Fall is my favorite time of the year! You may be more aware and grateful for the change of the seasons this year. Have you ever been more excited that school is back in session for our children and grandchildren? My daughter Holly started her first year as a freshman at the University of Arizona. Where has the time gone! You may agree that the last year and a half has come and gone with a loud sigh and exhale. The economy and investment climate are still doing well and there is more room to go!

You need to be up to speed on significant tax and estate planning changes being proposed by the Biden administration. Please call us to make sure you are positioned correctly and to address any gaps that may be filled to maximize the protection of your assets into 2022 and beyond.

A bit of friendly advice, plan your trips early this year and start your holiday shopping ASAP. You and others are anxious to travel, spend $$ and move beyond the malaise of the pandemic. The holiday season arrives earlier every year but this year you need to plan extra early. Don’t get caught off guard with last minute online or instore shopping. The U.S. and abroad are still experiencing inventory and supply chain issues which will last a few more quarters. If all else fails…you can always resort to a “gift card”.

Thank you for being a valued client of SAM. I wish you a safe and happy holiday season.

Sincerely,

Tom

With three months left until year-end, you should remain positive and stay motivated rather than being led by fear & desperation. This year COVID remained at the forefront for many, but you should know that “all pandemics end, and this is going to end when we reach herd immunity. We will get there one way or the other. You will either get the vaccine or you will get the virus. Be safe.” This is from our own Dr. David Kayne, a friend and member of the Strategy Asset Management community.

Resetting Expectations

You have just seen a tremendous rally, with the S&P 500 doubling since its pandemic low on March 23, 2020. This has been a strong recovery, without even an exhale in the equity markets. Recently, we have seen volatility return. But, if you put the recent price moves in perspective, you will see that the S&P 500 fell only 5% from its all-time high. This was the first such decline in almost 11 months. It is ok and healthy for the markets to take a much-needed breather. This sort of pullback was needed and necessary for the markets to digest the strong gains that we have seen this year.

The United States continues to be the best place to invest as world markets recover from the pandemic. Looking back in the rearview mirror, you saw unprecedented global government intervention. While this did help a lot of people, such as renters and the unemployed, the excess stimulus was done out of fear. The result was that government grew bigger, but as we emerge from the pandemic you should see government intervention wane and the United States return to being a free market. You will see America do what it does best as we get back up on our feet and the entrepreneurial spirit drives continued economic and market strength.

Key Facts

In our midyear commentary, you read that you should “remain bullish on the equity market due to the growth in earnings and the ongoing economic rebound.” You have experienced a V-Shaped recovery which has driven stocks up more than 100% from the lows last March.

Last month stocks wrapped up one of their strongest August’s ever, putting the S&P 500 on track to make more closing highs in 2021 than any other year on record.

The S&P has hit 53 new all-time highs so far this year, topping a previous record from 1964. Historically this has led to further gains in the year ahead, though typically not as strong as in the first half.

What to Watch

In the short-term, you could see a pull-back as markets digest headline uncertainty stemming from Evergrande, the debt ceiling, and the infrastructure bill. This will likely keep the Federal Reserve’s easy monetary policy in place for longer. As you have heard before, policy, not politics, is what matters. This is good news for you as the United States continues to be a haven for global capital.

Supportive fiscal and monetary policy will help prolong the economic expansion, though there could be more bumps along the road. As you know, the market often sees right through the rhetoric and treats media headlines as noise within the bigger picture truth. After the recent run-up in stock prices, you should not be surprised to see markets take a well-deserved breather.

You can continue to expect strong earnings growth from S&P 500 companies, and while forward price-to-earnings ratios are above historical norms, higher valuations may be warranted thanks to low interest rates, high profit margins, strong balance sheets, and rapid earnings growth.

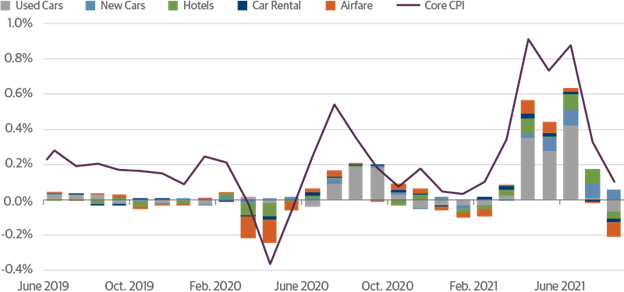

Inflation Easing?

Over the past two months, measured inflation has begun to ease. Most of the recent inflation spike came from transitory items such as airfare, hotels, and used cars. Although you might not be seeing this when you go shopping, inflation has moderated now that price increases in these categories have started to reverse. This indicates that inflation may be lower in 2022, though risks to this view remain due to the potential for rents to increase following the lifting of the eviction moratorium.

With inflation moderating the Fed will have room to continue to keep interest rates low for the foreseeable future.

Increased Taxes

The early U.S. tax draft should alleviate your worst fears, as the proposed increases are significantly lower than initially expected. The administration is now proposing a more modest increase in the corporate rate from 21% to 26.5%. The top rate on capital gains would rise from 20% to 25%, far below the 39.6% that was originally considered. In addition to this, the administration is proposing a 3% surtax on individuals with adjusted gross incomes more than $5 million.

Even if all these changes are fully adopted, both corporate and high net-worth tax rates would remain low relative to history and still be much lower than during the boom years of the 1980’s and 1990’s.

Employees Going Back to Work

With the end of extended unemployment benefits and the eviction moratorium, you should start to see more people join the workforce, especially in the service industry. Currently, there are more jobs available in the U.S. than there are unemployed. This situation is particularly pronounced in the service sector, which suffered the brunt of the lockdown.

The “work from home” movement is not over, and you might see workers continue to leave big cities and move to the suburbs. This is one of the reasons that wages have risen, as some members of the workforce are requiring a higher wage to move back to the city.

Technically

We are seeing short-term sell signals, but our long-term signals remain bullish. Forward returns for the S&P 500 are generally still positive and continue to improve as time horizons extend. However, those positive returns are slightly more muted than average.

Putting Pullbacks in Perspective

Pullbacks are not a time to panic and should instead be used as a reason to analyze and assess. Under certain circumstances, a pullback may represent an attractive buying opportunity. Reliable market and economic perspectives are essential to prepare for pullbacks. Rather than acting on emotion, it’s important that you put these events into context to determine their true meaning.

If you have any questions, please reach out to Strategy Asset Managers. We can help you to identify and achieve your financial goals.

Thomas W. Hulick, CIMA, CEO and Managing Partner

Joseph Traba, Managing Director and Senior Portfolio Manager

Alex Hagstrom, CFA, Portfolio Manager