With the unofficial kick-off to Summer this week, equity markets will see trading volume slow as families hit the road and take well-deserved vacations. But, before we dive into the markets, let us take a moment to give thanks to those who have made the ultimate sacrifice in service to our country. Strategy Asset Managers honors the over 1.8 million people who have died serving the United States since 1775. To learn more about the meaning of Memorial Day, visit USMemorialDay.org.

In Overcoming Adversity, America Becomes Stronger

The Spanish Flu struck the world more than a hundred years ago, during the height of the Great War, World War I. While deaths and casualties on the Western Front were staggering, we are reminded today that there is no single generation that has ever been completely immune from national hardship. Our country has always been resilient, rebuilding and growing stronger in response to the moments that have tested the will of our people. Adversity can make us braver and stronger, in sports and in life.

At times it can feel like a punch to the stomach, but overcoming hard times builds character. Bouncing back from life’s harshest disappointments creates confidence that we can endure, no matter what.

Stocks Backed by Solid Economic Growth

Economic data is painting a picture of an improving U.S. economy, even if the recovery is a bit bumpy. Historically, stocks have done just fine in rising interest rate environments, particularly when rates increase from low levels and are accompanied by solid economic growth. Economic data has been quite strong: the latest ISM Manufacturing reading was the highest since 1983, and the forward-looking Conference Board Consumer Confidence Index has surged higher, significantly exceeding estimates. Fiscal stimulus, high household savings and, of course, the vaccine, are all driving strong economic growth and positive expectations for the future.

As expected during an economic boom, corporate earnings have been tremendously strong. Almost nine out of ten S&P 500 companies have exceeded expectations, and, in aggregate, those earnings were more than 50% higher than in the 1st quarter of 2020. Robust earnings growth is expected to continue for years, and analysts now project that S&P 500 earnings in 2022 will be nearly 70% higher than they were in 2020.

1st quarter real GDP growth was measured at 6.4%, and Goldman Sachs predicts that 2021 GDP growth will hit 8%. This is by far the best growth in decades, comparable only to the boom years of the 1980s.

Buybacks Surge

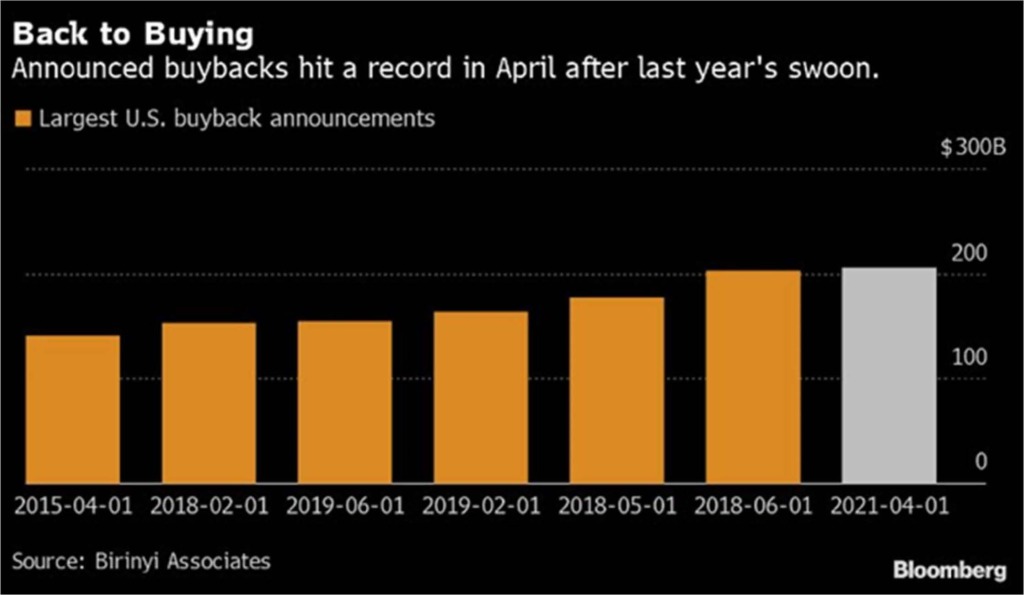

Over the past decade, corporate buybacks have been the largest source of demand for stocks. After a brief COVID driven hiatus, buybacks have returned in unprecedented size.

