First Quarter Recap

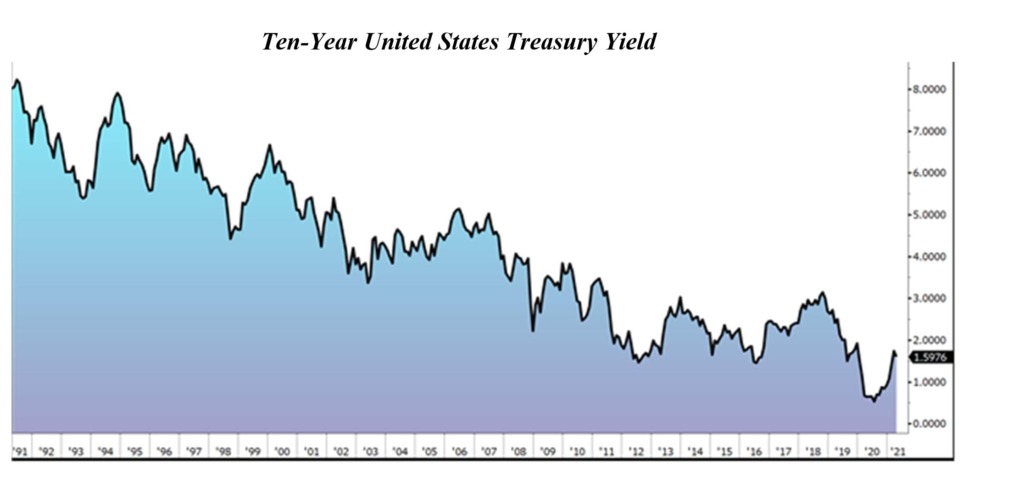

The first quarter of 2021 saw an extension of the reflationary price action from the end of last year, with both stocks and interest rates rising higher. While many pundits believed that higher rates would hurt the stock market, our research led us to conclude that rates at these levels would not be damaging. This view proved to be correct as stocks continued to make new all -time highs while bonds had one of their worst quarters since 1980.

The bull market was accompanied by a broadening of sector and stock performance. In a reversal of the price action that has defined the last decade, the largest Tech stocks underperformed relative to the Financial and Energy Sectors. This was driven in large part by the increase in interest rates as well as a recovery in oil prices. Expanding breadth tends to be a positive signal for markets.

On the economic front, the U.S. Manufacturing economy boomed, with some measures showing the strongest performance in many decades. This also helped to fuel the upward moves in stocks and interest rates. Commodities likewise rose significantly in the 1st Quarter, with lumber most notably having risen more than 200% in the last six months alone. Policymakers continue to flood the economy with Fiscal and Monetary stimulus with no signs of slowing down.

Both gold and long-term bonds have suffered since rates bottomed near the end of the 3rd Quarter of 2020. The reopening of the US economy and the flood of Central Bank liquidity has revived investor fears of a significant spike in inflation. Explosive demand for commodities and finished goods across the economy has pushed prices higher, although measured inflation remains below 3% for the time being.

U.S. Economic Boom

Americans are returning to work by the millions, the manufacturing sector is booming, and consumer spending is exploding higher. Job postings are already 16% higher than they were prior to Covid, with broad-based increases across sectors and regions. Manufacturing PMIs are the strongest in many decades, and sentiment within the housing market is the most optimistic in years.

