First Half Recap – What Happened?

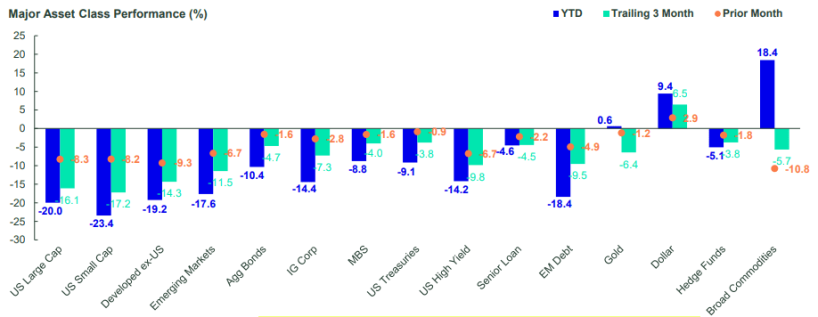

The first half of the year saw U.S. stocks enter a bear market, with growth expectations resetting to account for higher inflation, rising interest rates, and global supply disruptions. The declines were broad based; the S&P 500 was down more than 20%, the Nasdaq 100 was down more than 30%, international markets were down over 20%, bonds fell more than 10%, and crypto/momentum stocks plummeted over 60%.

You should know that consumer sentiment is near all-time lows and investors are holding high amounts of cash. Alongside the market selloff, expectations for future growth have been discounted. This high level of bearish sentiment tends to be positive for the stock market and often precedes strong returns over the subsequent year.

Asset Class Performance

Why the Market is Down

At the start of 2022, we talked about a “resetting of expectations” driven by less accommodative central banks. Surging inflation and the unwinding of stimulus policies continue to create uncertainty. These risks have forced companies and households to reset their expectations lower.

The market’s biggest worry is inflation, which is forcing central banks to slow economic growth with tighter policy. Federal Reserve officials are beginning to signal that higher unemployment rates might be a necessary consequence of their efforts to dampen inflation through rate hikes. This marks a reversal from last year, when Central Bank policies provided strong economic stimulus aimed at spurring the labor market’s recovery from the pandemic’s damaging effects.

Major Recession or Mild Slowdown?

The economy is slowing down, but this is not a repeat of 2008, with a collapse of confidence in the financial system. It also is not 2020, with the government shutting down the economy. Recent data shows that housing, manufacturing, and GDP are slowing. However, the job market, as measured by the unemployment rate, is healthy and near pre-pandemic levels. This is a positive sign, and the labor market continues to help prevent the economy from diving into a recession. The price of gas recently declined for more than thirty-five consecutive days. Pay attention to corporate earnings. Yes, earnings projections are being lowered; however, the economy and earnings are still growing. Right now, the evidence is more indicative of a mild slowdown.

Why the Second Half of the Year Could be Better

As we roll into the back half of the year, it is important to keep historical cycles and seasonality in mind. Although we are facing economic challenges, our U.S. outlook remains optimistic.