Total buybacks in April and the year-to-date have shattered all-time records. With companies flush with cash from low interest rates, government stimulus, and record earnings, there is no reason to expect this to abate.

Strong Foreign Demand

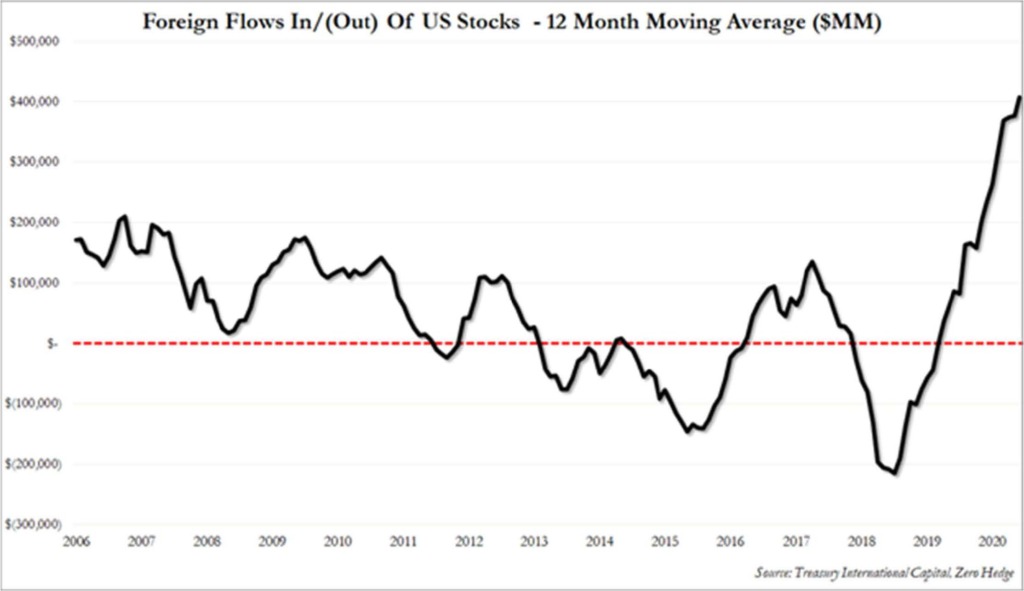

The United States has rapidly outpaced all other developed markets, both in economic growth and with its vaccine response. This has driven a flood of foreign capital into U.S. equities, with the 12-month moving average of foreign flows smashing the previous record. The superiority of U.S. assets has been a significant theme of the past decade. The United States has higher bond yields, better demographics, larger stimulus packages, and a more business friendly environment than Europe and Japan. These positive factors have underpinned a multi-year migration of capital from other developed markets into the U.S., and our country should remain a premiere investment destination for years to come.

Will the Surge in Commodities Continue?

