In the last few weeks, the level of uncertainty has created fear in almost every activity we do. What initially appeared to be a virus contained in China has quickly turned into a force that has brought global business to a virtual standstill. We have exerted caution and took some profits in January and February, which resulted in having high cash positions that served us very well. As we said on March 13, we thought this was a low risk buying opportunity and started to put our cash to work and were able to buy very good companies at a discount. We believe in the companies and investments that we own and understand the stock market is a forward-looking indicator. We also believe the unprecedented government policies proposed to stabilize the economy and slow down the spread of the virus is now priced into the market. But nervousness aside, there are reasons to be positive and even optimistic.

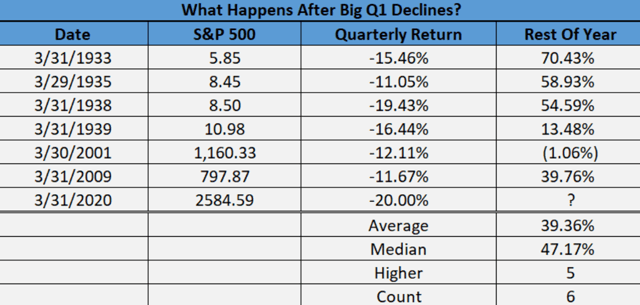

U.S. stocks peaked on 19 February, then plummeted in the deepest and fastest decline into a bear market in history. Then, the market experienced its largest weekly gain since 1938, up over 10%. Recently, the Dow Jones Industrial Average experienced its best day on record since 1933 on March 23 when it finished the trading session with a double-digit gain of 11.37%. The next day, the DJIA managed to record a second consecutive day of gains, marking the first time this has happened since the index hit all-time highs in February. This positive price action continued for a third day, which not only marked the first consecutive three-day rally to occur within the past few months for the DJIA, but also allowed the index to log its strongest three-day stretch dating back to 1931, gaining over 20%. Recall that just a few weeks ago, the DJIA recorded its two worst days since the Black Monday crash of 1987, which came on March 12 and March 16 when the index notched single-day losses of -9.99% and -12.93%, respectively. First quarter declines of big magnitude are rare as a lot of money historically comes into the market at that point. When we do have a decline of greater than 10%, the rest of the year has done quite well with one meager exception. (Source: LPL Financial)

Economic Data and Earnings Take a Backseat

Economic activity in many countries has ground to a halt as governments have placed restrictions on air travel and work to limit the contagion. Weekly unemployment claims came in at 3.28 million which was the largest number in history by a factor of five, and, by itself, implies a rise in the unemployment rate of 2%. We expect second quarter growth to fall between 10% and 20%. Although the number is jaw-dropping, many aren’t entirely surprised given the nationwide temporary store closures mid-month. The third estimate for Q3 2019 GDP was unrevised at 2.1%. Unfortunately, any backward-looking economic data will be largely ignored as it will not include the massive disruption caused by the government intervention to shut down the economy. We have never experienced something like this, and it will take time to see how businesses and consumers adjust to the new reality. The coronavirus crisis in unlikely to abate soon. New cases may have peaked in China and Italy, but it may be many weeks before that happens in the rest of the world. Many epidemiologists suggest a peak in the United States is still weeks away. Until that time, we don’t expect to see economic data improve.

Earnings

We think corporate earnings could decline 20% in 2020, before reversing higher in the third and fourth quarters. (Estimated earnings at $130 for the S&P 500). Fundamental strength in the technology, health care and communications services sectors, coupled with strong balance sheets in the financial sector, should prevent overall earnings from fully collapsing. It’s tough to forecast much beyond that given we don’t know the full extent of economic damage, but an earnings recovery by the end of the year looks likely. But equity markets may see a return of volatility when businesses start reporting quarterly performance and earnings in a few weeks.

Who Is Buying the Recovery?

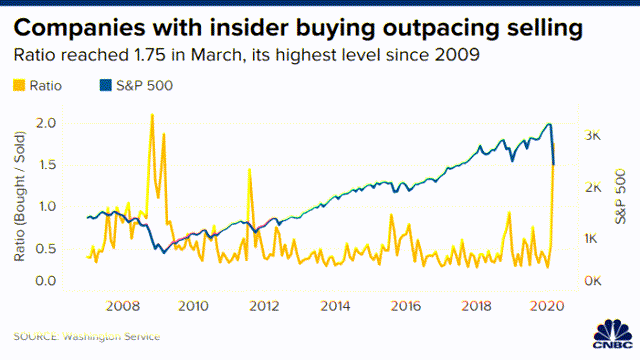

With volatility at all-time highs, many large institutions were forced to sell down a portion of their stocks. This resulted in record amounts of cash, and JP Morgan estimates that there could be $3.2 trillion of demand for stocks through the remainder of the year as these investors buy back into the market. We are also seeing a potential peak in pessimism as the general public is strongly bearish. This is generally a good indicator that a low in the markets has been made. Also, corporate insiders such as CEO’s are buying their company stock at a rapid rate. This is a very good indicator that suggests the March lows may have been the bottom.

