As we look forward to the reopening of the economy, we think it is “Time to Go”, time to start planning to be with loved ones, take a long-awaited vacation, or just go outside and enjoy the weather! We understand it is hard not to get caught up in the day-to-day market volatility, but the backdrop continues to be positive for equity markets. We are seeing market breadth improve, and that is very encouraging. With continued good news on vaccine rollouts and COVID hospitalizations, it is tough to hold back from wanting to get out and gather. According to the Washington Post, three million people were vaccinated in the U.S. last Saturday. On Monday, March 8, there was a positive update from the CDC with the announcement that vaccinated people would be allowed to gather indoors without masks. This will help get millions of the unemployed back to work and millions of students back to school.

This brings us back to what we said in December: “A key ingredient for the bullish bias in 2021 is the persistence of low interest rates”. They were the engine for multiple expansion despite negative earnings growth in 2020 and the fallback rationalization for continued inflows at premium valuations because ‘there was no alternative’. Now Wall Street is giving upbeat forecasts for an expected surge in economic activity in 2021 as the vaccine gets widely distributed, yet few analysts are predicting a large increase in interest rates. That seems counterintuitive for an economy that is expected to boom, but it also shows an expectation that the Federal Reserve will intervene to keep long-term rates from moving up too fast before there is a solid foundation for the economic recovery.

More Positive News

The U.S. Population is projected to be 90% Vaccinated by August (@nytimes)

California health officials set new rules on Friday, March 5th that would allow Disneyland and other theme parks, stadiums, and outdoor entertainment venues to reopen as early as April 1.

Connecticut is lifting all capacity limits on offices, retail shops and restaurants. (WSJ)

Las Vegas shows are also reopening…

Millions of students returned to schools in England on Monday, March 8th. (NYTimes)

Economic Data Continues to Improve

First quarter real GDP growth is going to run at a seasonally adjusted annual rate of 8.3%, according to the Atlanta Fed’s GDPNow forecasting model, and Goldman Sachs predicts that 2021 GDP growth will hit 6.8%.

We are seeing strong manufacturing sentiment, albeit with supply-chain issues. The Institute for Supply Management’s Manufacturing purchasing managers index (PMI) has stayed firmly in expansionary territory, and in February reached its highest level since December 2018. Businesses are experiencing supply chain disruptions which have caused the prices-paid and supplier-deliveries components to surge.

The February Employment Situation Report was much better than expected on the payrolls front. The key takeaways from the report are signs that the best is yet to come for the labor market. This bodes well for future growth prospects. The increase in nonfarm payrolls was the strongest since October and the best pace for a February in more than 20 years. Even more encouragingly, it came prior to the relaxation of Covid restrictions across many states.

One Year Ago

The stock market has been on a roll for months. Yes, there have been setbacks every now and then, but ever since the Federal Reserve rode to the rescue in March 2020, the markets have been rallying:

At the close of trading on March 1, small cap stocks, measured by the Russell 2000, were up 135% from the March 2020 low. The S&P Mid Cap 400 was up 117%, the Nasdaq 100 was up 105%, the S&P 500 was up 78%, and the Dow was up 73%.

However, the recent price action has caused some angst, especially since it has coincided with a jump in long-term rates and double-digit percentage declines for many pricey stocks which had more than doubled or tripled over the past year. The stock market started the year at a high valuation of 22.7x forward twelve-month earnings, and at that time the yield on the 10-yr note was just under 1.00%. The market now trades at 21.3x forward twelve-month earnings with the 10-yr note yield trading north of 1.50% and presumably poised to keep moving up in response to booming economic conditions.

It is healthy for the markets to exhale and this is often a prerequisite for equity markets to move even higher in the future. Returns have been pulled forward and were fueled by historically low interest rates. We are seeing corporate earnings surprise to the upside, a positive sign given that the market started the year trading at a historically high valuation. We believe that news on the health, economic, and earnings fronts should continue to improve during the year. This has been a theme ever since the fiscal and monetary support started flowing in March 2020, receiving additional support from the success of vaccines from Pfizer/BioNTech, Moderna, and Johnson & Johnson.

What Do Rising Rates Mean for You?

A key ingredient for the bullish outlook in 2021 is the persistence of low interest rates. The Fed needs to control the long-dated maturities because market worries about higher inflation rates could drive stock market volatility. Growth is picking up and inflation is expected to pick up markedly in coming months, but that is where the most important divide lies. The Fed believes the inflation pickup will be temporary. There are burgeoning concerns in the market, though, that the pickup will not be temporary, and ultimately it is the market’s opinion, not the Fed’s, that matters most.

Why does this matter? Throughout history, increases in interest rates have often negatively impacted equity prices. While the markets and economy may seem to perform okay as rates rise initially, the eventual negative impact can lead to temporary losses.

