The stock market had a strong performance in the first quarter of 2023 despite an increasingly shaky economic backdrop. We saw high rates of inflation and the collapse of both Silicon Valley Bank and Signature Bank. The banking crisis spread overseas, with Credit Suisse, one of the largest banks in Europe, merged with UBS as part of an emergency government bailout. Investors looked past these challenges, and stocks were buoyed by expectations of further declines in inflation and interest rates.

The S&P 500 had an impressive return for the quarter, driven by a small handful of the largest stocks. Without Alphabet, Apple, Meta, Nvidia, Amazon, Microsoft, and Tesla, the S&P 500 would have been flat in the first quarter.

Fed to the Rescue

Since the failures of Silicon Valley Bank and Signature Bank in March, the Federal Reserve has worked to pre-empt other regional bank runs. The decision to bailout uninsured depositors should give account holders confidence that their assets are safe in U.S. banks.

According to Warren Buffett:

“Nobody is going to lose money on a deposit in a U.S. bank. It’s not going to happen … you don’t need to turn a dumb decision by managers into panicking the whole citizenry of the United States about something they don’t need to be panicked about.”

He stressed that it’s crucial for banks to retain the public’s confidence and noted that they can lose that confidence in seconds, as we saw in March.

Although government intervention has stabilized the banking system for now, regional banks are not out of the woods yet. They will be facing additional regulatory pressures and scrutiny in addition to increased competition for customer deposits. Bank lending standards were already tightening prior to Silicon Valley Bank’s collapse and will likely continue to tighten. This could have negative implications for the wider economy. These negative effects could be felt most acutely in Commercial Real Estate, where small banks are by far the largest lenders.

Inflation is Cooling

As we expected, inflation declined for a 9th consecutive month in March, falling to 5% on a year-over-year basis. However, the pace of declines could moderate over the next few months as the cost of Shelter, which is by far the largest component of overall inflation, has yet to begin decelerating. Government Shelter inflation data tends to reflect home prices on a 12–18 month lag. While median existing home prices have fallen over the past year, this may not be reflected in official inflation data until the back half of the year.

The U.S. Consumer Continues to Spend

Thus far the economy has held up reasonably well in the face of the Fed’s rapid rate hike cycle. However, the effects of interest rate hikes tend to operate with a lag, and we can expect these effects to start bubbling to the surface in the rest of the year.

The jobs market is incredibly strong, and the unemployment rate is near a 50-year low. Wage growth and consumer spending have remained robust. U.S. GDP growth is positive and predicted to come in around a respectable 1.3% for Q1, and Q2 is currently tracking at a little over 2%. However, we have recently seen moderation in the pace of job growth, and excess savings accumulated during the Pandemic are likely to run out by the end of the year.

Earnings Recession

Current estimates indicate that S&P 500 earnings will decline 7% on a year-over-year basis for the 1st quarter. This will mark the second consecutive quarter of declining earnings, officially putting the S&P 500 in an earnings recession. However, earnings recessions have not always been accompanied by economic recessions.

Company guidance during earnings season will be critical, as the market currently is trading at a premium valuation reliant upon favorable economic growth.

Will the U.S. Dollar Lose its Reserve Currency Status?

