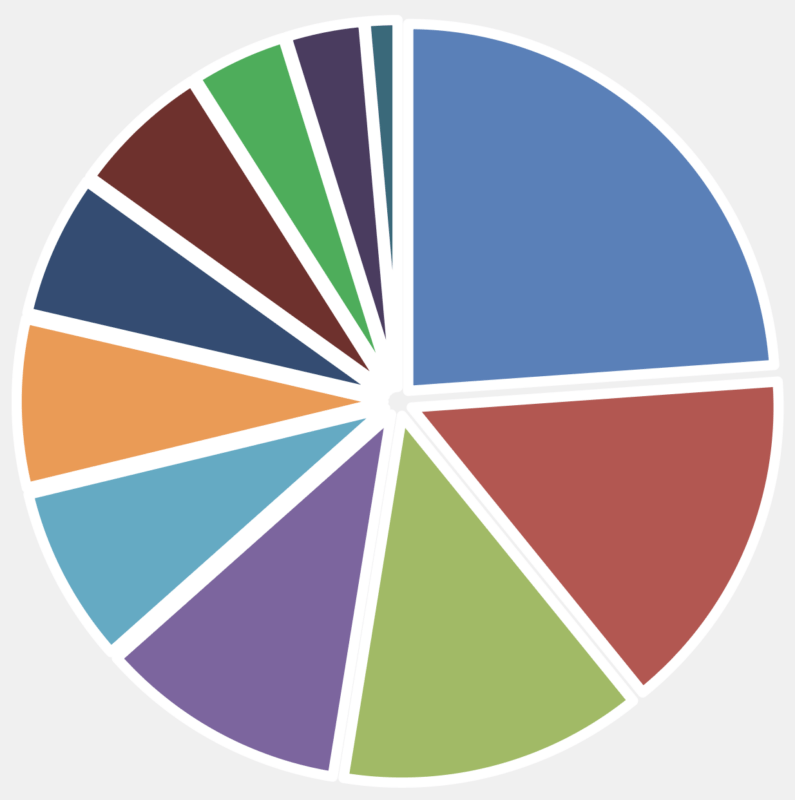

Sector Percentages as of 12/31/2025

Period Ending 12/31/2025

| QTD | 2025 | 3 Year | 5 Year | 10 Year | |

|---|---|---|---|---|---|

| Market Oriented Gross | (0.6)% | 24.1% | 22.0% | 13.9% | 13.0% |

| Market Oriented Net | (0.8)% | 23.2% | 21.1% | 13.0% | 12.2% |

| S&P 500 ETF | 2.7% | 17.9% | 23.0% | 14.4% | 14.8% |