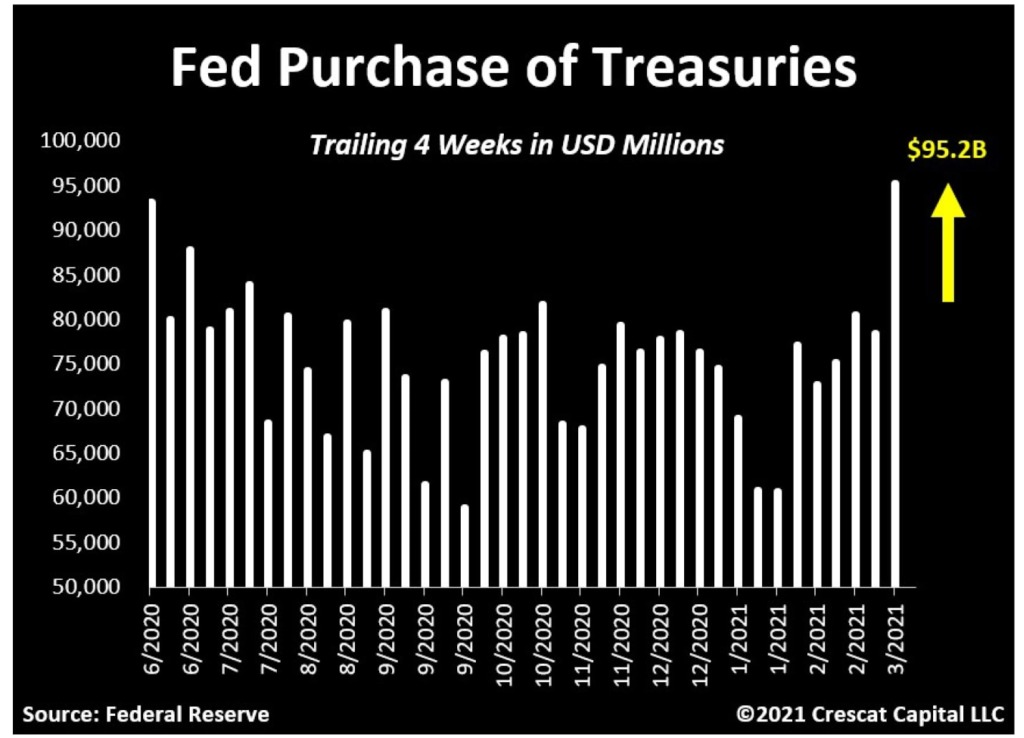

Don’t Fight the Fed

We still believe long-term interest rates will have a hard time moving much higher in a sustainable way. However, if the Fed loses control over the long end because of high inflation, the stock market could be destined for more turbulence. However, this would eventually lead the Fed to come to the rescue, as it has done many times previously, and push rates back downwards toward zero.

We have seen some vestiges of that unruliness already. Many stocks have corrected simply because they ran too far, too fast, but some are now feeling a valuation pinch from rising interest rates. However, this is more a result of the speed of the rate rise, rather than the level of long-term rates, which is still quite low on a nominal basis and negative in real terms.

Technically

From this years’ intraday high to this months’ intraday low, the S&P 500 was down about 5%, and the Nasdaq was down about 9%. Investors used this opportunity to take some profits as long-term rates resumed their recent ascent. We also saw money come out of the high-flying stocks and into beaten down sectors, but, as we pointed out last year, market breadth is improving, and other segments of the market are outperforming. Recently risk sentiment improved on new expectations from the Biden administration that vaccines will be available for every adult by the end of May, a big improvement over the prior guidance of July. The long-term market picture is still strong, but we are seeing some short-term sell signals. However, this is not unheard of in March. March and October tend to be challenging months to navigate.

Good news may not be moving the needle like it used to because the forward-looking stock market has priced in so many positive catalysts already. As a result, the market is more sensitive these days to bad news, and future developments could act as speed bumps. Rising interest rates are only a speed bump for now, providing a reality check for some of the speculative excess that has gripped the stock market. Many unreal moves have been dialed back, and rightfully so.

What It All Means

The path ahead remains bright, and we can expect a big boost in spending as economic activity resumes and consumers feel safe to go out again. Corporate profits are surging, economic data is soaring, and people are getting out. We are on the path to herd immunity thanks to the fastest vaccine development in history, and this will be another positive catalyst for the economic recovery. The economy is set to surge in 2021, and the future is filled with optimism and excitement.

Trillions of dollars of fiscal stimulus, ultralow interest rates, and a newfound sense of liberation should fuel a boom in the U.S. economy unlike any we have experienced in decades.