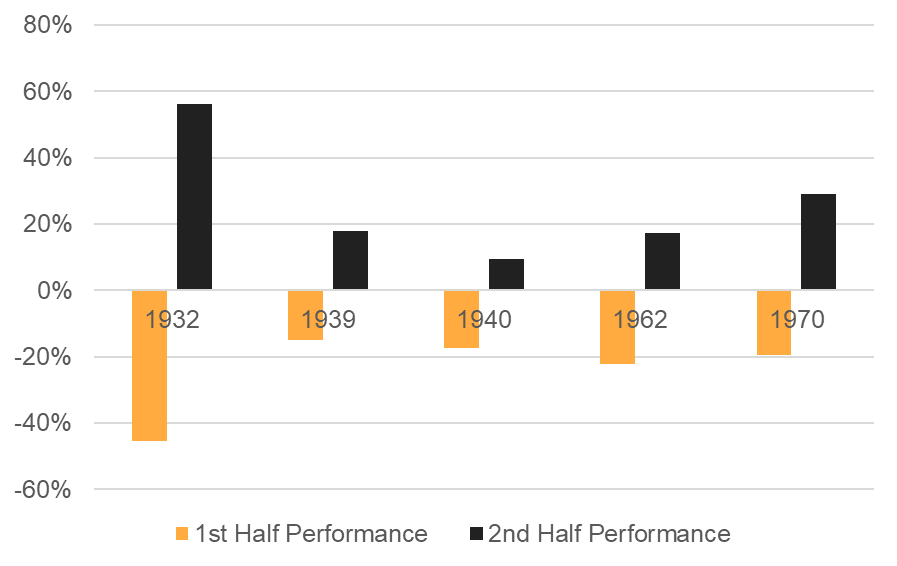

After suffering big losses in the first half of the year, history shows that the market typically rebounds in the second half. When the S&P 500 fell at least 15% in the first six months of the year, as it did in 1932, 1939, 1940, 1962, and 1970, it has risen an average of 24% in the second half.

S&P 500 Performance After a Rough First Half

The stock market has already priced in future rate increases. This helps slow down the economy and does the Fed’s work for them. Commodity prices have corrected aggressively off their year-to-date highs, hinting that inflation rates may have peaked for the time being. If inflation cools, this will help the Fed be less aggressive raising rates.

Inflation Outlook

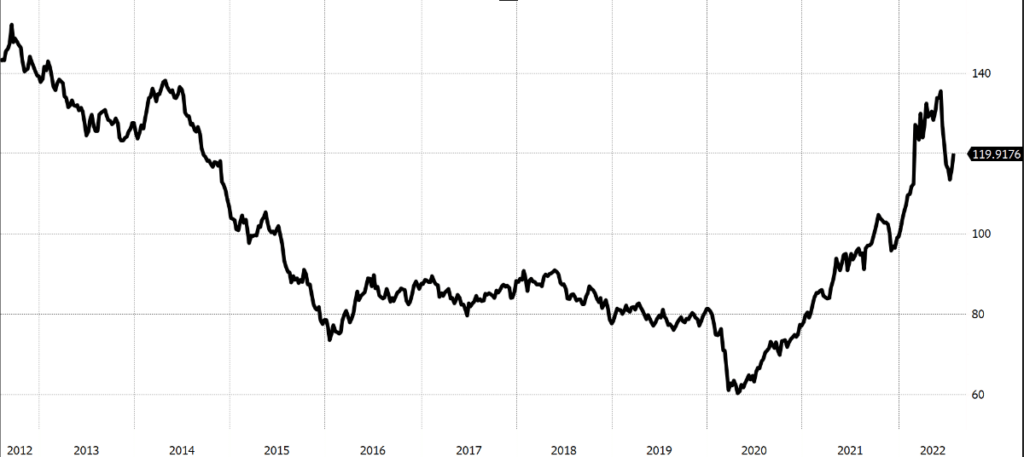

The prices of almost all commodities have fallen significantly in the past couple months, with most traded commodities down more than 20%. This will help push inflation lower in the back half of the year. Oil is down nearly 20% from its early June peak. Gasoline demand has fallen significantly in the past month and is close to where it was in July of 2020, during the heart of the lockdown. That is a positive signal in the long run, as it shows that the economy is healing itself from the artificially driven inflation spike.

Bloomberg Commodity Index

U.S. Budget Deficit Decreasing

The U.S. budget deficit is improving. As you know, the policy response to the Covid pandemic resulted in a significant increase in the deficit. At one point it reached levels only ever seen around the 2nd World War. However, that has now reversed, and the budget deficit is close to where it was in February of 2020. Given the inflationary consequences of the policies enacted during Covid, policymakers will be reticent to run a massive deficit, especially over the next couple of years. America is in great shape economically compared to the rest of the world. The strength of our currency and capital flows from foreign investors are expressing that right now.

