We understand these are challenging times and that parts of America are afraid and hurting. However, in times like these the people of America have always come together, using hope to overcome fear. Our nation invariably has emerged from each crisis stronger and more durable than before, and we have no reason to expect anything different in this era. Thanks to technology the nation is better equipped than ever before to handle the challenges we face. Our nation boasts advanced biotechnology with the potential to create a vaccine in record time, and

advances in non-lethal weaponry will eventually revolutionize policing and potentially eliminate many of the root causes of social unrest.

If we look out twelve or eighteen months from now, there is a high probability that the business outlook will be much better. The global pandemic has had and may continue to have a significant impact on world economies and many companies’ fundamentals in months to come; however, the market severely discounted most of that

damage back during the March crash. As economies planned their re-opening phases and the efforts curbing the spread of the virus proved to be working, the market continued to “climb the wall of worry.”

THE MARKET IS A LEADING INDICATOR

It is easy to forget that the stock market is a leading indicator—it starts to respond before we get the data. That is why the S&P 500 was already in free fall when the World Health Organization declared a pandemic on March 11 and was starting to rise as the headlines kept getting worse. The Fed stimulus provided the spark and the S&P

500 went on to rebound 39% from its low and stands just 8% below its old high. The leaders have been Tech stocks led by the Nasdaq 100 Index, which hit a record in Friday trading. The corporate credit market also has been on fire, even though the Fed has bought relatively small amounts of securities. Just the presence of the central-bank backstop did the job, allowing corporations to issue more than $1 trillion of debt this year. For instance, Amazon issued $10 billion in bonds, including $1 billion of three-year notes at just 0.40%, reportedly the lowest borrowing cost ever for a U.S. dollar issue.

THE STOCK MARKET IS NOT THE ECONOMY

Although the disconnect between the financial markets and the world around us has grown even wider in recent months, the markets have continued to rise. This year has been absolutely devastating as the coronavirus has claimed more than 108,000 lives across the U.S., reported job losses were the worst ever, and now the eruption of demonstrations across America. Despite this stock prices hover just under their peaks hit earlier this year. The rising tide of liquidity has lifted stocks, despite record unemployment and the most serious U.S. social unrest since the Vietnam War protests and urban riots of the 1960s.

However, the financial scenario is a bullish setup for the equity markets, and they can climb higher as we start to see more glimmers of hope. The markets are pricing in better days ahead and the Fed is providing the fuel for the market’s ascent. One example was the May unemployment report issued on the 5th of June this year, which was much better than expected. This points to people returning to work at a faster pace than expected which should not be such a big surprise since the government caused the economic shutdown.

KEY ECONOMIC INDICATORS ARE AT ODDS

Personal income rose 10.5% in March, according to the latest Bureau of Economic Analysis figures, while consumption fell by 13.6%, resulting in a massive increase in the savings rate for households. This shows Americans’ collective income rising by double-digits, even as tens of millions of people lost jobs, incomes, and businesses. It is a statistical oddity caused by Congress’ massive infusion of cash into the economy. The dollars going into the pockets of households largely came from government benefits, ($1,200 stimulus checks and an extra $600 a week). Households saved a third of their income in April as their spending on restaurants, travel and health care dropped. What is done with those savings will be key to the recovery trajectory. Also, these expanded benefits are scheduled to run out by the end of July, but a new $1 trillion stimulus is already in the works. The thinking is if we start to see better economic data then we will have a swift recovery and if the data disappoints the administration will continue to print money.

RALLY FUELED BY RECOVERY OPTIMISM

The S&P 500 index finishing May with its best two-month gain since April 2009, and the stock market rally continues on optimism that global economies will rebound as retailers and service providers reopen and that a vaccine will be developed. The view is that things will just keep getting better and better as the economy gets running again, helped not only by normal activity but also by fiscal and monetary policy support.

REBOUND AFTER PANDEMICS

The S&P 500 index finishing May with its best two-month gain since April 2009, and the stock market rally continues on optimism that global economies will rebound as retailers and service providers reopen and that a vaccine will be developed. The view is that things will just keep getting better and better as the economy gets running again, helped not only by normal activity but also by fiscal and monetary policy support.

