May 15, 2020

We hope that all of you are healthy and doing well as we continue to deal with the Coronavirus pandemic.

All of us at Strategy Asset Managers are grateful for the ability to help guide and manage your assets during both

the good and the tough times.

As we near the end of the second month of stay-at-home orders, things are slowly beginning to head back in the

direction of normal. States are making moves to open their economies one bit at a time, and there has been a

growing pushback against the stay-at-home guidelines. Despite this it is likely that social distancing, masks, and

sneezing will remain in our thoughts through the balance of 2020. We do think that the market’s optimism is

partially the consequence of good news concerning COVID-19 and economic stabilization from the actions taken

by central banks around the world. The market is clearly viewing the shutdown as a limited event that will soon

pass. As we begin to see businesses reopen, our enthusiasm is tempered by thoughts of how many will not.

The Coronavirus pandemic has rocked the international economy and disrupted our lives in unimaginable ways.

Things may never fully return to the way they were before the COVID-19 crisis, but the world will not stay on

lockdown forever. We know the labor market is awful right now, but it will get better. Our economy relies heavily

on consumer spending and right now getting people back to work is key. That is why our recent webinar with Dr.

Stella Sung was so encouraging – we learned why testing will be such a critical element of any effective

reopening. The webinar replay may be viewed on our website.

We believe the stock market is looking ahead to better days as it appears that the Coronavirus pandemic is cresting,

and areas of both the U.S. and global economies are starting to re-open. But we also expect economic activity to

remain depressed and uneven for some time. We now enter a difficult phase for the stock market recovery as

speculative hope clashes with the fundamental reality on the ground. After the 34% recovery off the March lows,

we are cautiously optimistic that Fiscal and Monetary stimulus has provided time for an economic recovery later

this year. In the meantime, the economy will be operating well below pre-crisis levels, negatively affecting

earnings, profits, asset values, and investor psychology. The good news is there has been a dramatic shift in

sentiment in the financial markets and, despite the awful news, risk-reward dynamics will be reassessed as we see

encouraging COVID-19 developments and exciting scientific advances which could push markets higher.

Can Bad News be Good News?

Although economic growth is in widespread collapse, we think stimulus measures will help set the stage for the

start of a recovery later this year. GDP growth fell 4.8% in the first quarter, the first contraction since 2014 and

the worst number since 2008, and expectations are that second quarter growth will fall by 25% or more. The