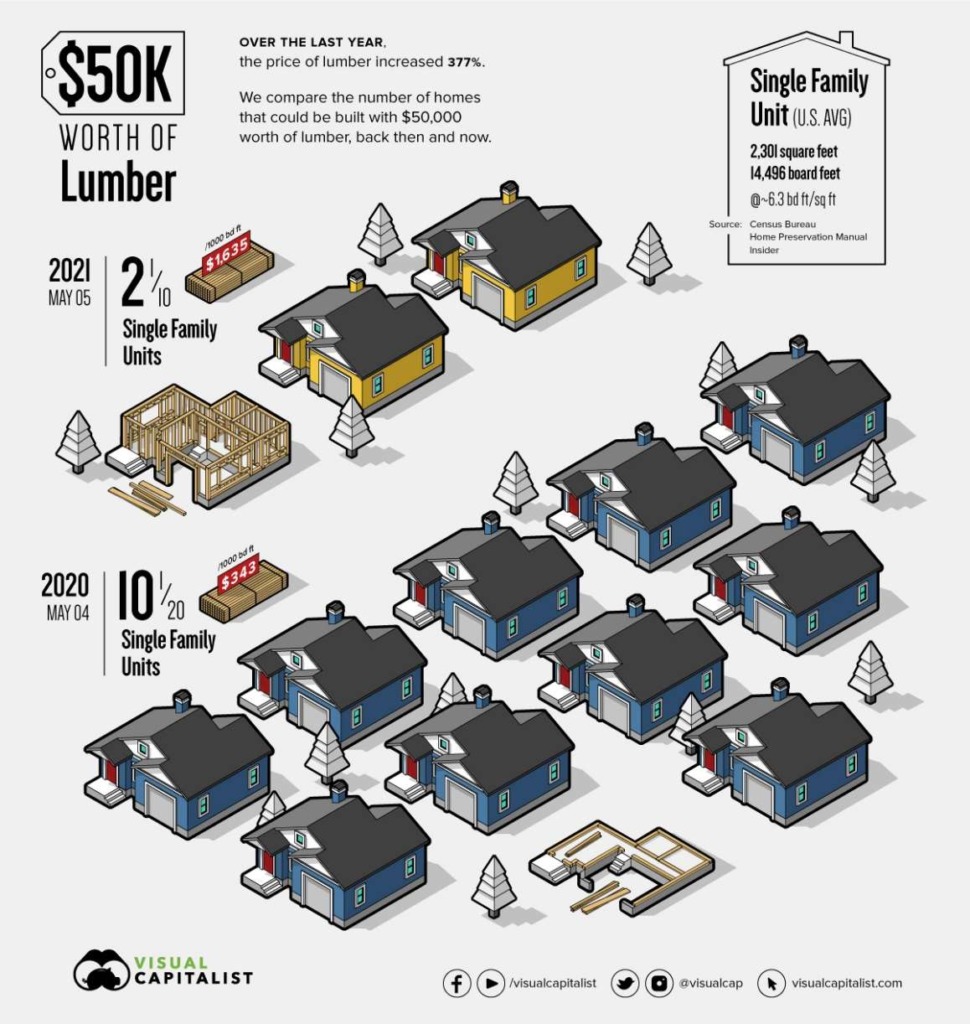

Anyone doing a home remodel has witnessed firsthand how much the price of lumber has skyrocketed. We are seeing widespread global supply chain disruptions and rapidly rising costs for semiconductors, freight shipping, copper, iron ore, and a host of other commodities and services. These disruptions are contributing to fears that higher inflation is on the way. Supply chain issues are also being exacerbated by surging demand from the economy’s reopening and boosted consumption thanks to extremely stimulative fiscal policy. However, the Federal Reserve and most prominent economists believe that today’s skyrocketing lumber prices and the shortages of essential parts, materials, and labor will not be persistent or spark runaway inflation. We agree and think that soaring prices for various key materials, like lumber, are likely to ease once additional supply capacity begins to come online later this year.

The impact of lumber on house prices can be substantial. The visualization below compares the number of homes that can be built with $50,000 worth of lumber this year vs. the last. Over that time, the price of lumber has risen nearly 400%, breaching multi-decade highs.

While supply issues will be a near-term challenge, these types of price pressures are typical during intense economic rebounds. Furthermore, the effects of higher prices caused by supply-chain bottlenecks in the manufacturing sector have normally been short-lived. Suppliers generally bring capacity online to meet demand, while consumers start to reduce spending on the inflated products due to higher prices. In this instance we expect manufacturing capacity to expand as COVID fades and employees return to work.

Historically, supply-chain driven inflation tends to be more of a one-off adjustment, not the kind of sustained inflation which might prompt the Federal Reserve (Fed) to react and raise interest rates. Federal Reserve Chairman Jerome Powell recently echoed this sentiment, dismissing signs of inflation pressures in some parts of the economy as largely the result of “transitory factors” like supply bottlenecks and a surge of pent-up spending.

Technically

Markets were overbought and we are seeing an exhalation, a 4% to 5% pullback which the market needs to help digest the recent move higher. There will always be something to worry about, but we must filter out the noise and focus on the fundamental backdrop – this still favors owning equities.

What It All Means

There are plenty of reasons to remain bullish on the stock market. The ongoing reopening of the economy is the best possible stimulus for consumers and businesses, and we can expect growth to be boosted as hotels, cruise lines, theme parks, and other hard-hit businesses open their doors. No matter what happens in Washington, over the longer term we continue to expect strong growth in the economy, in earnings, and in the stock market as the world reaps the benefits of revolutionary technological progress.

Have a wonderful kickoff to your Summer,

Joseph Traba, Managing Director and Senior Portfolio Manager

Thomas W. Hulick, CIMA, CEO and Managing Partner

Alex Hagstrom, CFA, Portfolio Manager