We hope you and your families are continuing to do well and remain healthy. Before we discuss why we see better days ahead, I want to share an upcoming celebration with you as we start the month of September. It is with great pleasure that we celebrate the 80th birthday on September 29th of our own, Lee Grichuhin. Happy Birthday to you, Lee!

Lee has been a friend, a mentor and a long-standing employee of Strategy Asset Managers and its predecessors for over 32 years. In anticipation of his birthday, I want to pay joyful tribute to Lee for all he has done for me and the firm.

Lee and his wife, Gerry, are avid tennis players. In 2019, they played in the USTA League Senior Nationals men’s and women’s division in Orlando, Florida. It is a very rare achievement for a married couple to compete at this high level of tennis, and Lee reminds me that he is humbled by Gerry because her team has actually won the Nationals!

Lee is an amazing grandfather, father and husband. He is a coach and a mentor to many. He is also a great listener with a big heart. His values, experience and words of wisdom have impacted us all. He inspires us “to be all that you can be…and then some.”

Happy Birthday, Lee, from all of us. We are grateful to have you in our lives. Sincerely, Tom

As we start the month of September, stock prices have risen dramatically since March and just registered the fifth straight weekly gain for the S&P 500 and the Nasdaq. Both set new record highs and the Dow turned positive for the year. For some perspective, the S&P 500 index finished in August up 59% from its March 23 low and up 8% for the year. Year-to-date, the S&P has outperformed equities in nearly every other major economy, including the European Union (EU), United Kingdom (UK), Hong Kong and Japan. A lot of this has to do with the performance of tech stocks (more on that later), but something else appears to be happening here. We believe the markets can continue rising, fueled by the Fed stimulus, consumer spending, and excess liquidity. This background favors owning investments and putting cash to work.

Why Do We See Brighter Days Ahead?

We know that many businesses and families are still struggling. The number of Americans filing for initial jobless claims this week spiked above 1 million, while the number of deaths attributed to COVID-19 remains above 1,000 per day. But the markets are forward-looking and are indicating that business activity and economic data will improve. Officially, the S&P 500 closed at a new record high, ending the shortest bear market in U.S. history. The pandemic-induced pullback lasted only 33 days, compared to the median bear market length of 302 days based on data going back to the 1920s (Reuters reports).

4th Industrial Revolution

With the impact of COVID-19, trends that might have happened over the course of the next decade have accelerated into 2020. Over the next few months, headlines will likely be filled with news on vaccine trials, political uncertainty, a deepening recession and more social unrest. But underlying this are fundamental disruptions in our economy that will impact how we live and work and present opportunities in the longer-term trends. Tele-health, remote learning, working from home, internet retail, and many technological innovations are changing commerce and our ways of living and interacting. We are not returning to the way things functioned pre-COVID-19, especially now that it seems the pandemic will be with us for many more months.

There are currently five stocks that combined, account for nearly 25% of the entire S&P 500 Index. When we take a close look at the SPY, XLG, and QQQ, the three US major market funds that reached new highs, we find the same five stocks underlying each. The “Big Five,” which includes Apple, Microsoft, Amazon, Facebook and Alphabet, make up over 23.5% of SPY, 42% of XLG, and over 47% of QQQ! Remember, with quarterly rebalancing, we can expect to see some selling in these names as they are above the position size for institutions.

Fed Stimulus

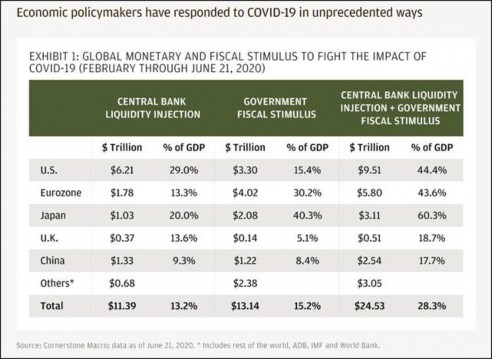

J.P. Morgan calculates that over nine trillion dollars in stimulus has been made available for the U.S. economy alone (see chart below). No matter how bad the Q2 economy may have been, this very large amount of Government aid is meant to lift the economy up off of the ground so that it can start walking forward again. Just as other countries such as China and Germany have shown that they can move past the virus and get back to their pre-COVID economic levels, so will the U.S.

What to Watch

In the short term, we could see a pull back as markets are extended and investors become fearful due to negative headlines, especially as election rhetoric heats up. We expect that supportive fiscal and monetary policy will help prolong the economic expansion, but until we get a significant medical breakthrough for the pandemic, we also expect to see more bumps along the road. However, the market often sees right through the rhetoric and treats media headlines as noise within the bigger picture’s truths. While the bigger picture is optimistic, there are some looming indicators that warrant some attention. After the recent run up in stock prices we would not be surprised to see the markets take a well-deserved breather.

Debt Concerns

Due to tremendous social and economic changes, several notable companies are facing bankruptcy. Many of these are old economy companies that are closing because they are being disrupted by innovation, rather than solely due to the economic slowdown. We also see that state and local municipalities are struggling. Senior living centers are reeling from the public health and financial crises caused by the pandemic, driving a wave of defaults in the $3.9 trillion municipal-bond market. On August 19, Municipal Market Analytics, an independent research firm, said that municipal defaults in senior living centers hit a record. The survey showed that 55% of the 463 nursing homes are operating at a loss.

Inflation

Once the economy has recovered and inflation is moving higher, the Fed and the Treasury will be faced with the very big dilemma of how to remove the trillions of dollars of stimulus from the U.S. economy. If they do nothing, then the U.S. dollar could suffer, inflation could rise, and interest rates could follow. We believe another inflationary signal would be if the economy strengthened, allowing the government time to curb spending and raise taxes.

Housing Uncertainty

The breadth of financial uncertainty is palpable with renters across America struggling to pay their rent. However, with mortgage rates at all-time lows, the housing market is booming. A recent survey reveals that July housing starts were at their strongest levels since 2016, and building permits experienced their strongest increase since 1990. In contrast, NYC apartment vacancies have reached a 10 year high. Manhattan office towers are still nearly empty (NY Times). An estimated 27% of adults in the U.S. missed their rent or mortgage payment for July, according to a nationwide survey conducted weekly by the U.S. Census Bureau over the last three months.

The Bottom Line

The economy is likely to face an uneven and bumpy recovery until we see a medical solution to the pandemic. Both monetary and fiscal policy will remain supportive, but some companies will not make it through this upheaval while others will forge a new paradigm. We invest in demonstrated leaders – companies that are innovators in their industries, and equally important, we avoid companies that will be disrupted.

We believe Americans can look to our past for strength, comfort and insight during today’s quarantined times. During another national crisis, the U.S. civil war, Abraham Lincoln said these words in 1862, almost three years before the end of the bloodiest war in the young country’s history: “May our children and our children’s children to a thousand generations, continue to enjoy the benefits conferred upon us by a united country, and have cause yet to rejoice under those glorious institutions bequeathed us by Washington and his compeers.” Even during the darkest hours, Americans would do well to remember the incredible institutions that they have built and that will sustain them.

In today’s volatile times, Strategy Asset Mangers is committed to providing you with trusted insights and analysis, from the safest places to invest your money to building a sustainable financial plan for your future.

Thank you for your trust and we look forward to seeing you in person soon.

Thomas W. Hulick, CIMA

CEO and Managing Partner Strategy Asset Managers

Joseph Traba

Managing Director and Senior Portfolio Manager Strategy Asset Managers

Alex Hagstrom, CFA

Portfolio Manager Strategy Asset Managers