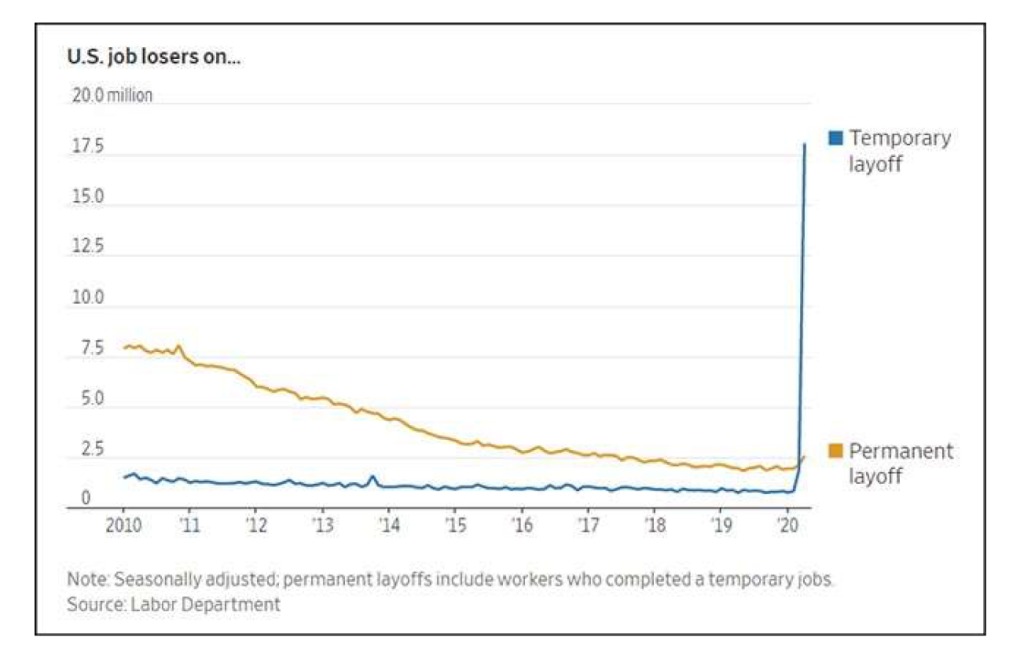

employment situation is the worst since the World War II era, yet the market is assuming the recent layoffs are

temporary and that these employees will be employed again soon. According to Barron’s, 85% of Californians

who filed for unemployment expect to get their job back once the crisis ends. We do not dispute that jobs will

come back; it is just a matter of when and to what extent. We must remember that the government forced a

shutdown of the economy to contain the spread of the Coronavirus. Now, the government must assure people it

is safe to reopen. This will be the first and most critical condition necessary for an improvement in the economic

outlook and sustained upside in markets.

When will it be Safe to Go Back Outside?

According to Bill Gates, it will be safe when an almost perfect drug to treat COVID-19 is developed or when

almost every person on the planet has been vaccinated against the virus. According to his foundation, as of April

9 there are 115 different COVID-19 vaccine candidates in the development pipeline, and he thinks that eight to

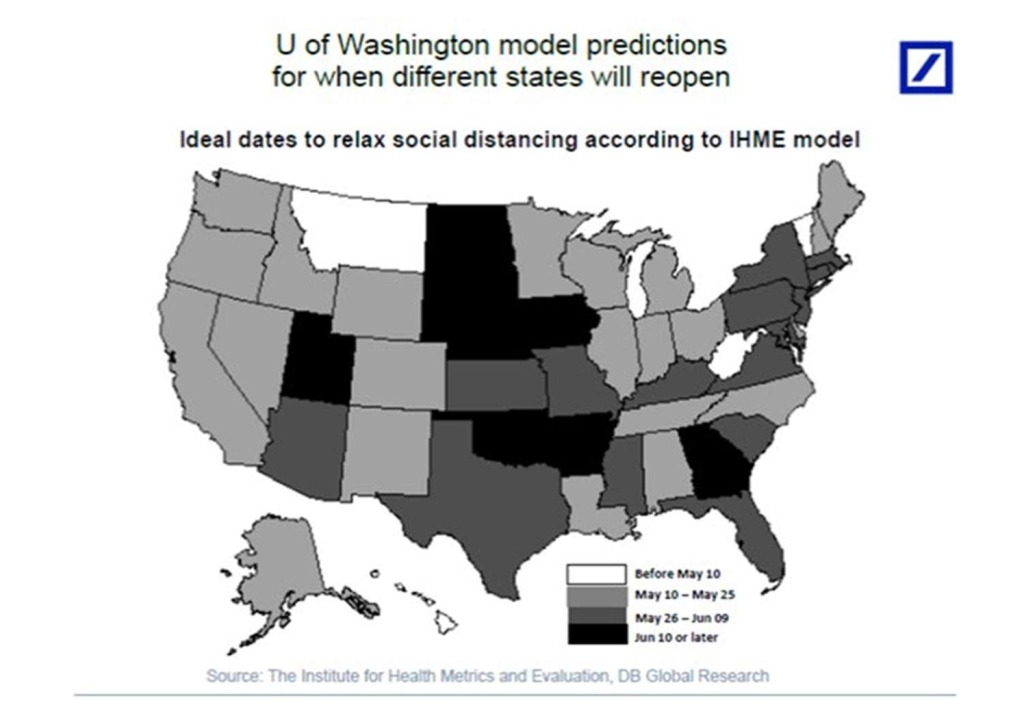

ten of those look particularly promising. However, we think all states will ease business restrictions soon and

open well before the development of any vaccine. If you are working from home now, you may very well still be

working from home six months or a year from now. Moreover, your employer may eventually decide the business

can lease half the space it currently does and have you work from home permanently. Students at K-12 schools

and at colleges may go through a full year in which they never physically meet a teacher or attend a school play

or an athletic event in person. It is unknown how many entertainment venues will disappear permanently.

