With less than a month to go before the presidential election, we are hosting a webinar on October 15th at 1:15pm PT., to share our insights and analysis on the upcoming election, the markets, and what it all means for you. We will also discuss our plan and where we see things heading through the end of the year and into 2021. To access the webinar, it will require a pre-registration that will be available through an email link. A replay of the webinar will be available on our website the week of October 19th. Please reach out to any member of our team and we will make sure you have the details for the webinar.

Historically, September and October are rough months for the markets, and this year has been no exception. Global markets got off to a rough start in September as uncertainty related to political, economic, and health issues created concerns about consumer demand. There were plenty of negative headlines for the markets to react to, and European stocks fell the most since July. Investors worried about both renewed COVID lockdowns and a report detailing suspicious transactions at international banks. Political discontent and disagreements on additional stimulus negatively impacted sentiment in the US.

However, as we said in our September market update, we expected to see a pullback as the markets were overbought. After a huge rally off the March lows, we thought markets might take a breather and they did. We still believe the markets can continue rising, fueled by the Fed stimulus, consumer spending, and excess liquidity. Earnings reports are being adjusted to the upside in 2021 and 2022. We must also point out that in a low interest rate environment, we believe it makes sense to put cash to work and invest in companies that are demonstrated leaders.

Political Uncertainty

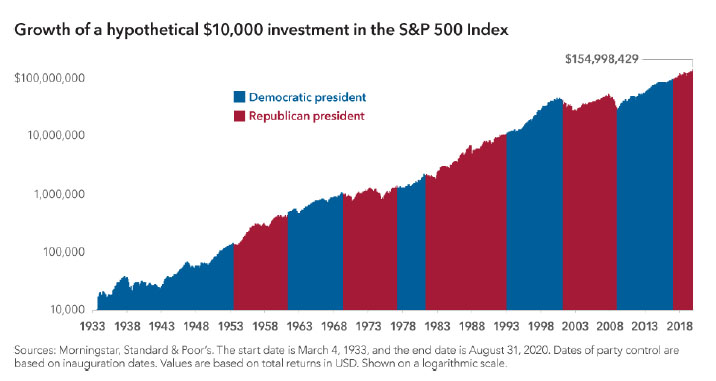

The November election is the primary focus for many investors. As we have been saying all along, we do not expect the U.S. election results to be the driver of future market performance. We understand investors’ fears concerning the potential market impact of the elections, but ultimately markets are driven by fundamentals, not politics. Investor returns over the long term are mainly driven by market valuations and individual asset allocation decisions, not the political party controlling the House, Senate or White House. Regardless of the outcome, the U.S. economy will require more federal assistance in 2021. We also think that a bipartisan trend towards onshoring manufacturing will develop alongside measures to limit global trade. No matter the outcome, we believe the companies we invest in will continue to be demonstrated leaders and deliver strong after-tax returns.

Investors Often Become More Conservative in Election Years

It can be tough to avoid the negative messaging around election coverage, and it is natural to have an emotional response to the rhetoric of political campaigns. History has shown that elections have had a clear impact on investor behavior, but it is important not to allow emotions to detract from your long-term investment plan. Typically, volatility rises in the months leading up to voting day. The bottom line is that election outcomes and political alignments are rarely significant or durable drivers of key market bellwethers like the S&P 500 Index or the 10-year U.S. Treasury yield. Fundamental factors like market valuations and asset allocation have always been more impactful over the long term.

Volatility will Continue and This Should not be a Surprise

We continue to expect volatility as the markets are subject to “headline news.” While politics are a considerable new disruption for financial markets, the pandemic is also creating angst. Virus data for new cases in the U.S. and abroad must be closely monitored as another shutdown would put even more stress on the U.S. and Global financial picture. However, if we look further out, we are seeing positive developments regarding the pandemic and the reopening of the economy. The U.S. elections may have clear winners, and companies/consumers could regain their footing and continue to spend. We may also get an additional stimulus which will buy more time for people to get back to work. Against this backdrop, the economy is likely to face an uneven and bumpy recovery. On a positive note, we are seeing encouraging advancements in COVID treatment and vaccination. We also see continuing support from the Fed, and we expect fiscal and monetary stimulus as needed.

Lower Interest Rates for Longer

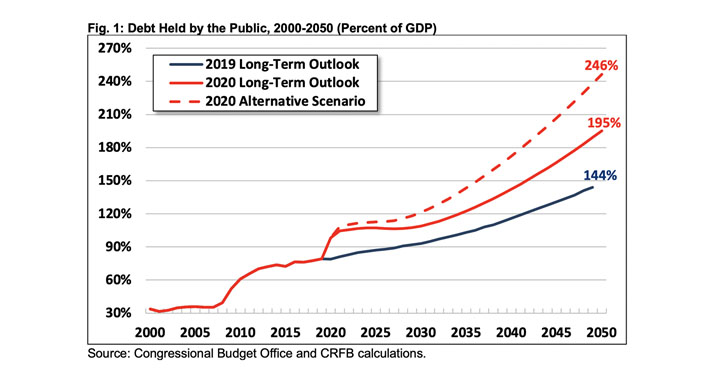

Our expectation is that interest rates will remain low. Federal Reserve Chair Jerome Powell signaled expectations the central bank’s policy-setting committee would keep rates low for the next three years, but the plans for continued low rates come amid expectations of longer spells of joblessness and economic weakness than the market had anticipated. Powell described the economic outlook as “highly uncertain.” Projected debt in 2050 is nearly five times higher than the 50-year average of 42 percent of GDP. It will be on track to double the previous record of 106% set just after World War II. In dollar terms, debt will rise from nearly $21 trillion today to $121 trillion by 2050. Source: CFRB.

What Do We See Ahead?

We expect volatility to continue in the short term as the markets digest the recent gains. Many trends that have been in force before the pandemic will continue; these include the rising importance of environmental, social, and regulatory factors in investment decision-making as well as the increased demand for dividend-paying stocks that can generate income in a low-yield environment.

Tax, spending, and regulatory policies could look very different depending on the election outcome. Regarding taxes, few if any major policy reforms are likely to be enacted until well into 2021. Regardless of the makeup of Washington next year, addressing the pandemic and the resulting economic distress will certainly be job number one. With U.S. debt at these high levels, we believe taxes will increase no matter who is in office. This favors our strategies which hold high quality stocks and have low turnover.

We at Strategy Asset Managers strive for consistency – we take control of what we can and try to limit the peaks and lows. We believe Mark Twain said it best: “Courage is resistance to fear, mastery of fear, not absence of fear.” It is important to have courage and believe in yourself to push through during these difficult times. It is natural for some fatigue to set in as pandemic protocols continue. However, the most important thing in your life is your health and well-being. Stay positive!

Best wishes from the Strategy Asset Managers team,

Thomas W. Hulick, CIMA, CEO and Managing Partner

Joseph Traba, Managing Director and Senior Portfolio Manager

Alex Hagstrom, CFA, Portfolio Manager