DO VALUATIONS MATTER?

We can look back to the 1918-1919 Spanish flu pandemic and the effect it had on stock market to get a sense of history. Many are not sure how we can bounce back from COVID-19, but we do have precedent. If we look back to the Spanish flu of early last century, we can see that the U.S. emerged from the 1918-1919 pandemic that killed millions around the world and then went on to enjoy one of the most prosperous decades of the 20th century, the Roaring 20s. This was achieved without the Fed or Treasury guiding the way.

Stock values are calculated on the basis of future free cash flow expectations, they are priced nominally (not inflation-adjusted), and stock investing is one way to combat the risk of inflation as strong companies price goods higher to outpace rising costs to reap in ever-higher earnings. Even if this excess money in the economy is not translated into inflation in physical goods and services, it may translate into inflating equity prices specifically, as has been the case during the period of 2010-2019. As of May 28, 2020, the S&P 500 traded at 23.8 times next12 month (NTM) EPS projections, according to S&P Capital IQ, as compared with 17.6x and 14.6x two months after the bear-market bottoms of 2002 and 2009. According to FactSet, the blended Q1 earnings decline is -14.6% versus -6.9% on March 31. The consensus earnings growth estimate for Q2 is -43.1%. For calendar year 2020, it is -21.1%. For calendar year 2021, however, it is +28.2%.

TECHNICALLY

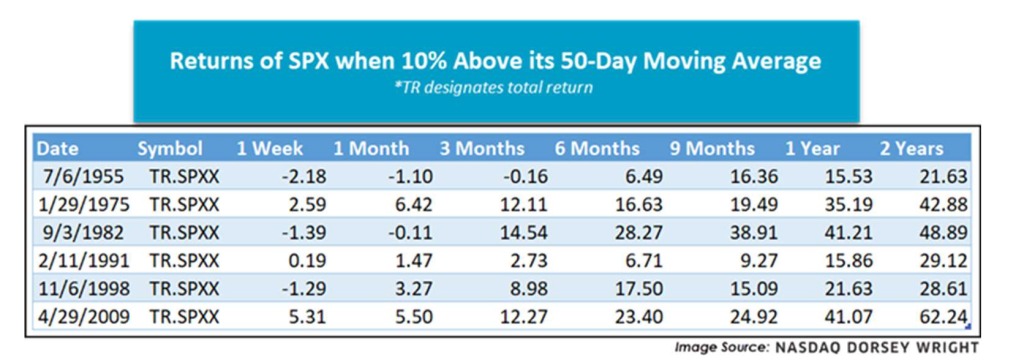

As a result of the upward movement several technical indicators were extremely overbought and due for some consolidation. But if we look out further, the market has a strong probability of being higher. On May 27, the SPX managed to get 10% above its 50-day moving average. This event rarely happens, only occurring six times since 1955 (April 2009, November 1998, February 1991, September 1982, January 1975, and July 1955). Looking forward, performance for the S&P 500 is also positive, with all returns positive six months out. It is also worth noting that events like these are infrequent, resulting in a small sample size to build from. However, the findings here do provide evidence that demand continues to reenter the equity markets.

The bottom line is that despite all the worrying concerns about the economy, fundamentals, and geopolitical/social turmoil, the market is saying “everything is going to be alright.” In April we said that there was a good change the bottom was in for the markets, and in May we were optimistic the recovery would continue. Our outlook continues to be positive and we look for further gains as the U.S. economy re-opens and the consumer spends. We can then possibly look to pre-COVID-19 earnings numbers for 2021 and 2022 with some adjustments here and there, and that means the bull market is on. Even if the U.S. economy re-opens and economic numbers do not live up to expectations, we could see even more stimulus- which has been a positive for the stock market.

Thank you for listening, and please keep the faith.

Sincerely,

Thomas W. Hulick, CIMA

CEO and Managing Partner

Strategy Asset Managers

Joseph Traba

Managing Director and Senior Portfolio Manager

Strategy Asset Managers

Alex Hagstrom, CFA

Portfolio Manager

Strategy Asset Managers