As of Monday (5/4), there were 32 US states with either no active stay-at-home order or a limited re-opening

underway. According to Jefferies Research, 72% of surveyed consumers state they would return to work

immediately if allowed. Consumers are most excited to slowly re-visit restaurants and personal services (hair

salon, barber shop, nail salon, etc.) but plan to avoid entertainment areas and apparel stores. According to the

same research consumers would not be comfortable at casinos, concerts, public transport, and elevators.

Glimmers of Hope

The hope is that local and state economies around the country as well as European economies will reopen and

that the COVID-19 case curve will continue to flatten. We are seeing progress towards a new antigen test that

could rapidly screen people for the Coronavirus. During our Webinar Dr. Stella Sung said that reliable and widely

available testing will be critical for businesses to slowly open. She was right, and the U.S. Food and Drug

Administration recently approved its first antigen test, a move could mark a breakthrough in screening. Many

health professionals have argued that swift screening is essential to temper new outbreaks. It was also encouraging

to hear NIAID Director Dr. Fauci say there have been “glimmers of hope” that social distancing is helping to

curtail the spread of COVID-19. Finally, we are seeing some small, early signs that life is resuming some form

of normalcy. We are seeing more people driving, which is causing an increase in gasoline prices. TSA checkpoint

travel numbers are increasing for the first time since March, and though they remain far below levels from last

year there is some indication that at least the worst may be behind us. We expect these small signs of recovery to

continue as the country gradually reopens and consumers resume their daily activities.

There are a few big things to look forward to as long as the public wears masks. Shanghai Disney recently opened,

while the Bundesliga (German professional soccer league) and NASCAR will restart this weekend. Wynn Resorts

would like to open their Vegas properties on May 26th. The English Premier league will play on June 1st, and

Major League Baseball will return in July. We are also seeing increased spending on home projects; Camping

World announced that they just had the biggest RV weekend in the company’s history and the top fertilizer

company, Scotts Miracle Gr, just had its best week ever.

What Will our ‘New Normal’ look like when the Pandemic finally passes?

Consumers are realigning their purchasing priorities, personal lifestyles, and working practices post-pandemic. If

we look to history, society has always been slow to react to technological change (the telegraph, mobile phones).

There’s always resistance because people think that the new way is inferior to the old one. The COVID-19

outbreak is knocking down the psychological barriers surrounding working from home and remote learning, and

we think it will force a permanent acceptance of certain online and remote activities.