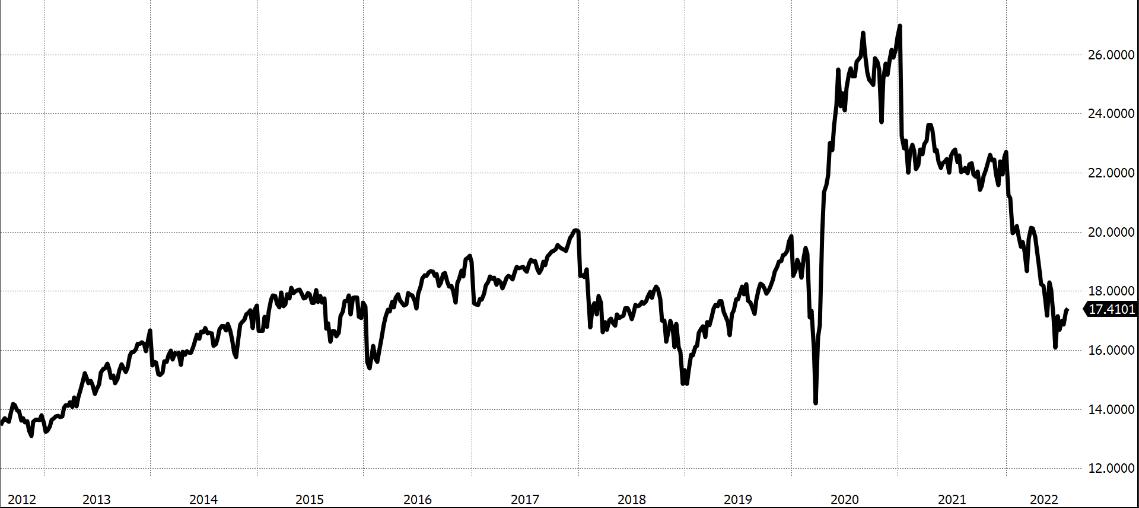

What Have Stocks Priced in?

We believe that inflationary pressures should ease in the second half of the year as demand for gasoline and real estate slows. Rate hikes should also help inflation fall in the coming months. The Chinese economy reopening will be positive and should help ease supply-chain constraints.

We will get a better picture as companies report earnings over the next few weeks with respect to how they are coping with the economic headwinds. Things are likely to be better than feared. Companies are still growing, even if more slowly than last year. When supply chains finally recover, corporations will be able to better navigate changes in consumer spending.

Has the market already discounted lower earnings? If so, we could see stocks stabilize as growth fears are replaced by optimism and a sense that economic growth will not be as bad as expected. Earnings estimates in 2022 and 2023 still show growth, and we think that central banks will eventually pivot to a more accommodative stance.

S&P 500 Forward Price to Earnings Ratio

Bottom Line

There has been heavy selling and a lack of conviction as this bear market cycle has developed since the beginning of the year. From a technical perspective, the market could continue to trade sideways while it builds a base for the next advance. When will the next advance occur? Historically, markets have been higher 6 to 12 months after sentiment has reached excessively bearish levels.

To avoid a severe economic slowdown and a prolonged bear market, you will need to see inflation slow down, allowing the Federal Reserve to stop raising interest rates. Corporate earnings are slowing from high levels in 2021, and the forward-looking stock market is predicting a recession. Keep in mind that, while sentiment drives the market in the short-term, earnings drive it over the long run. The U.S. consumer is still resilient, and corporate balance sheets are in much better shape than in prior slowdowns. Bear markets such as these can create excellent opportunities for long term investors.

Strategy Asset Managers is here to help you navigate this ever-changing and increasingly complex environment. We aim to be proactive, concentrate on the future, and adapt when the market and economic conditions change. We truly appreciate the personal relationships we have with you and look forward to seeing you in person!