Economic conditions and job growth are key factors that can impact housing prices, along with interest rates, housing supply, and government policies related to housing and real estate. When the economy is growing, people have greater job security and more income, which can lead to increased demand for housing – and therefore increased competition for available homes. If there is a shortage of housing supply it can further drive up prices. The inverse can be true in an economic downturn, where housing prices drop and sellers try to attract buyers in a market with reduced demand. (National Association of Realtors)

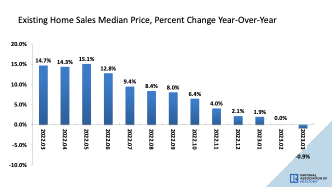

According to recent data, the National Association of Realtors has seen negative readings in the median price of home sales for the past two months. This is the first time we have seen negative readings since 2012, this bodes well for future inflation numbers. (National Association of Realtors)

Additionally, interest rates can impact the market. Higher rates equal higher mortgage payments, making homes less affordable for some buyers. This can result in fewer buyers entering the market and can cause a slowdown in sales activity. (National Association of Realtors)

Current National Market Snapshot

Existing-home sales jumped 14.5% in February, snapping a 12-month slide and representing the largest monthly percentage increase since July 2020 (+22.4%). Compared to one year ago, however, sales retreated 22.6%. Inventory of unsold existing homes was unchanged from the prior month at 980,000 at the end of February, or the equivalent of 2.6 months’ supply at the current monthly sales pace. Six months’ supply is considered a balanced market. Inventory levels are still at historic lows. Consequently, multiple offers are returning on a good number of properties. The median existing-home price for all housing types in February was $363,000, a decline of 0.2% from February 2022 ($363,700), as prices climbed in the Midwest and South yet waned in the Northeast and West. This ends a streak of 131 consecutive months of year-over-year increases, the longest on record.

First-time buyers were responsible for 27% of sales in February, down from 31% in January and 29% in February 2022. NAR’s 2022 Profile of Home Buyers and Sellers – released in November 20224 – found that the annual share of first-time buyers was 26%, the lowest since NAR began tracking the data.

All-cash sales accounted for 28% of transactions in February, down from 29% in January but up from 25% in February 2022. Individual investors or second-home buyers, who make up many cash sales, purchased 18% of homes in February, up from 16% in January but down from 19% in February 2022. Distressed sales5 – foreclosures and short sales – represented 2% of sales in February, nearly identical to last month and one year ago.

Current market data is dependent on your area. Just like the weather, it’s different in every region. However, we have statistics for the overall housing climate and can narrow it down by region, state, county, city, and finally, your home.

Mortgage Rates and Housing

Black Knight estimates 13.4 million homes nationwide have first mortgages with rates below 3%, while 20.9 million have loans with rates from 3% to 3.99%. Together, that accounts for approximately 65% of all U.S. homes with a first-lien mortgage. About 37% of homes in the US have no mortgage, leaving only about 4% of homes have first mortgages with rates of 6% and above.

According to Freddie Mac, the 30-year fixed-rate mortgage averaged 6.60% as of March 16. That’s down from 6.73% from the previous week but up from 4.16% one year ago. (NAR)

The Mortgage Bankers Association expects average mortgage rates to fall to 6.1% in the 2nd quarter of 2023 and to 5.3% by year’s end. It’s not until the 3rd quarter of 2024, that they predict rates will be below 5%. (LA TIMES)

The primary causes of the 2008 crisis — a glut of poor-quality subprime mortgages that had been spread round the world via derivatives on to the balance sheets of poorly capitalized banks — do not apply in 2023. Credit quality remains decent. And bank capital is two to three times stronger than it was a decade and a half ago. (FT)

Information about NAR is available at nar.realtor. This and other news releases are posted in the newsroom at nar.realtor/newsroom. Statistical data in this release, as well as other tables and surveys, are posted in the “Research and Statistics” tab.

Let me provide you with a Real Estate Review on the value of your home. Just as you receive an annual review of your financial portfolio, it is a good idea to receive annual updates on your home – even if you don’t intend to sell it. There are many reasons to do this: a change of title (ownership), dropping mortgage insurance, taking out a line of credit, refinancing, choosing which maintenance and/or improvements to invest in, re-evaluating your homeowners insurance, or assessing potential capital gains.

Christine Edwards, MPH

Christine Edwards, MPH

Realtor® | Advisor

M: 818.384.6890

DRE# 01973089

christine.edwards@compass.com

www.edwardsrealestateca.com