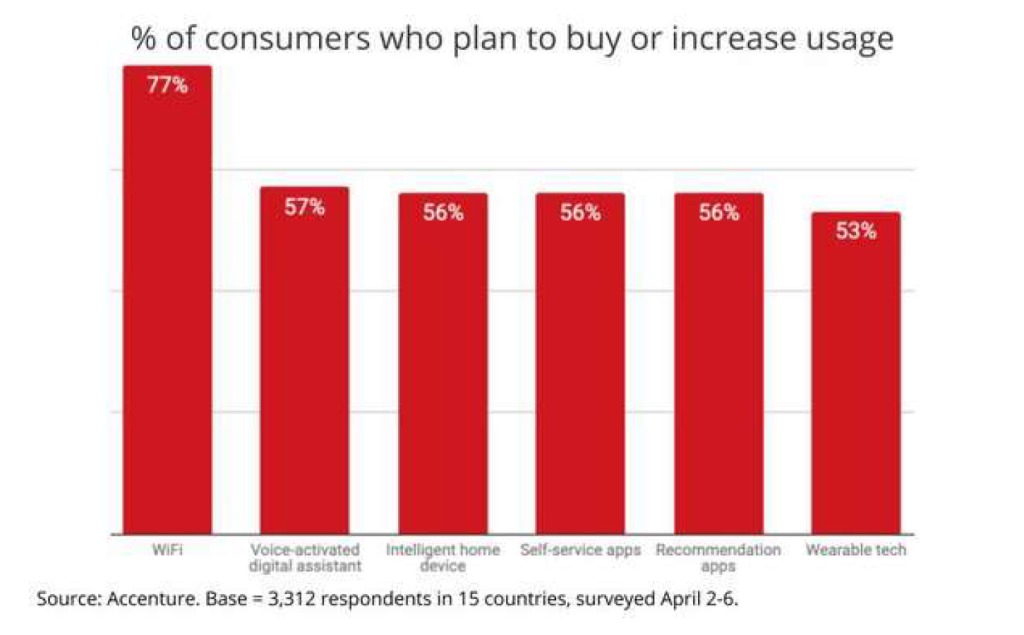

According to an Accenture survey, more than half of consumers plan to buy or increase their usage of Wi-Fi

(77%), voice-enabled digital assistants (57%), intelligent home devices (56%), self-service apps (56%), online

recommendation apps (56%), and wearable technology (53%). These were changes that were happening before

the shutdown occurred and many of these changes in consumer behavior are permanent, particularly those related

to environmental impacts. For instance, 64% of consumers are now focusing more on limiting food waste and

will likely continue to do so going forward. These findings collectively suggest a “healthier human habitation of

the planet,” according to Oliver Wright, managing director and head of Accenture’s global consumer goods

practice. He adds that it is “a wake-up call” for companies to ensure they have the agility and capability to be

relevant to consumers.

The Fed’s Backing

We have seen the Federal Reserve and Jerome Powell provide unprecedented liquidity which lifted every asset

that was set to fall. Central banks around the globe followed the American lead and remain committed to

supporting the financial system. Measures by the Fed and U.S. government have underpinned the recent rally

across markets. The Fed made clear that it was willing to step in to buoy the economy. This attitude is defined by

the following quote from Jerome Powell on businesses and investors: “We should make them whole. They did

not cause this.” Businesses and investors are blameless in this crisis, and so the Government bailouts appear

justified. The Fed and Congress have political cover to prevent investor losses and are committed to do just that.

Obviously, this is more easily said than done, especially for small businesses, but it has put a floor underneath

large cap equities and high yield prices. The Fed’s commitment to “make them whole” is likely to be realized and

reflected in official policy. It looks like there simply will not be a lot of debt defaults no matter how long the

economy is shut for; the Fed will print the money and make everyone whole again.

Unintended Consequences

The average worker in more than half of U.S. states stands to collect more from unemployment than from their

prior job, according to an analysis conducted by Ernie Tedeschi, an economist at Evercore ISI. Roughly 40% of

workers stand to make more money while unemployed than from their former jobs, according to one analysis of

expanded benefits. This is especially true for lower-wage earners, who are concentrated in certain industries like

retail, accommodation, and food services. That wage replacement rate means the average worker could earn more

than twice as much as from their regular job, which pays just $11 an hour. Workers in New Mexico, for example,

would replace 129% of their prior salaries on average from unemployment — the largest “wage replacement rate”

among any state. In Kansas and Montana, more than half their respective state workforces could make more on

unemployment than by working – the largest shares of any other states.

Dividend Safety

As companies react to the economic shutdown, we are seeing management take extraordinary actions to preserve

cash and address balance sheets. Unfortunately, dividends are likely the first causalities. Companies are reducing

staff, decreasing salaries, postponing capital expenditures, halting stock buybacks, and raising capital to prioritize

areas of growth and cash generation. However, most of the attention will be on which companies cut their

dividend. In the coming weeks expect to hear the words suspensions, cuts, reductions, and eliminations as it

relates to the dividend. These are necessary steps taken by management in response to COVID-19 to support

employees, consumers, stockholders, and communities. For more information, please feel free to contact your

“SAM” representative.