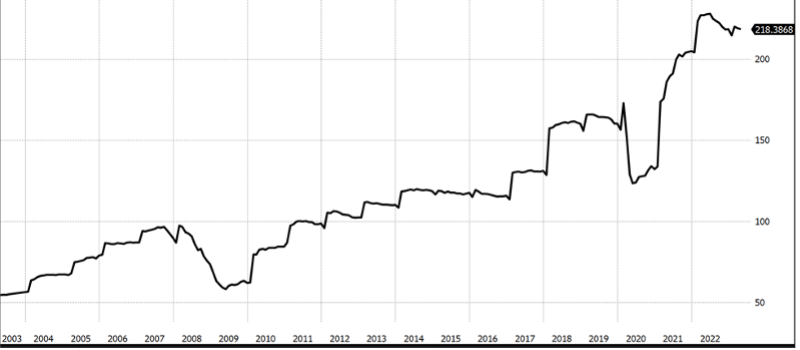

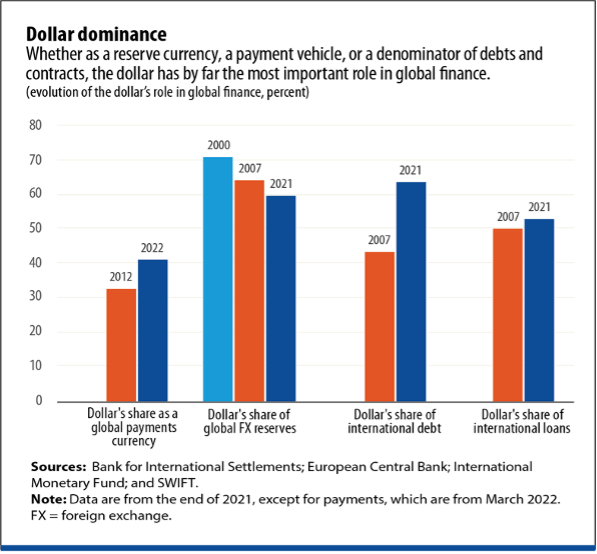

Although the U.S. dollar rose significantly last year, there is widespread concern that Russia, China, Brazil, and Saudi Arabia will somehow replace the U.S. Dollar and undermine the United States’ premier economic position. These fears are not new, and you can find news articles dating back decades repeating the same arguments and predicting the “collapse” of the dollar and of the U.S. economy.

While the U.S. certainly has its issues, there is no viable competitor either to the U.S. Dollar or to the U.S. economy. China, Japan, and Europe, the other largest economies in the world, face far more serious issues than the United States does with respect to debt levels and demographic declines. The technological innovations that have defined this era originated here in the United States, and the human capital and infrastructure that enabled those innovations is based in America.

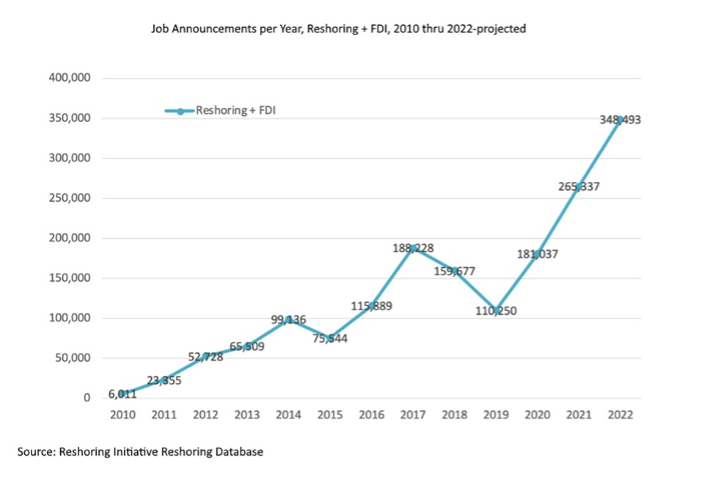

America is Back to Manufacturing

New factories are rising in urban cores and rural fields, desert flats and surf towns. Much of the growth is coming in high-tech areas such as electric-vehicle batteries and semiconductors. These industries are national priorities backed by billions of dollars in government incentives. Other companies that once relied exclusively on lower cost countries to manufacture products like eyeglasses, bicycles, and bodybuilding supplements have found reasons to come home.

Manufacturing has always been an integral part of American life. Paul Revere opened a foundry that produced bells and cannons following his famous midnight ride. Henry Ford’s assembly line made cars affordable to the masses, and U.S. industrial might helped win World War II.

Explosive developments in automation and robotics could drive a new boom in American manufacturing.

What to Watch For

It’s easy to get distracted by the media and their excessively negative headlines, especially after last year’s dismal stock and bond market performance. But you should ask yourself, how much bad news is already priced into markets? Recently there have been massive inflows into short-term U.S. Treasuries; what will happen when those Treasuries mature over the next few months? Will that money go into stocks?

While we know the economy is slowing and earnings are declining, conditions may not be as dour as you are hearing. Strategy Asset Manager’s active management outperformed the markets last year, and we will guide you through these uncertain times, just like we have in the past.