The Virus

NIAID Director Dr. Fauci said there have been “glimmers of hope” that social distancing is helping to curtail the spread of COVID-19, but the situation remained dire with the number of infections continuing to rise in the U.S. We need very quick virus and antibody tests, and we need a COVID-19 vaccine. We have some therapies and tests rolling out which is good, but how quickly can they ramp up and how accurate will they be? Only time will tell. However, there are some positive signs coming out of Asia. Recently, economic data from China showed manufacturing activity climbed sharply in March as factories resumed work following months of a near-total shutdown, though economists warned that business activity remains far from normal. There are also tentative signs that new infections in Italy might be slowing, according to data compiled by Johns Hopkins University.

How Long Will It Take?

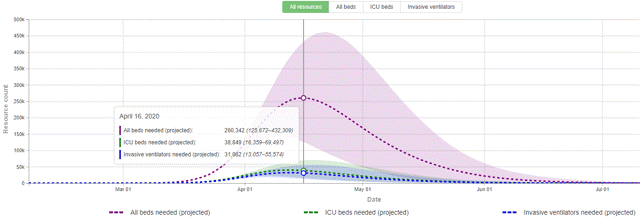

It is important to remember that the current crisis is government induced, and the true depth of it will be determined by how long this complete shutdown of our economy lasts. Based on Asian and European stats and with increased testing, we should see cases peak in the next 3 to 4 weeks. On March 14, a few days after the lockdown, total known cases were growing at almost 20% a day. Today that number is close to 4% and continues to fall. Now this is to some extent the law of large numbers at play, but it also shows how effective the countermeasures can be. In the U.S. April 16th is currently projected to be the peak in the usage of medical resources.

Central Banks Buy Time

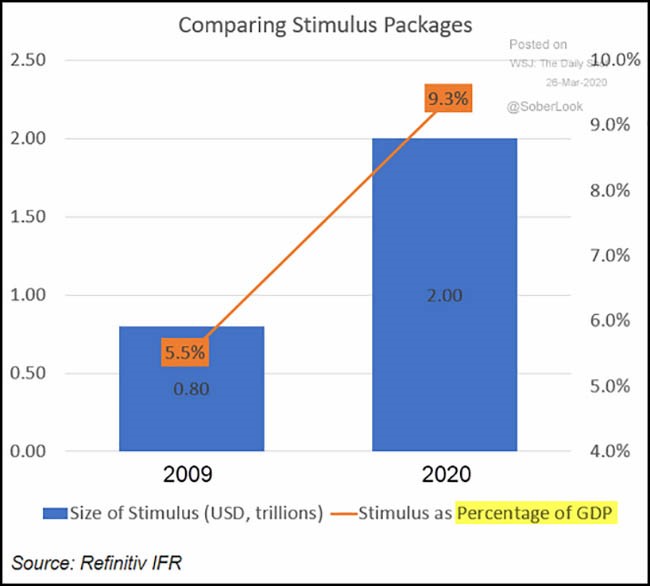

Central banks led by the Fed have been forced into emergency interventions to boost funding in credit markets and ensure an adequate supply of U.S. dollars to calm the worst of the anxiety. The Federal Government has offered to print an unlimited amount of money until the crisis is resolved, even exceeding the stimulus to fight the financial crisis in 2008-09. The U.S., Europe and many Asian countries have rolled out very sizable fiscal stimulus packages and we saw a series of emergency interest-rate cuts by the Federal Reserve which have helped stabilize the financial system. This was simply the latest “whatever it takes” action by the Fed to support financial markets. Congress and the Federal Reserve have bought the U.S. economy a few months of life.

Coronavirus Relief Bill

The United States government recently approved a multi-trillion Dollar stimulus package which included a provision to directly mail $1,200 checks to most Americans. The CARES Act has provided ample funds and legal authority for this “whatever it takes” approach, which has currently calmed markets. This unprecedented action has perhaps not received as much attention as it deserves, and it marks a new era in United States economic policy. We are now in the age of “Helicopter money” (a term economists use to describe the direct distribution of newly created money to the population) and we can expect this tool to be used early and often in response to the economic challenges that face the nation. While the technicalities can be complex, at its core this simply means that the Federal Reserve will create money, which will then be “lent” back to the government (in this case at an interest rate of 0%). This is likely to be the way forward regardless of the outcome of the election, and it will be important for us to prepare our portfolios for a future of zero rates and almost unlimited money printing.