Why Is the Fed Buying Junk Bonds?

The Federal Reserve’s recent announcements that it had created two new facilities to purchase up to $750 billion

worth of both investment-grade and junk bonds, including bond exchange-traded funds, was a first. The Fed’s

Secondary Market Corporate Credit Facilities, or SMCCF, has already begun these purchases. The promise alone

seems to have achieved the aim of preventing the economic crisis from becoming a financial crisis, in which the

flow of money becomes restricted, debt markets become less liquid, and the financial system seizes up. The Fed

is purchasing debt from companies that were downgraded to junk because of the Covid-19 crisis. The number of

global companies whose debt has been downgraded from investment grade to junk has never been higher. The

Federal Reserve has said it will buy high-yield bonds to backstop these companies.

Technically

Several technical factors suggested that a bottoming process began in March and we wrote that, based on historical

analysis, this represented a low risk buying opportunity from extreme washed out levels. Over the near term,

market volatility is likely to remain high in both directions as our technical indicators are neither overbought nor

oversold. Over 23 sessions between February 19 and March 23, U.S. stocks (SPX) fell 35%. In the 24 trading

sessions that followed through April 29, stocks (SPX) rose 34%. In our previous letters, we relayed that our base

case was for a recovery that resembled a square root and we thought that we could see a bounce back in economic

activity by the 3rd quarter. We still think that is the case today but expect volatility will continue as the markets

overreact to both good and bad news. The recent price improvements came from a sense that the Coronavirus

pandemic may be easing, stimulus measures were working, and the recession could be short-lived. Stocks remain

caught between the massive $8 trillion in fiscal and monetary stimulus and collapsing economic and earnings

growth on the downside. The technical picture has improved dramatically, and that just means we could see some

consolidation, as the markets digest the recent move higher and money on the sidelines comes back into the equity

markets.

2020 Market Expectations

We expect the economy will rebound modestly in the second half of 2020 and we think the underlying economic

structure of the world and U.S. remains sound. We think corporate earnings could decline 20% in the first half of

2020 before reversing higher in the third and fourth quarters. (Estimated earnings are at $130 for the S&P 500).

Fundamental strength in the Technology, Healthcare, and Communications Services sectors coupled with strong

balance sheets in the Financial sector should prevent overall earnings from fully collapsing. It is tough to forecast

much beyond that given that we do not know the full extent of the economic damage, but an earnings recovery

by the end of the year looks likely. However, equity markets may see the return of volatility when businesses start

reopening in a few weeks and the political elections gain renewed attention. Looking further ahead, we think the

biggest positive so far is probably the massive and unprecedented monetary and fiscal stimulus, with the prospect

of even more to come.

What It All Means

The stock market has been climbing a wall of worry as “scared money” comes back in off the sidelines. We know

the market is looking past the dismal economic and earnings reports and is pricing in better days ahead. Sentiment

is improving as people grow more optimistic about going outside and heading back to work. Our cautious

optimism is that the economy continues to reopen, and sentiment stays positive as the market remains under

owned. Peter Diamandis, Founder of Singularity University recently said, “Exponential tech has been disrupting

traditional industries at an ever-increasing pace… And the pandemic has basically put these changes into hyperspeed. Never have we had the opportunity to rewrite entire sectors, redefine the problems they address, and reinvent their solutions.”

At Strategy Asset Managers, we believe in a U.S. recovery and that the U.S. equity markets will make new highs.

As Warren Buffett recently said, “never bet against America; nothing can stop this nation.”

Wishing you and your family good health,

Thomas W. Hulick, CIMA

CEO and Managing Partner

Strategy Asset Managers

Joseph Traba

Managing Director and Senior Portfolio Manager

Strategy Asset Managers

Alex Hagstrom, CFA

Portfolio Manager

Strategy Asset Managers