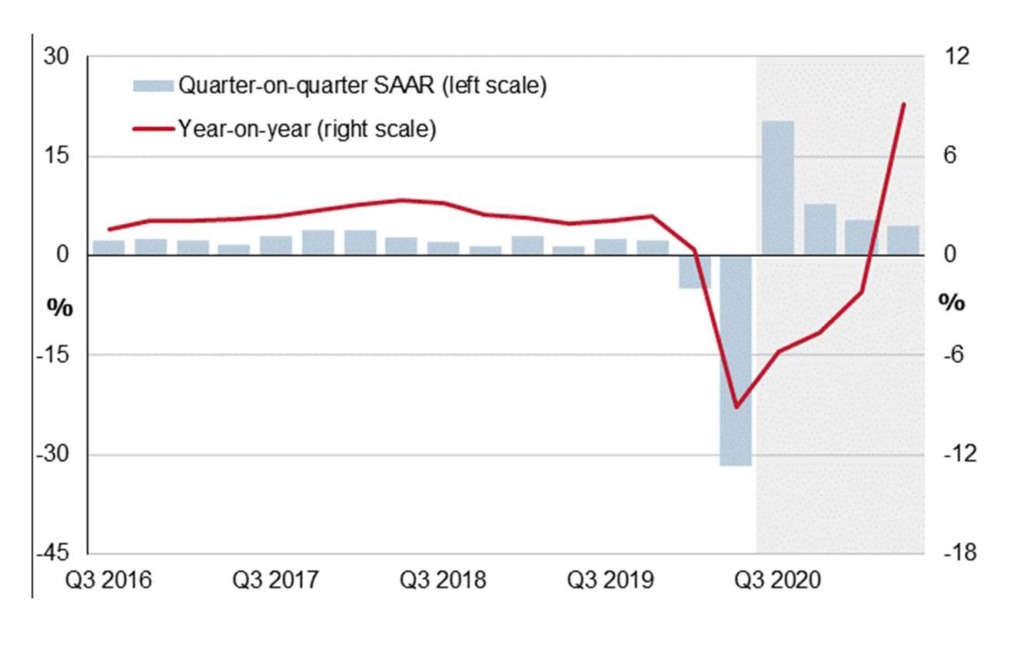

Earnings and GDP Trending Up

As expected during an economic boom, Corporate earnings have been tremendously strong. More than 80% of the companies that have reported so far have exceeded expectations, and in aggregate, those earnings have come in 30% better than estimates. These gains are expected to continue for years, and analysts now project that S&P 500 earnings in 2022 will be a full 60% higher than they were in 2020.

The Fed estimated 1st quarter real GDP growth at 8.3%, while Goldman Sachs predicts that 2021 GDP growth will hit 6.8%. This is by far the best growth in decades, comparable only to the boom years of the 1980s. Government stimulus packages, low interest rates, technological innovations, and prosperous consumers have powered this resurgence, and we have no reason to expect that any of these factors will wane in the foreseeable future.

The Future of Interest Rates

Because of the size of the National debt, the U.S. Government is highly incentivized to keep interest rates low. Although they have risen a great deal over the past six months, interest rates remain near historical lows and are nowhere near levels that would negatively impact the economy. This is evidenced by the strength of the housing market, which has continued to boom without interruption. The government has the power to set interest rates at any level they choose, and we do not expect them to allow rates to rise high enough to damage either the Stock Market or the economy. Authorities have not yet felt the need to intervene into longer-term rates, but they certainly have this option, and we have seen in Japan that Central Banks can exert total control over government bond yields if they so choose. Policymakers will simply not allow rates to continue rising if they believe that these higher rates will negatively impact the economy.

Market Outlook

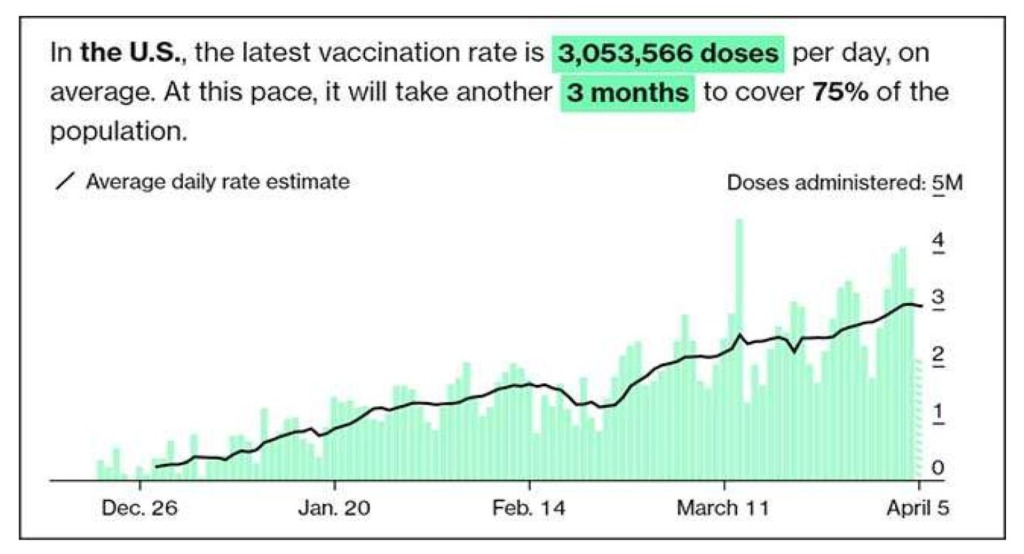

Just as we said in January, the long-term outlook remains very bright. We can expect continued increases in consumer spending as the economy fully reopens. Corporate profits are surging, economic data is soaring, and the American people are getting out and living life. This awakening has caused an increase in demand at a time when supply is not at full capacity. As a result, we can expect to pay higher prices for goods to offset the rises in commodities, transportation costs, and wages. However, people are getting back to work, and wages are increasing as the U.S. population reaches herd immunity, with nearly half the population having received at least one dose of the vaccine. 2021 is likely to be the best year for economic growth since the boom years of the 1980s. Trillions of dollars of fiscal stimulus, rapid technological innovation, and low interest rates will continue to fuel growth in the years to come. The backdrop remains very positive for equity markets, and we would encourage you to look past the day-to-day volatility and focus on the bright future that lies ahead.

Thank you for listening,

Joseph Traba, Managing Director and Senior Portfolio Manager

Alex Hagstrom, CFA, Portfolio Manager

Thomas W. Hulick, CIMA, CEO and Managing Partner