The monetary policy response exceeds the 2008 financial crisis. The massive fiscal stimulus will help, but not solve the economic crisis. The $2 trillion package includes direct cash payments to individuals, loans to small businesses, extended unemployment benefits, help for distressed industries and the purchase of medical equipment. Here is a good list of where the $2 trillion will go…

CARES ACT – Individual & Business. The CARES Act provides eligible employers a credit against applicable employment taxes for each calendar quarter equal to 50 percent of the qualified wages with respect to each employee of the employer for the calendar quarter. Direct Payments: Single individuals and joint filers can expect to receive a payment of $1,200 or $2,400, respectively, plus $500 for each qualifying child.

The Paycheck Protection Program (“PPP”) authorizes up to $349 billion in forgivable loans to small businesses to pay their employees during the COVID-19 crisis. All loan terms will be the same for everyone. The loan amounts will be forgiven as long as: The loan proceeds are used to cover payroll costs, and most mortgage interest, rent, and utility costs over the 8 week period after the loan is made; and Employee and compensation levels are maintained. Visit www.sba.gov for a list of SBA lenders.

What do I need to apply? You will need to complete the Paycheck Protection Program loan application and submit the application with the required documentation to an approved lender that is available to process your application by June 30, 2020. Click https://home.treasury.gov/system/files/136/Paycheck-Protection-Program-Application-3-30-2020-v3.pdf for the application.

The Families First Coronavirus Response Act (Families First Act) on March 18 will have a significant impact on both individuals and businesses. In addition to containing four new tax credits for businesses and self-employed individuals, the Families First Act includes the Emergency Paid Sick Leave Act and the Emergency Family and Medical Leave Expansion Act, which are aimed at helping employees who have lost wages due to business closures.

Technically

The reaction to the coronavirus, and the fallout from it, is unlike anything we’ve ever seen before. Several technical factors suggest a bottoming process has begun. The price action has caused a few of our technical indicators to react positively from historically washed out low levels. Historically, this provides a low risk buying opportunity for investors with 12-month time horizons. According to Bob Dole, Nuveen Management: Looking at severe market declines from 1987, 1998, 2008, 2011 and 2015 shows that these selloffs typically have three phases. The first is a panic-driven waterfall decline marking a bottom. The second phase is a prolonged series of sharp rallies and sharp declines as volatility remains high. The third phase is a retesting of the primary low, which could still happen. In due course, this pandemic will subside, and the economy, consumer confidence, and investor confidence will rebound alongside the stock market.

What Are We Doing?

We understand this is a pandemic now and it cannot be eliminated. But we know we can take steps and reduce its impact. Even though we cannot travel and visit with you, we can communicate with you through a live meeting and answer any questions or concerns you may have. Once again, we strongly urge everyone to learn how to use Google Hangouts, Zoom, Facetime or other video chatting platforms. We want to hear how you are doing and we think it is very good for the mind and body. Call us if you need help in getting this set up. Also, there is one very simple thing that we can do that we know for a fact works: social distance. Containment is the next step in which we make sure all the cases are identified, controlled, and isolated. The earlier we impose heavy measures, the less time we need to keep them, the easier it is to identify brewing cases, and the fewer people get infected. The faster we lower the growth rate of the virus the faster the recovery will be. We will get through this, as we have in the past and we will come out stronger.

What It All Means

The fears surrounding the pandemic and its effects on the global economy remain front and center and a logical concern for all as both health and wealth are at risk. However, this is the new reality – we must think differently. People are coming together online and doing their part to combat the spread. Better hygiene, social distancing, and home quarantine is working. We remain hopeful that the administration is now taking the necessary steps to reduce the impact of the virus and provide solutions (a fiscal stimulus bill of unprecedented size) for the economic shutdown. As a result of the steps taken by government agencies to shut down the economy it is likely that we will enter another recession. However, as former Federal Reserve (Fed) Chair Ben Bernanke noted recently, the country is in for a “sharp, short recession,” and he sees a “fairly quick rebound” ahead. This optimistic view is based on the expected trajectory of the pandemic case curve and the magnitude and timing of the policy response. Another thing to note is the market has been using the spikes higher on “positive” headlines as an opportunity to sell into strength. Be aware of the day that the market fails to go lower or reverses on a “negative” headline, as it will assume the worst is already priced in. The reactions to data can be more telling than the data itself.

Wishing you and your family good health,

Strategy Asset Managers